Travelers 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 21

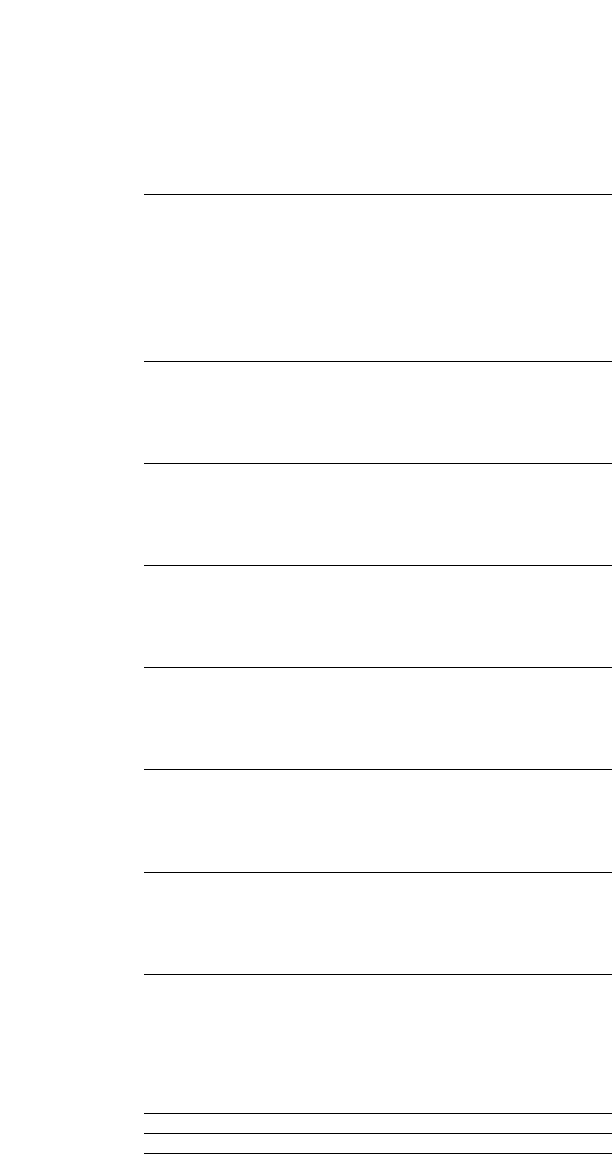

% of 2001

Year ended Written

December 31 Premiums 2001 2000 1999

(Dollars in millions)

primary insurance

operations:

Specialty Commercial

Written premiums 27% $2,109 $ 1,563 $ 1,322

Underwriting result $ (181) $ (10) $ (191)

Combined ratio 108.6 97.9 113.6

Adjusted combined ratio* 103.4 105.7 115.7

Commercial Lines Group

Written premiums 20% $1,604 $ 1,436 $ 1,303

Underwriting result $4$ 74 $ (189)

Combined ratio 98.2 94.7 113.3

Adjusted combined ratio* 94.2 92.9 115.9

Surety and Construction

Written premiums 13% $991 $ 859 $ 826

Underwriting result $ (33) $ 68 $ (27)

Combined ratio 102.7 88.8 100.1

Adjusted combined ratio* 104.0 95.1 102.8

Health Care

Written premiums 10% $770 $ 599 $ 545

Underwriting result $ (985) $ (241) $ (70)

Combined ratio 222.9 139.5 114.8

Adjusted combined ratio* 221.2 142.2 –

Lloyd’s and Other

Written premiums 8% $608 $ 351 $ 201

Underwriting result $(374) $ (86) $ (23)

Combined ratio 164.2 123.1 112.2

Adjusted combined ratio* 129.9 132.7 –

total primary insurance

Written premiums 78% $6,082 $ 4,808 $ 4,197

Underwriting result $ (1,569) $ (195) $ (500)

Combined ratio 126.5 103.1 111.2

Adjusted combined ratio* 119.7 107.7 113.2

Reinsurance

Written premiums 22% $1,681 $ 1,076 $ 915

Underwriting result $ (725) $ (114) $ 75

Combined ratio 145.6 112.0 92.2

Adjusted combined ratio* 117.5 120.7 109.1

total property-liability

insurance

Written premiums 100% $7,763 $ 5,884 $ 5,112

Underwriting result $(2,294) $ (309) $ (425)

Statutory combined ratio:

Loss and loss expense ratio 102.5 70.0 72.9

Underwriting expense ratio 28.1 34.8 35.0

Combined ratio 130.6 104.8 107.9

Adjusted combined ratio* 119.3 110.4 112.4

* For purposes of meaningful comparison, adjusted combined ratios in all

three years exclude the impact of the reinsurance treaties described on

pages 18 and 19 of this report, and in 2001, the impact of the Sept. 11, 2001

terrorist attack.

property-liability insurance

Primary Insurance Operations

Our primary insurance underwriting operations consist of five busi-

ness segments that underwrite property-liability insurance and

provide insurance-related products and services to commercial and

professional customers. We utilize a network of more than 5,000

independent insurance agents and brokers to distribute the major-

ity of our insurance products.

To provide a more meaningful analysis of the underlying perform-

ance of our property-liability business segments, the following

discussion of segment results excludes the impact of the terrorist

attack in 2001 and the reinsurance treaties in all three years. The

impact of the terrorist attack on individual segment results was dis-

cussed on page 13 of this report, and the impact of the reinsurance

treaties was discussed on pages 18 and 19 of this report.

primary insurance operations

Specialty Commercial

The business centers comprising this segment are

designated specialty commercial operations because

each provides dedicated underwriting, claim and risk

control services that require specialized expertise, and

each focuses exclusively on the respective customer

group each serves.Those business centers are as follows.

Technology offers a comprehensive portfolio of specialty

products and services to companies involved in tele-

communications, information technology, medical

technology, biotechnology and electronics manufactur-

ing. Financial and Professional Services (“FPS”)

provides coverages for financial institutions, including

property, liability, professional liability and manage-

ment liability coverages; financial products coverages

for corporations and nonprofit organizations; and errors’

and omissions’ coverages for a variety of professionals

such as lawyers, insurance agents and real estate

agents. Public Sector Services markets insurance prod-

ucts and services to cities, counties, townships and

special governmental districts. Discover Re serves retail

brokers and insureds who are committed to the alter-

native risk transfer market, which is typically utilized by

sophisticated insureds that are financially able to

assume a substantial portion of their own losses.