Travelers 2001 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report66

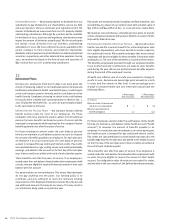

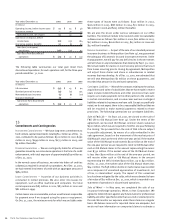

Year ended December 31 2001 2000 1999

(In millions)

Operating income, before income taxes $19$53$48

Income tax expense —10 13

Operating income, net of taxes 19 43 35

Gain (loss) on disposal, before

income taxes (61) (25) 184

Income tax expense (benefit) 37 (5) 90

Gain (loss) on disposal,

net of taxes (98) (20) 94

Gain (loss) from discontinued

operations $(79)$23$129

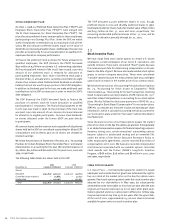

The following table summarizes our total gain (loss) from

discontinued operations, for each operation sold, for the three-year

period ended Dec. 31, 2001.

Year ended December 31 2001 2000 1999

(In millions)

Life insurance $ (55) $43$44

Standard personal insurance (13) (11) 155

Nonstandard auto insurance (5) (9) (70)

Insurance brokerage (6) ——

Gain/(loss) from discontinued

operations $(79)$23$129

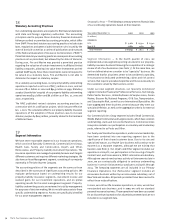

15

Commitments and Contingencies

Investment Commitments — We have long-term commitments to

fund venture capital investments totaling $1.2 billion as of Dec. 31,

2001, estimated to be paid as follows: $302 million in 2002; $290

million in 2003; $299 million in 2004; $275 million in 2005; and

$9 million thereafter.

Financial Guarantees — We are contingently liable for a financial

guarantee issued by our reinsurance operation in the form of a credit

enhancement, with total exposure of approximately $15 million as

of Dec. 31, 2001.

In the normal course of business, we enter into letters of credit as

collateral, as required in certain of our operations. As of Dec. 31, 2001,

we had entered into letters of credit with an aggregate amount of

$984 million.

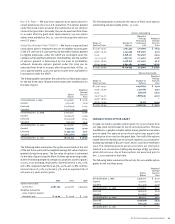

Lease Commitments — A portion of our business activities is

conducted in rented premises. We also enter into leases for

equipment, such as office machines and computers. Our total

rental expense was $83 million in 2001, $83 million in 2000 and

$82 million in 1999.

Certain leases are noncancelable, and we would remain responsible

for payment even if we stopped using the space or equipment.

On Dec. 31, 2001, the minimum rents for which we are liable under

these types of leases were as follows: $137 million in 2002,

$126 million in 2003, $88 million in 2004, $71 million in 2005,

$60 million in 2006 and $203 million thereafter.

We are also the lessor under various subleases on our office

facilities. The minimum rentals to be received under noncancelable

subleases are as follows: $22 million in 2002, $20 million in 2003,

$17 million in 2004, $16 million in 2005, $15 million in 2006 and

$37 million thereafter.

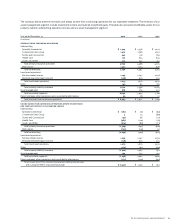

Reserve Guarantees — As part of the sale of our standard personal

insurance business to Metropolitan (see Note 14), we guaranteed

the adequacy of Economy’s loss and loss expense reserves. Under

that guarantee, we will pay for any deficiencies in those reserves

and will share in any redundancies that develop by Sept. 30, 2002.

We remain liable for claims on non-Economy policies that result

from losses occurring prior to closing. By agreement, Metropolitan

will adjust those claims and share in redundancies in related

reserves that may develop. As of Dec. 31, 2001, we estimated that

we will owe Metropolitan $7 million on these guarantees, and

recorded that amount in discontinued operations.

Contingent Liabilities — Most of the contracts relating to the various

acquisitions and sales of subsidiaries that we have made in recent

years include indemnifications and other provisions that could

require us to make payments to the other parties to the contracts

in certain circumstances, and in some cases we have contingent

liabilities related to businesses we have sold. Except as specifically

noted, we do not expect there to be a reasonable likelihood that we

will be required to make material payments related to those

provisions. The following summarizes our contingent liabilities.

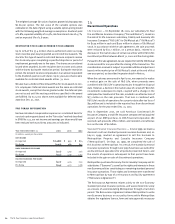

Sale of F&G Life — On Sept. 28, 2001, we closed on the sale of

F&G Life to Old Mutual (see Note 14). Under the terms of the

agreement, we received Old Mutual common shares valued at

$300 million, which we are required to hold for one year following

the closing. The proceeds from the sale of F&G Life are subject

to possible adjustment, by means of a collar embedded in the

sale agreement, based on the movement of the market price of

Old Mutual’s stock at the end of the one-year period. If the market

value of the Old Mutual stock exceeds $330 million at the end of

the one-year period, we are required to remit to Old Mutual either

cash or Old Mutual shares in the amount representing the excess

over $330 million. If the market value of the Old Mutual shares

is less than $300 million at the end of the one-year period, we

will receive either cash or Old Mutual shares in the amount

representing the deficit below $300 million, up to $40 million.

At Dec. 31, 2001, the market value of the Old Mutual shares was

$242 million. The $58 million decline in market value was recorded

as a component of unrealized appreciation of investments, net

of tax, in shareholders’ equity. The impact of this unrealized

loss has been mitigated by the collar, which was estimated to have

a fair value of $17 million at Dec. 31, 2001, which is recorded in our

statement of operations in discontinued operations.

Sale of Minet — In May 1997, we completed the sale of our

insurance brokerage operation, Minet, to Aon Corporation. We

agreed to indemnify Aon against any future claims for professional

liability and other specified events that occurred or existed prior to

the sale. We monitor our exposure under these claims on a regular

basis. We believe reserves for reported claims are adequate, but

we do not have information on unreported claims to estimate a