Travelers 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

policyholder. The payment of the loss amounts above the deductible are reported within ‘‘Claims

and claim adjustment expenses’’ in the above table. Because the timing of the collection of the

deductible (contractholder receivables) occurs shortly after the payment of the deductible to a

claimant (contractholder payables), these cash flows offset each other in the table.

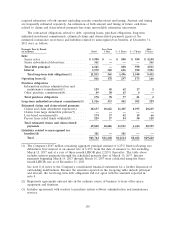

The estimated timing of the payment of the contractholder payables and the collection of

contractholder receivables for workers’ compensation policies is presented below:

Less than After

(in millions) Total 1 Year 1 - 3 Years 3 - 5 Years 5 Years

Contractholder payables/receivables ......... $4,328 $1,091 $1,204 $633 $1,400

(8) The amounts in ‘‘Loss-based assessments’’ relate to estimated future payments of second-injury

fund assessments which would result from payment of current claim liabilities. Second injury funds

cover the cost of any additional benefits for aggravation of a pre-existing condition. For loss-based

assessments, the cost is shared by the insurance industry and self-insureds, funded through

assessments to insurance companies and self-insureds based on losses. Amounts relating to second-

injury fund assessments are included in ‘‘other liabilities’’ in the consolidated balance sheet.

(9) The amounts in ‘‘Payout from ceded funds withheld’’ represent estimated payments for losses and

return of funds held related to certain reinsurance arrangements whereby the Company holds a

portion of the premium due to the reinsurer and is allowed to pay claims from the amounts held.

(10) The Company’s current liabilities related to unrecognized tax benefits from uncertain tax positions

are $381 million. Offsetting these liabilities are deferred tax assets of $362 million associated with

the temporary differences that would exist if these positions become realized.

The above table does not include an analysis of liabilities reported for structured settlements for

which the Company has purchased annuities and remains contingently liable in the event of default by

the company issuing the annuity. The Company is not reasonably likely to incur material future

payment obligations under such agreements. In addition, the Company is not currently subject to any

minimum funding requirements for its qualified pension plan. Accordingly, future contributions are not

included in the foregoing table.

Dividend Availability

The Company’s principal insurance subsidiaries are domiciled in the state of Connecticut. The

insurance holding company laws of Connecticut applicable to the Company’s subsidiaries requires

notice to, and approval by, the state insurance commissioner for the declaration or payment of any

dividend that, together with other distributions made within the preceding twelve months, exceeds the

greater of 10% of the insurer’s capital and surplus as of the preceding December 31, or the insurer’s

net income for the twelve-month period ending the preceding December 31, in each case determined in

accordance with statutory accounting practices and by state regulation. This declaration or payment is

further limited by adjusted unassigned surplus, as determined in accordance with statutory accounting

practices. The insurance holding company laws of other states in which the Company’s subsidiaries are

domiciled generally contain similar, although in some instances somewhat more restrictive, limitations

on the payment of dividends. A maximum of $3.33 billion is available by the end of 2014 for such

dividends to the holding company, TRV, without prior approval of the Connecticut Insurance

Department. The Company may choose to accelerate the timing within 2014 and/or increase the

amount of dividends from its insurance subsidiaries in 2014, which could result in certain dividends

being subject to approval by the Connecticut Insurance Department.

132