Travelers 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TRV is not dependent on dividends or other forms of repatriation from its foreign operations to

support its liquidity needs. U.S. income taxes have not been recognized on $714 million of the

Company’s foreign operations’ undistributed earnings as of December 31, 2013, as such earnings are

intended to be permanently reinvested in those operations. Furthermore, taxes paid to foreign

governments on these earnings may be used as credits against the U.S. tax on dividend distributions if

such earnings were to be distributed to the holding company. The amount of undistributed earnings

from foreign operations and related taxes on those undistributed earnings were not material to the

Company’s financial position or liquidity at December 31, 2013.

TRV has a shelf registration statement with the Securities and Exchange Commission which

permits it to issue securities from time to time. TRV also has a $1.0 billion line of credit facility with a

syndicate of financial institutions that expires in June 2018. This line of credit also supports TRV’s

$800 million commercial paper program, of which $100 million was outstanding at December 31, 2013.

TRV is not reliant on its commercial paper program to meet its operating cash flow needs.

The Company utilized uncollateralized letters of credit issued by major banks with an aggregate

limit of approximately $206 million, to provide a portion of the capital needed to support its obligations

at Lloyd’s at December 31, 2013. If uncollateralized letters of credit are not available at a reasonable

price or at all in the future, the Company can collateralize these letters of credit or may have to seek

alternative means of supporting its obligations at Lloyd’s, which could include utilizing holding company

funds on hand.

Operating Activities

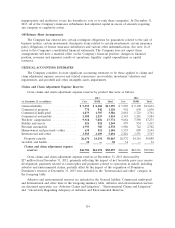

Net cash flows provided by operating activities were $3.82 billion, $3.23 billion and $2.17 billion in

2013, 2012 and 2011, respectively. Cash flows in 2013 primarily reflected a decrease in losses paid

related to catastrophes and a higher level of collected premiums, partially offset by an increase in

income tax payments. Cash flows in 2012 primarily reflected a decrease in losses paid related to

catastrophes, a lower level of paid losses related to asbestos claims and operations in runoff and a

higher level of collected premiums, partially offset by an increase in paid losses related to

non-catastrophe ongoing business (including the impact of increased loss costs). In 2013, the Company

made no contributions to its qualified domestic pension plan, which was 106% funded at December 31,

2013. In 2012 and 2011, the Company voluntarily made contributions totaling $217 million and

$185 million, respectively, to its qualified domestic pension plan.

Investing Activities

Net cash flows used in investing activities in 2013 and 2012 were $910 million and $972 million,

compared with net cash flows provided by investing activities of $1.15 billion in 2011. The 2013 total

included $997 million related to the Company’s acquisition of Dominion (net of cash acquired). The

Company’s consolidated total investments at December 31, 2013 decreased by $678 million, or 1% from

year-end 2012, primarily reflecting the impact of a significant decline in net unrealized appreciation of

investments driven by an increase in interest rates, common share repurchases and dividends paid to

shareholders, partially offset by net cash flows provided by operating activities and the impact of the

acquisition of Dominion.

On December 5, 2012, the Company increased its ownership in J. Malucelli Participa¸c˜

oes em

Seguros e Resseguros S.A, its Brazilian joint venture (JMalucelli), through the exercise of a pre-existing

option. As a result, the Company increased its ownership to 49.5% of the venture. JMalucelli is

currently the market leader in surety in Brazil based on market share. The Company’s investment was

funded with cash provided internally from an operating subsidiary of the Company.

The Company’s investment portfolio is managed to support its insurance operations; accordingly,

the portfolio is positioned to meet obligations to policyholders. As such, the primary goals of the

126