Travelers 2013 Annual Report Download - page 132

Download and view the complete annual report

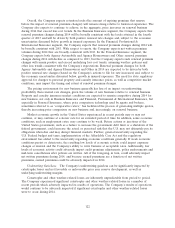

Please find page 132 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overall, the Company expects retention levels (the amount of expiring premium that renews,

before the impact of renewal premium changes) will remain strong relative to historical experience. The

Company also expects to continue to achieve, in the aggregate, price increases on renewal business

during 2014 that exceed loss cost trends. In the Business Insurance segment, the Company expects that

renewal premium changes during 2014 will be broadly consistent with the levels attained in the fourth

quarter of 2013 and will be driven by both positive renewal rate changes and, subject to the economic

uncertainties discussed below, growth in insured exposures. In the Financial, Professional &

International Insurance segment, the Company expects that renewal premium changes during 2014 will

be broadly consistent with 2013. With respect to surety, the Company expects net written premium

volumes during 2014 that are broadly consistent with 2013. In the Personal Insurance segment, the

Company expects both Agency Automobile and Agency Homeowners and Other renewal premium

changes during 2014 will decline as compared to 2013, but the Company expects such renewal premium

changes will remain positive and exceed underlying loss cost trends, assuming weather patterns and

other loss trends consistent with the Company’s expectations. Renewal premium changes for both

Agency Automobile and Agency Homeowners and Other in 2014 are expected to be driven by both

positive renewal rate changes (based on the Company’s actions to file for rate increases) and, subject to

the economic uncertainties discussed below, growth in insured exposures. The need for state regulatory

approval for changes to personal property and casualty insurance prices, as well as competitive market

conditions, may impact the timing and extent of renewal premium changes.

The pricing environment for new business generally has less of an impact on underwriting

profitability than renewal rate changes, given the volume of new business relative to renewal business.

Property and casualty insurance market conditions are expected to remain competitive during 2014 for

new business, not only in Business Insurance and Financial, Professional & International Insurance, but

especially in Personal Insurance, where price comparison technology used by agents and brokers,

sometimes referred to as ‘‘comparative raters,’’ has facilitated the process of generating multiple quotes,

thereby increasing price comparison on new business and, increasingly, on renewal business.

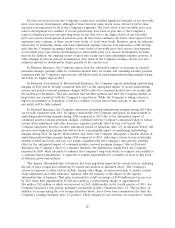

Modest economic growth in the United States experienced in recent periods may or may not

continue, or may continue at a slower rate for an extended period of time. In addition, some economic

conditions, such as employment rates, may continue to be weak. Future actions or inactions of the

United States government, such as a failure to increase the government debt limit or a shutdown of the

federal government, could increase the actual or perceived risk that the U.S. may not ultimately pay its

obligations when due and may disrupt financial markets. Further, general uncertainty regarding the

U.S. Federal budget and taxes, implementation of the Affordable Care Act and the regulatory

environment has added to the uncertainty regarding economic conditions generally. If weak economic

conditions persist or deteriorate, the resulting low levels of economic activity could impact exposure

changes at renewal and the Company’s ability to write business at acceptable rates. Additionally, low

levels of economic activity could adversely impact audit premium adjustments, policy endorsements and

mid-term cancellations after policies are written. All of the foregoing, in turn, could adversely impact

net written premiums during 2014, and because earned premiums are a function of net written

premiums, earned premiums could be adversely impacted in 2014.

Underwriting Gain/Loss. The Company’s underwriting gain/loss can be significantly impacted by

catastrophe losses and net favorable or unfavorable prior year reserve development, as well as

underlying underwriting margins.

Catastrophe and other weather-related losses are inherently unpredictable from period to period.

The Company experienced significant catastrophe and other weather-related losses in a number of

recent periods which adversely impacted its results of operations. The Company’s results of operations

would continue to be adversely impacted if significant catastrophe and other weather-related losses

were to occur during 2014.

122