Travelers 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 3

to our shareholders:

2001 was a challenging year for

The St. Paul Companies.

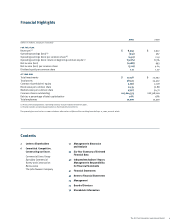

We reported a net loss of $1.09 billion for the year,

compared with net income of $993 million for 2000.

The 2001 result includes more than $600 million in

after-tax losses related to the September 11 terrorist

attack on the World Trade Center and Pentagon.

It also includes $612 million after-tax for reserve

strengthening, restructuring charges and the write-

down of goodwill, primarily related to our planned

exit of the medical malpractice business and most

of the company’s international operations. Our asset

management operation, The John Nuveen Company,

reported a seventh consecutive year of record earnings.

The St. Paul’s common shareholders’ equity fell to $5.06 billion,

or $24.35 per share, at the end of 2001, down from equity of

$7.18 billion, or $32.88 per share, a year earlier.

The financial losses incurred by The St. Paul on September 11,

however, pale in comparison to the scope of human tragedy

suffered by the thousands whose lives were lost or forever

changed on that day. I am proud of the efforts of our employees,

in New York and elsewhere, who showed courage, compassion

and professionalism under extraordinary circumstances.

In my first letter to you as chairman of The St. Paul I want

to outline how we intend to return this company to profitability

and build shareholder value.

Strategic Actions

In the fourth quarter of 2001 we undertook a comprehensive

review of the performance and prospects of each of our business

operations. We looked at the market dynamics, current financial

results and the prospects for appropriate future returns of each

business. Of particular concern were those operations that have

generated significant underwriting losses in recent years. Our

objective was to take actions by the end of 2001 that would best

position The St. Paul for success in 2002 and beyond.

As a result of this review, we announced in December a number

of steps to return our company to profitability:

• We began to exit the medical malpractice business. Medical

malpractice has been highly unprofitable for us in recent years

and is not likely to return to profitability.

• We plan to shut down most of our international underwriting

operations, with the exception of offices in locations where we

believe we have sufficient scale to be competitive and profitable:

the United Kingdom, Canada and Ireland. In addition, we remain

committed to our surety underwriting company in Mexico,

where we have a leading market share in that product line.

• We significantly reduced 2002 exposure and expenses in our

Reinsurance and Lloyd’s underwriting operations by exiting

unprofitable lines, eliminating duplicated lines of business

between the two organizations and sharply reducing the

number of reinsurance branch offices we maintain outside

the United States.

• We have begun to improve efficiency and shrink our cost

structure through staff and expense reductions. Our cost-

cutting efforts so far will result in $130 million of expense

savings in 2002. That’s approximately 10 percent of our total

2001 fixed expense. We are confident that we will achieve

additional savings during the year.

These actions will result in our exit from lines of business that

have little prospect of profitability. We recognize that these

actions impact the lives of many dedicated employees, and

they represent a marked change from the past for this company.

Nonetheless, they are the right actions for The St. Paul.