Travelers 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report72

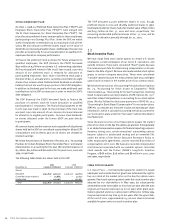

December 31 2001 2000

(In millions)

identifiable assets

Property-liability insurance $36,490 $33,708

Asset management 855 650

Total reportable segments 37,345 34,358

Parent company, other operations,

consolidating eliminations

and discontinued operations 976 1,144

Total assets $38,321 $35,502

Note 16, “Restructuring and Other Charges,” describes charges we

recorded during 2001, 2000 and 1999 and where they are included

in the foregoing tables.

20

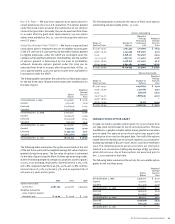

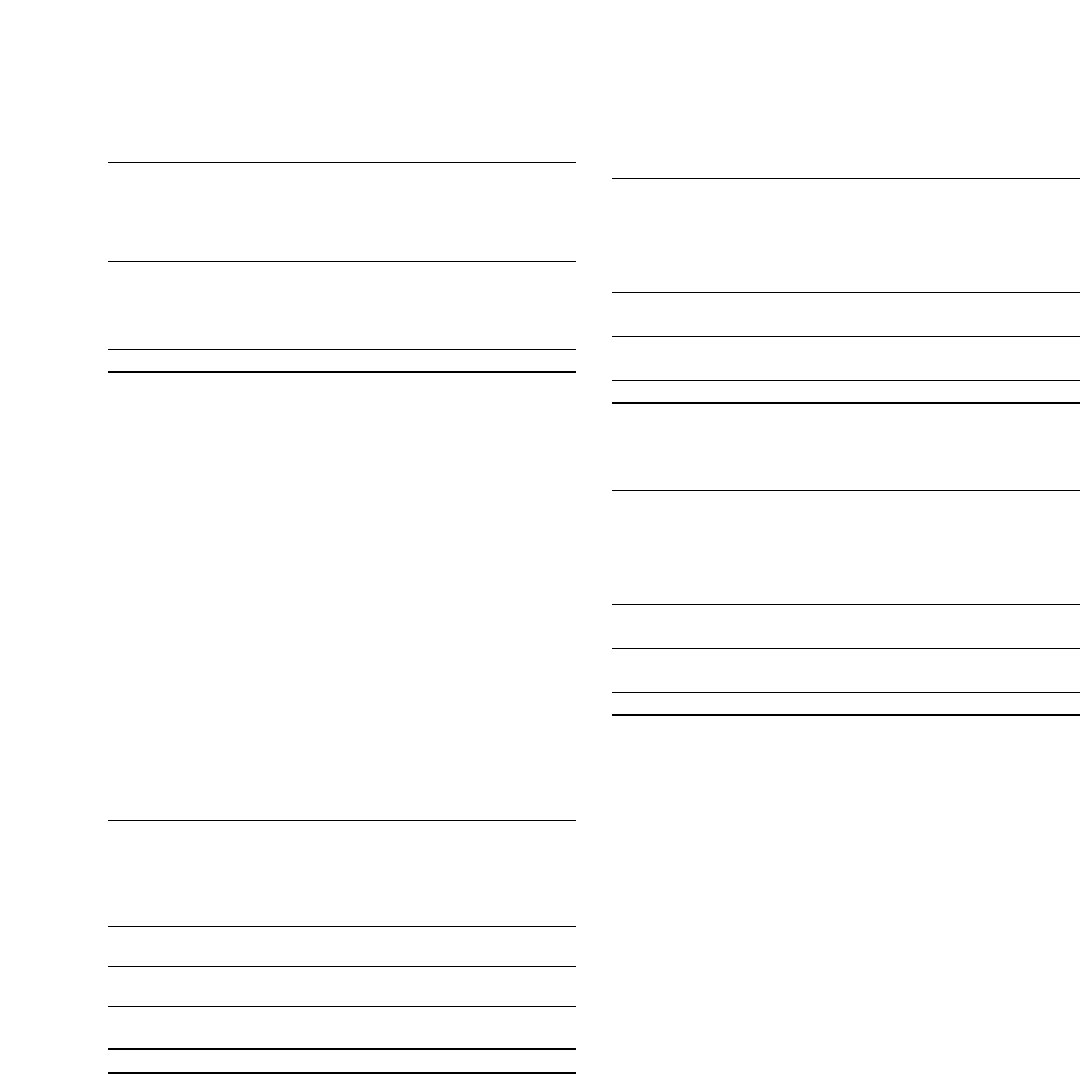

Other Comprehensive Income

Other comprehensive income is defined as any change in our equity

from transactions and other events originating from non-owner

sources. In our case, those changes are comprised of our reported

net income, changes in unrealized appreciation and changes in

unrealized foreign currency translation adjustments. The following

summaries present the components of our other comprehensive

income, other than net income, for the last three years.

Income Tax

Year ended December 31, 2001 Pretax Effect After-Tax

(In millions)

Unrealized depreciation arising

during period $ (652) $ (248) $ (404)

Less: reclassification adjustment for

realized losses included in net loss (124) (43) (81)

Net change in unrealized appreciation

on investments (528) (205) (323)

Net change in unrealized loss

on foreign currency translation (12) (4) (8)

Net change in unrealized loss

on derivatives (2) — (2)

Total other comprehensive loss $ (542) $ (209) $ (333)

Income Tax

Year ended December 31, 2000 Pretax Effect After-Tax

(In millions)

Unrealized appreciation arising

during period $ 902 $ 318 $ 584

Less: reclassification adjustment for

realized gains included in net income 595 208 387

Net change in unrealized appreciation

on investments 307 110 197

Net change in unrealized loss

on foreign currency translation (41) 1 (42)

Total other comprehensive income $ 266 $ 111 $ 155

Income Tax

Year ended December 31, 1999 Pretax Effect After-Tax

(In millions)

Unrealized depreciation arising

during period $ (457) $ (159) $ (298)

Less: reclassification adjustment for

realized gains included in net income 248 87 161

Net change in unrealized appreciation

on investments (705) (246) (459)

Net change in unrealized loss

on foreign currency translation (10) 2 (12)

Total other comprehensive loss $ (715) $ (244) $ (471)