Travelers 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

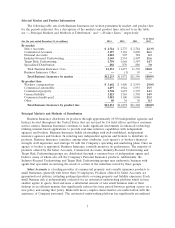

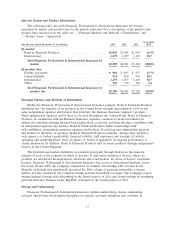

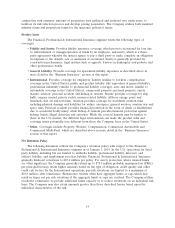

Selected Market and Product Information

The following table sets forth Business Insurance net written premiums by market and product line

for the periods indicated. For a description of the markets and product lines referred to in the table,

see ‘‘—Principal Markets and Methods of Distribution’’ and ‘‘—Product Lines,’’ respectively.

% of Total

(for the year ended December 31, in millions) 2013 2012 2011 2013

By market:

Select Accounts ................................ $ 2,724 $ 2,775 $ 2,784 22.3%

Commercial Accounts ............................ 3,197 3,101 2,890 26.1

National Accounts .............................. 1,010 907 782 8.3

Industry-Focused Underwriting ..................... 2,645 2,554 2,407 21.6

Target Risk Underwriting ......................... 1,799 1,666 1,587 14.7

Specialized Distribution ........................... 858 870 880 7.0

Total Business Insurance Core .................... 12,233 11,873 11,330 100.0

Business Insurance Other ......................... —(1) 10 —

Total Business Insurance by market ................ $12,233 $11,872 $11,340 100.0%

By product line:

Workers’ compensation ........................... $ 3,642 $ 3,400 $ 2,959 29.8%

Commercial automobile .......................... 1,897 1,924 1,955 15.5

Commercial property ............................ 1,748 1,647 1,595 14.3

General liability ................................ 1,823 1,765 1,705 14.9

Commercial multi-peril ........................... 3,083 3,100 3,096 25.2

Other ........................................ 40 36 30 0.3

Total Business Insurance by product line ............ $12,233 $11,872 $11,340 100.0%

Principal Markets and Methods of Distribution

Business Insurance distributes its products through approximately 10,500 independent agencies and

brokers located throughout the United States that are serviced by 116 field offices and three customer

service centers. Business Insurance continues to make significant investments in enhanced technology

utilizing internet-based applications to provide real-time interface capabilities with independent

agencies and brokers. Business Insurance builds relationships with well-established, independent

insurance agencies and brokers. In selecting new independent agencies and brokers to distribute its

products, Business Insurance considers, among other attributes, each agency’s or broker’s financial

strength, staff experience and strategic fit with the Company’s operating and marketing plans. Once an

agency or broker is appointed, Business Insurance carefully monitors its performance. The majority of

products offered by the Select Accounts, Commercial Accounts, Industry-Focused Underwriting and

Target Risk Underwriting groups are distributed through a common base of independent agents and

brokers, many of whom also sell the Company’s Personal Insurance products. Additionally, the

Industry-Focused Underwriting and Target Risk Underwriting groups may underwrite business with

agents that specialize in servicing the needs of certain of the industries served by these groups.

Select Accounts is a leading provider of commercial property and casualty insurance products to

small businesses, generally with fewer than 50 employees. Products offered by Select Accounts are

guaranteed-cost policies, including packaged products covering property and liability exposures. Each

small business risk is independently evaluated via an automated underwriting platform which in turn

enables agents to quote, bind and issue a substantial amount of new small business risks at their

desktop in an efficient manner that significantly reduces the time period between quoting a price on a

new policy and issuing that policy. Risks with more complex characteristics are underwritten with the

assistance of Company personnel. The automated underwriting platform has significantly streamlined

7