Travelers 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304

|

|

achieve its primary investment goals of assuring the Company’s ability to meet policyholder obligations

as well as to optimize investment returns, given these obligations.

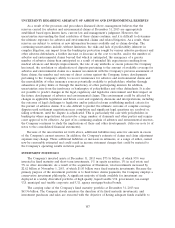

CATASTROPHE MODELING

The Company uses various analyses and methods, including proprietary and third-party computer

modeling processes, to analyze catastrophic events and the risks associated with them. The Company

uses these analyses and methods to make underwriting and reinsurance decisions designed to manage

its exposure to catastrophic events. There are no industry-standard methodologies or assumptions for

projecting catastrophe exposure. Accordingly, catastrophe estimates provided by different insurers may

not be comparable.

The Company actively monitors and evaluates changes in third-party models and, when necessary,

calibrates the catastrophe risk model estimates delivered via its own proprietary modeling processes.

The Company considers historical loss experience, recent events, underwriting practices, market share

analyses, external scientific analysis and various other factors to account for non-modeled losses to

refine its proprietary view of catastrophe risk. These proprietary models are continually updated as new

information emerges.

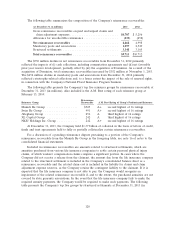

The tables below set forth the probabilities that estimated losses, comprising claims and allocated

claim adjustment expenses (but excluding unallocated claim adjustment expenses), from a single event

occurring in a one-year timeframe will equal or exceed the indicated loss amounts (expressed in dollars

and as a percentage of the Company’s common equity), based on the current version of the proprietary

and third-party computer models utilized by the Company at December 31, 2013. For example, on the

basis described below the tables, the Company estimates that there is a one percent chance that the

Company’s loss from a single U.S. hurricane in a one-year timeframe would equal or exceed

$1.3 billion, or 6% of the Company’s common equity at December 31, 2013.

Dollars (in billions)

Single U.S.

Single U.S. and Canadian

Likelihood of Exceedance(1) Hurricane Earthquake

2.0% (1-in-50) ................................. $1.0 $0.4

1.0% (1-in-100) ................................. $1.3 $0.6

0.4% (1-in-250) ................................. $2.2 $0.8

0.1% (1-in-1,000) ............................... $4.7 $1.7

Percentage of

Common Equity(2)

Single U.S.

Single U.S. and Canadian

Likelihood of Exceedance Hurricane Earthquake

2.0% (1-in-50) ................................. 4% 2%

1.0% (1-in-100) ................................. 6% 2%

0.4% (1-in-250) ................................. 9% 3%

0.1% (1-in-1,000) ............................... 20% 7%

(1) An event that has, for example, a 2% likelihood of exceedance is sometimes described as

a ‘‘1-in-50 year event.’’ As noted above, however, the probabilities in the table represent

the likelihood of losses from a single event equaling or exceeding the indicated threshold

loss amount in a one-year timeframe, not over a multi-year timeframe. Also, because the

probabilities relate to a single event, the probabilities do not address the likelihood of

more than one event occurring in a particular period, and, therefore, the amounts do not

address potential aggregate catastrophe losses occurring in a one-year timeframe.

117