Volvo 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146

|

|

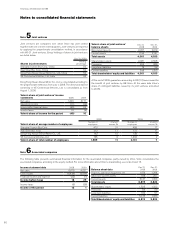

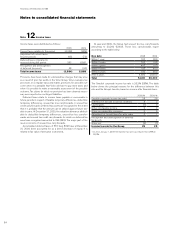

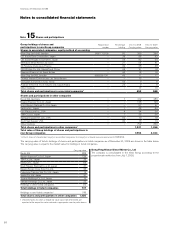

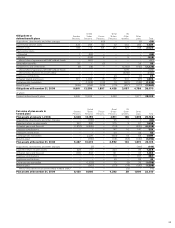

Changes in the Volvo Group’s holdings of shares and participations: 2008 2009

Balance sheet, December 31, preceding year 2,219 1,953

Change in Group structure (88) (15)

Acquisitions and divestments, net 16 45

Write-downs of associated companies (33) (48)

Capital contribution 56 2

Share of income in associated companies 15 12

Revaluation of shares to fair value (546) 92

Translation differences 325 (74)

Dividends (7) (21)

Re-classification of holdings of Volvo Technology Transfer – 80

Other (4) 18

Balance sheet, December 31 1,953 2,044

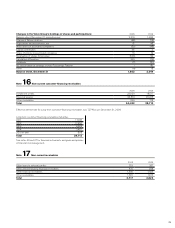

Note 16 Non-current customer-financing receivables

2008 2009

Installment credits 23,029 18,517

Financial leasing 26, 874 20,478

Other receivables 529 718

Total 50,432 39,713

Effective interest rate for Long-term customer-financing receivables was 7.27% as per December 31, 2009.

Long-term customer-financing receivables maturities

2011 17,918

2012 11, 9 54

2013 6,526

2014 2,457

2015 or later 858

Total 39,713

See notes 36 and 37 for financial instruments and goals and policies

in financial risk management.

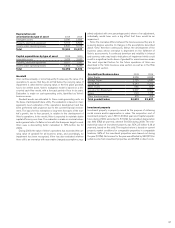

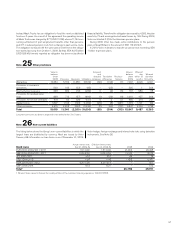

Note 17 Non-current receivables

2008 2009

Other loans to external parties 219 287

Other interest-bearing financial receivables 475 298

Other financial receivables 1,382 1,425

Other receivables 1,641 1,613

Total 3,717 3,623

89