Travelers 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 31

property-liability underwriting

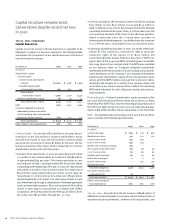

Loss and Loss Adjustment Expense Reserves

Our loss reserves reflect estimates of total losses and loss adjust-

ment expenses we will ultimately have to pay under insurance and

reinsurance policies. These include losses that have been reported

but not settled, and losses that have been incurred but not reported

to us (“IBNR”). Loss reserves for certain workers’ compensation

business and certain assumed reinsurance contracts are discounted

to present value. We reduce our loss reserves for estimates of

salvage and subrogation.

For reported losses, we establish reserves on a “case” basis within

the parameters of coverage provided in the insurance policy or rein-

surance agreement. For IBNR losses, we estimate reserves using

established actuarial methods. Our case and IBNR reserve esti-

mates consider such variables as past loss experience, changes in

legislative conditions, changes in judicial interpretation of legal lia-

bility and policy coverages, and inflation. We consider not only

monetary increases in the cost of what we insure, but also changes

in societal factors that influence jury verdicts and case law and, in

turn, claim costs.

Because many of the coverages we offer involve claims that may

not ultimately be settled for many years after they are incurred, sub-

jective judgments as to our ultimate exposure to losses are an

integral and necessary component of our loss reserving process.

We record our reserves by considering a range of estimates

bounded by a high and low point. Within that range, we record our

best estimate. We continually review our reserves, using a variety

of statistical and actuarial techniques to analyze current claim costs,

frequency and severity data, and prevailing economic, social and

legal factors. We adjust reserves established in prior years as loss

experience develops and new information becomes available.

Adjustments to previously estimated reserves are reflected in our

financial results in the periods in which they are made.

While our reported reserves make a reasonable provision for all of

our unpaid loss and loss adjustment expense obligations, it should

be noted that the process of estimating required reserves does, by

its very nature, involve uncertainty. The level of uncertainty can be

influenced by such things as the existence of coverages with long

duration payment patterns and changes in claim handling practices.

Many of the insurance subsidiaries within The St. Paul’s group have

written coverages with long duration payment patterns such as

medical professional liability, large deductible workers’ compensa-

tion and assumed reinsurance. In addition, claim handling practices

change and evolve over the years. For example, new initiatives are

commenced, claim offices are reorganized and relocated, claim

handling responsibilities of individual adjusters are changed, use

of a call center is increased, use of technology is increased, caseload

issues and case reserving practices are monitored more frequently,

etc. However, these are sources of uncertainty that we have

recognized in establishing our reserves.

Note 9 to the financial statements includes a reconciliation of our

beginning and ending loss and loss adjustment expense reserves

for each of the years 2001, 2000 and 1999. That reconciliation

shows that we recorded an increase in the loss provision from

continuing operations for claims incurred in prior years totaling

$577 million in 2001, compared with reductions in prior-year

incurred losses of $265 million and $208 million in 2000 and

1999, respectively.

The increase in prior-year loss provisions in 2001 was driven by

additional losses emerging in our Health Care segment. In 2000,

loss trends in this segment had indicated an increase in the sever-

ity of claims incurred in the 1995 through 1997 accident years;

accordingly, we recorded a provision for prior-year losses. In 2001,

loss activity continued to increase not only for the years 1995

through 1997, but also 1998, and early activity on claims incurred

in the years 1999 through 2001 indicated an increase in severity for

those years. Those developments led us to a much different view

of loss development in this segment, which in turn caused us to

record provisions for prior-year losses totaling $735 million in this

segment in 2001. At the end of the year, we announced our inten-

tion to withdraw fully from the medical liability insurance market.

A reduction in prior-year losses was recorded in 2000 and 1999. In

2000, the favorable prior-year loss development was widespread

across lines of business with the exception of the Health Care seg-

ment. In 1999, favorable prior-year loss development in several lines

of business, including workers’ compensation and assumed rein-

surance, was partially offset by adverse development in our Ocean

Marine operation and certain commercial business centers.

property-liability underwriting

Environmental and Asbestos Claims

We continue to receive claims alleging injury or damage from envi-

ronmental pollution or seeking payment for the cost to clean up

polluted sites. We also receive asbestos injury claims tendered

under general liability policies. The vast majority of these claims

arise from policies written many years ago. Significant legal issues,

primarily pertaining to the scope of coverage, complicate our

alleged liability for both environmental and asbestos claims. In our

opinion, court decisions in certain jurisdictions have tended to

broaden insurance coverage beyond the intent of original insurance

policies.

Our ultimate liability for environmental claims is difficult to estimate

because of these legal issues. Insured parties have submitted

claims for losses that in our view are not covered in their respective

insurance policies, and the final resolution of these claims may be

subject to lengthy litigation, making it difficult to estimate our

potential liability. In addition, variables such as the length of time

necessary to clean up a polluted site, and controversies surround-

ing the identity of the responsible party and the degree of

remediation deemed necessary, make it difficult to estimate the

total cost of an environmental claim.

Estimating our ultimate liability for asbestos claims is also very dif-

ficult. The primary factors influencing our estimate of the total cost

of these claims are case law and a history of prior claim develop-

ment, both of which are still developing.

The following table represents a reconciliation of total gross and

net environmental reserve development for each of the years in the

three-year period ended Dec. 31, 2001. Amounts in the “net” column

are reduced by reinsurance recoverables.