Travelers 2013 Annual Report Download - page 137

Download and view the complete annual report

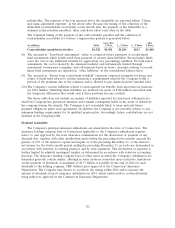

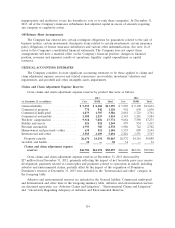

Please find page 137 of the 2013 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company’s asset-liability management process are to satisfy the insurance liabilities and maintain

sufficient liquidity to cover fluctuations in projected liability cash flows. Generally, the expected

principal and interest payments produced by the Company’s fixed maturity portfolio adequately fund

the estimated runoff of the Company’s insurance reserves. Although this is not an exact cash flow

match in each period, the substantial amount by which the market value of the fixed maturity portfolio

exceeds the value of the net insurance liabilities, as well as the positive cash flow from newly sold

policies and the large amount of high quality liquid bonds, contributes to the Company’s ability to fund

claim payments without having to sell illiquid assets or access credit facilities.

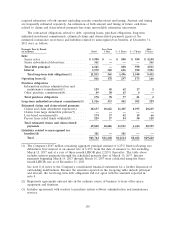

Financing Activities

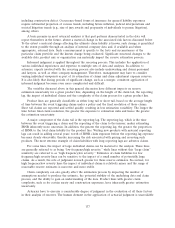

Net cash flows used in financing activities were $2.94 billion, $2.15 billion and $3.31 billion in 2013,

2012 and 2011, respectively. The totals in each year reflected common share repurchases, dividends to

shareholders and the repayment of debt, partially offset by the proceeds from employee stock option

exercises and, in 2013, proceeds from the issuance of debt.

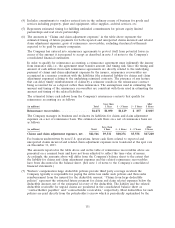

Debt Transactions.

2013. On July 25, 2013, the Company issued $500 million aggregate principal amount of 4.60%

senior notes that will mature on August 1, 2043. The net proceeds of the issuance, after original

issuance discount and the deduction of underwriting expenses and commissions and other expenses,

totaled approximately $494 million. Interest on the senior notes is payable semi-annually in arrears on

February 1 and August 1, commencing on February 1, 2014. The senior notes are redeemable in whole

at any time or in part from time to time, at the Company’s option, at a redemption price equal to the

greater of (a) 100% of the principal amount of senior notes to be redeemed or (b) the sum of the

present value of the remaining scheduled payments of principal and interest on the senior notes to be

redeemed (exclusive of interest accrued to the date of redemption) discounted to the date of

redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the

then current treasury rate (as defined) plus 15 basis points.

On March 15, 2013, the Company’s $500 million, 5.00% senior notes matured and were fully paid.

2012. On May 29, 2012, the Company purchased and retired $8.5 million aggregate principal

amount of its 6.25% fixed-to-floating rate junior subordinated debentures due March 15, 2067 in an

open market transaction. The Company’s $250 million, 5.375% senior notes matured on June 15, 2012

and were paid from existing holding company liquidity.

2011. On June 1, 2011, the Company repaid the remaining $9 million principal balance on its

7.22% real estate non-recourse debt.

In 2014, no debt obligations, other than commercial paper, become due. In 2015, the amount of

debt obligations, other than commercial paper, that comes due is $400 million. The Company may

refinance maturing debt through funds generated internally or, depending on market conditions,

through funds generated externally, including as a result of the issuance of debt or other securities.

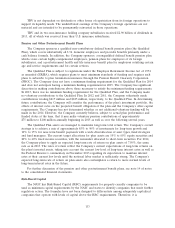

Dividends. Dividends paid to shareholders were $729 million, $694 million and $665 million in

2013, 2012 and 2011, respectively. The declaration and payment of future dividends to holders of the

Company’s common stock will be at the discretion of the Company’s board of directors and will depend

upon many factors, including the Company’s financial position, earnings, capital requirements of the

Company’s operating subsidiaries, legal requirements, regulatory constraints and other factors as the

board of directors deems relevant. Dividends will be paid by the Company only if declared by its board

of directors out of funds legally available, subject to any other restrictions that may be applicable to the

Company. On January 21, 2014, the Company announced that it declared a regular quarterly dividend

of $0.50 per share, payable March 31, 2014, to shareholders of record on March 10, 2014.

127