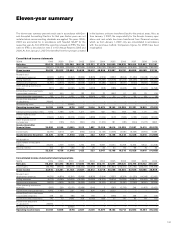

Volvo 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes and comments

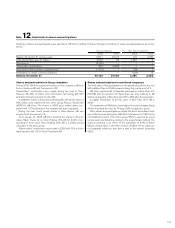

Note 15 Provisions for pensions

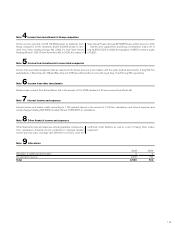

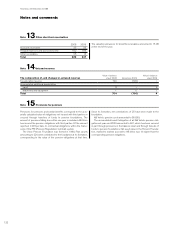

Note 13 Other short-term receivables

Note 14 Untaxed reserves

Provisions for pensions and similar benefits correspond to the actu-

arially calculated value of obligations not insured with third parties or

secured through transfers of funds to pension foundations. The

amount of pensions falling due within one year is included. AB Volvo

has insured the pension obligations with third parties. Of the amount

reported, 0 (41) pertains to contractual obligations within the frame-

work of the PRI (Pension Registration Institute) system.

The Volvo Pension Foundation was formed in 1996. Plan assets

amounting to 224 were contributed to the foundation at its formation,

corresponding to the value of the pension obligations at that time.

2008 2009

Accounts receivable 35 35

Prepaid expenses and accrued income 162 199

Other receivables 25 13

Total 222 247

The composition of, and changes in, untaxed reserves Value in balance

sheet 2008 Allocations 2009 Value in balance

sheet 2009

Tax allocation reserve 700 (700) –

Accumulated additional depreciation

Land 3 – 3

Machinery and equipment 101

Total 704 (700) 4

Since its formation, net contributions of 25 have been made to the

foundation.

AB Volvo’s pension costs amounted to 55 (95).

The accumulated benefit obligation of all AB Volvo’s pension obli-

gations at year-end 2009 amounted to 601, which has been secured

in part through provisions in the balance sheet and through transfer of

funds to pension foundations. Net asset value in the Pension Founda-

tion, marked to market, accrued to AB Volvo was 14 higher than the

corresponding pension obligations.

The valuation allowance for doubtful receivables amounted to 15 (5)

at the end of the year.

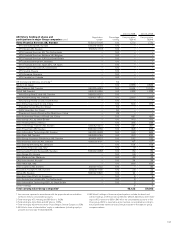

FINANCIAL INFORMATION 2009

122