Travelers 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNCERTAINTY REGARDING ADEQUACY OF ASBESTOS AND ENVIRONMENTAL RESERVES

As a result of the processes and procedures discussed above, management believes that the

reserves carried for asbestos and environmental claims at December 31, 2013 are appropriately

established based upon known facts, current law and management’s judgment. However, the

uncertainties surrounding the final resolution of these claims continue, and it is difficult to determine

the ultimate exposure for asbestos and environmental claims and related litigation. As a result, these

reserves are subject to revision as new information becomes available and as claims develop. The

continuing uncertainties include, without limitation, the risks and lack of predictability inherent in

complex litigation, any impact from the bankruptcy protection sought by various asbestos producers and

other asbestos defendants, a further increase or decrease in the cost to resolve, and/or the number of,

asbestos and environmental claims beyond that which is anticipated, the emergence of a greater

number of asbestos claims than anticipated as a result of extended life expectancies resulting from

medical advances and lifestyle improvements, the role of any umbrella or excess policies the Company

has issued, the resolution or adjudication of disputes pertaining to the amount of available coverage for

asbestos and environmental claims in a manner inconsistent with the Company’s previous assessment of

these claims, the number and outcome of direct actions against the Company, future developments

pertaining to the Company’s ability to recover reinsurance for asbestos and environmental claims and

the unavailability of other insurance sources potentially available to policyholders, whether through

exhaustion of policy limits or through the insolvency of other participating insurers. In addition,

uncertainties arise from the insolvency or bankruptcy of policyholders and other defendants. It is also

not possible to predict changes in the legal, regulatory and legislative environment and their impact on

the future development of asbestos and environmental claims. This environment could be affected by

changes in applicable legislation and future court and regulatory decisions and interpretations, including

the outcome of legal challenges to legislative and/or judicial reforms establishing medical criteria for

the pursuit of asbestos claims. It is also difficult to predict the ultimate outcome of complex coverage

disputes until settlement negotiations near completion and significant legal questions are resolved or,

failing settlement, until the dispute is adjudicated. This is particularly the case with policyholders in

bankruptcy where negotiations often involve a large number of claimants and other parties and require

court approval to be effective. As part of its continuing analysis of asbestos and environmental reserves,

the Company continues to study the implications of these and other developments. (Also see note 16 of

notes to the consolidated financial statements).

Because of the uncertainties set forth above, additional liabilities may arise for amounts in excess

of the Company’s current reserves. In addition, the Company’s estimate of claims and claim adjustment

expenses may change. These additional liabilities or increases in estimates, or a range of either, cannot

now be reasonably estimated and could result in income statement charges that could be material to

the Company’s operating results in future periods.

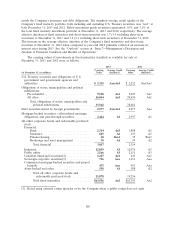

INVESTMENT PORTFOLIO

The Company’s invested assets at December 31, 2013 were $73.16 billion, of which 93% was

invested in fixed maturity and short-term investments, 1% in equity securities, 1% in real estate and

5% in other investments. As a result of the acquisition of Dominion, total investments increased by

$2.62 billion at November 1, 2013, of which $1.83 billion were fixed maturity investments. Because the

primary purpose of the investment portfolio is to fund future claims payments, the Company employs a

conservative investment philosophy. A significant majority of funds available for investment are

deployed in a widely diversified portfolio of high quality, liquid taxable U.S. government, tax-exempt

U.S. municipal and taxable corporate and U.S. agency mortgage-backed bonds.

The carrying value of the Company’s fixed maturity portfolio at December 31, 2013 was

$63.96 billion. The Company closely monitors the duration of its fixed maturity investments, and

investment purchases and sales are executed with the objective of having adequate funds available to

107