Travelers 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report56

10

Income Taxes

Method for Computing Income Tax Expense (Benefit) — We compute

our income tax expense under the liability method. This means

deferred income taxes reflect what we estimate we will pay or

receive in future years. A current tax liability, or asset, is recognized

for the estimated taxes payable, or recoverable, for the current year.

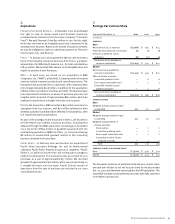

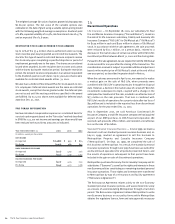

Income Tax Expense (Benefit) — Income tax expense or benefits are

recorded in various places in our financial statements. A summary

of the amounts and places follows.

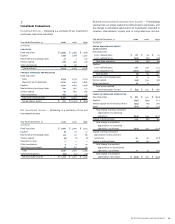

Year ended December 31 2001 2000 1999

(In millions)

statements of operations

Expense (benefit) on continuing

operations $ (422) $ 431 $ 219

Benefit on operating loss

of discontinued operations —10 15

Expense (benefit) on gain or loss on

disposal of discontinued operations 37 (6) 90

Total income tax expense (benefit)

included in statements of operations (385) 435 324

common shareholders’ equity

Expense (benefit) relating to stock-

based compensation and the

change in unrealized appreciation

and unrealized foreign exchange (218) 86 (253)

Total income tax expense (benefit)

included in financial statements $(603) $ 521 $ 71

Components of Income Tax Expense (Benefit) — The components of

income tax expense (benefit) on continuing operations are as follows.

Year ended December 31 2001 2000 1999

(In millions)

Federal current tax expense (benefit) $(303) $19$104

Federal deferred tax expense (benefit) (81) 372 102

Total federal income tax

expense (benefit) (384) 391 206

Foreign income tax expense (benefit) (48) 26 2

State income tax expense 10 14 11

Total income tax expense (benefit)

on continuing operations $ (422) $ 431 $ 219

Our Tax Rate is Different from the Statutory Rate — Our total income

tax expense on income from continuing operations differs from the

statutory rate of 35% of income from continuing operations before

income taxes as shown in the following table.

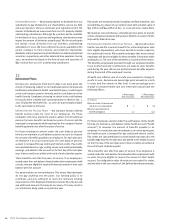

Year ended December 31 2001 2000 1999

(In millions)

Federal income tax expense (benefit)

at statutory rate $ (501) $ 490 $ 333

Increase (decrease) attributable to:

Nontaxable investment income (85) (95) (103)

Valuation allowance 74 —2

Foreign underwriting operations 44 18 4

Goodwill 30 45

Other 16 14 (22)

Total income tax expense (benefit)

on continuing operations $ (422) $ 431 $ 219

Effective tax rate on continuing

operations 29.5% 30.7% 23.0%

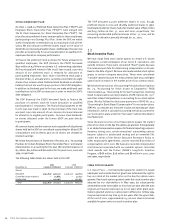

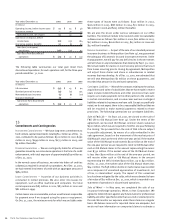

Major Components of Deferred Income Taxes on Our Balance Sheet —

Differences between the tax basis of assets and liabilities and their

reported amounts in the financial statements that will result in

taxable or deductible amounts in future years are called temporary

differences. The tax effects of temporary differences that give rise

to the deferred tax assets and deferred tax liabilities are presented

in the following table.

December 31 2001 2000

(In millions)

deferred tax assets

Loss reserves $792 $ 800

Unearned premium reserves 193 160

Alternative minimum tax credit carryforwards 124 265

Net operating loss carryforwards 496 136

Deferred compensation 113 121

Other 612 549

Total gross deferred tax assets 2,330 2,031

Less valuation allowance (106) (32)

Net deferred tax assets 2,224 1,999

deferred tax liabilities

Unrealized appreciation of investments 218 426

Deferred acquisition costs 218 183

Real estate 132 123

Prepaid compensation 92 88

Other 316 249

Total gross deferred tax liabilities 976 1,069

Deferred income taxes $ 1,248 $ 930