Volvo 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

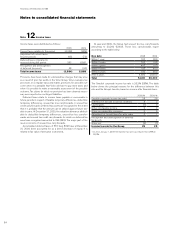

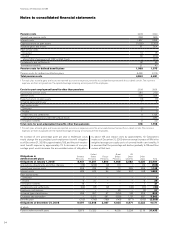

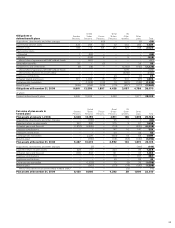

Note 24 Provisions for post-employment benefits

Post-employment benefits, such as pensions, healthcare and other

benefits are mainly settled by means of regular payments to

in dependent authorities or bodies that assume pension obligations

and administer pensions through defined contribution plans. The

remaining post-employment benefits are defined benefit plans; that is,

the obligations remain within the Volvo Group or are secured by own

pension foundations. Costs and the obligations at the end of the

period for defined benefit plans are calculated based on actuarial

assumptions and measured on a discounted basis. The Volvo Group

defined benefits plans relate mainly to subsidiaries in the US and

comprise both pensions and other benefits, such as healthcare. Other

large-scale defined benefit plans apply for salaried employees in

Sweden (mainly through the Swedish ITP pension plan) and employ-

ees in France and Great Britain. See note 1 for further information

about the accounting principles.

The following tables disclose information about defined benefit

plans in the Volvo Group. Volvo reports the difference between the

obligations and the plan assets adjusted for unrecognized actuarial

gains and losses in the balance sheet. The information refers to

assumptions applied for actuarial calculations, periodical costs and the

value of obligations and plan assets at year-end. The tables also include

reconciliation of obligations and plan assets during the year and the

difference between fair values and carrying amounts reported on the

balance sheet date. According to IAS 19, actuarial assumptions such

as the discount rate shall be based on market expectations at the

balance sheet date for the period over which the obligations are to be

settled and reflect the time-value of money but not the actuarial or

investment risk.

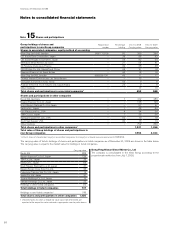

Summary of provision for

post-employment benefits 2008 2009

Obligations 41,171 38,070

Fair value of plan assets 22,105 22,610

Funded status (19,066) (15,460)

Unrecognized actuarial

(gains) and losses 9,320 9,155

Unrecognized past service costs 482 303

Net provisions for post-

employment benefits (9,264) (6,002)

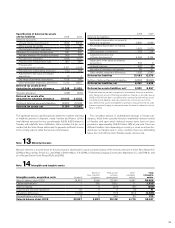

Assumptions applied for

actuarial calculations, % December 31,

2008 December 31,

2009

Sweden

Discount rate 4.50 4.00

Expected return on plan assets16.00 6.00

Expected salary increases 3.50 3.00

Inflation 2.00 1.50

United States

Discount rate 5.75–6.25 4.00–5.75

Expected return on plan assets17.65 7.65

Expected salary increases 3.50 3.00

Inflation 2.50 2.00

France

Discount rate 5.25 4.50

Expected salary increases 3.00 1.00–3.00

Inflation 2.00 1.50

Great Britain

Discount rate 5.75 5.50

Expected return on plan assets14.60–5.50 5.00–6.30

Expected salary increases 3.60–4.90 3.50

Inflation 3.00 3.00

1 Applicable for the following accounting period. These assumptions reflect

the expected long-term return rate on plan assets, based upon historical

yield rates for different categories of investments and weighted in accord-

ance with the foundation’s investment policy. The expected return has been

calculated net of administrative expenses and applicable taxes.

93