Travelers 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

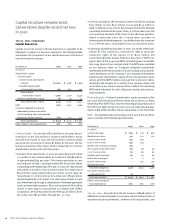

2001 2000 1999

Gross Net Gross Net Gross Net

(In millions)

environmental

Beginning reserves $ 665 $ 563 $ 698 $ 599 $ 783 $ 645

Incurred losses 118 25 14 (33) 1

Paid losses (84) (74) (58) (50) (52) (47)

Ending reserves $582 $507 $ 665 $ 563 $ 698 $ 599

The following table represents a reconciliation of total gross and

net reserve development for asbestos claims for each of the years in

the three-year period ended Dec. 31, 2001. Amounts in the “net”

column are reduced by reinsurance recoverables.

2001 2000 1999

Gross Net Gross Net Gross Net

(In millions)

asbestos

Beginning reserves $ 397 $ 299 $ 398 $ 298 $ 402 $ 277

Incurred losses 133 110 41 33 28 51

Paid losses (52) (42) (42) (32) (32) (30)

Ending reserves $478 $367 $ 397 $ 299 $ 398 $ 298

Our reserves for environmental and asbestos losses at Dec. 31, 2001

represent our estimate of our ultimate liability for such losses,

based on all information currently available to us. Because of the

inherent difficulty in estimating such losses, however, we cannot

give assurances that our ultimate liability for environmental and

asbestos losses will, in fact, match our current reserves. We con-

tinue to evaluate new information and developing loss patterns. We

believe any future additional loss provisions for, or settlement of,

environmental and asbestos claims will not materially impact our

financial position, but may materially impact our results of opera-

tions or liquidity in the period in which such provisions or

settlements occur.

In 2001, we completed a periodic analysis of environmental and

asbestos reserves at one of our subsidiaries in the United Kingdom.

The analysis was based on a policy-by-policy review of our known

and unknown exposure to damages arising from environmental pol-

lution and asbestos litigation. The analysis concluded that loss

experience for environmental exposures was developing more

favorably than anticipated, while loss experience for asbestos expo-

sures was developing less favorably than anticipated. The

divergence in loss experience had an offsetting impact on respec-

tive reserves for environmental and asbestos exposures; as a result,

we recorded a $48 million reduction in net incurred environmental

losses in 2001, and an increase in net incurred asbestos losses for

the same amount.

Total gross environmental and asbestos reserves at Dec. 31, 2001

of $1.06 billion represented approximately 5% of gross consolidated

reserves of $22.1 billion.

Record sales and strong asset growth

lead to Nuveen’s seventh consecutive

year of record earnings

ASSET MANAGEMENT

The John Nuveen Company

We hold a 77% interest in The John Nuveen Company

(“Nuveen”), which constitutes our asset management

segment. Nuveen’s core businesses are asset manage-

ment, and the development, marketing and distribution

of investment products and services for the affluent,

high net worth and institutional market segments.

Nuveen distributes its investment products and services,

including mutual funds, exchange-traded funds, defined

portfolios and individually managed accounts, to the

affluent and high net worth market segments through

unaffiliated intermediary firms including broker-deal-

ers, commercial banks, affiliates of insurance providers,

financial planners, accountants, consultants and invest-

ment advisors. Nuveen provides investment products

and services directly to the institutional market. The

Company markets its capabilities under three distinct

brands: Nuveen, a leader in tax-free investments;

Rittenhouse, a retail managed account service platform;

and Symphony, a leading institutional manager of

market-neutral and other investment portfolios. Nuveen

is listed on the New York Stock Exchange, trading under

the symbol “JNC.”

The following table summarizes Nuveen’s key financial data for the

last three years.

Year ended December 31 2001 2000 1999

(In millions)

Revenues $378 $ 376 $ 353

Expenses 190 201 193

Pretax income 188 175 160

Minority interest (46) (40) (37)

The St. Paul’s share of pretax income $142 $135 $123

Assets under management $68,485 $ 62,011 $59,784

The St. Paul Companies 2001 Annual Report32