Travelers 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report62

stock ownership plan

As of Jan. 1, 1998, our Preferred Stock Ownership Plan (“PSOP”) and

Employee Stock Ownership Plan (“ESOP”) were merged into

The St. Paul Companies, Inc. Stock Ownership Plan (“SOP”). The

plan allocates preferred shares semiannually to those employees

participating in our Savings Plus Plan. Under the SOP, we match

100% of employees’ contributions up to a maximum of 4% of their

salary. We also allocate preferred shares equal to the value of

dividends on previously allocated shares. Additionally, this plan now

provides an opportunity for an annual allocation to qualified U.S.

employees based on company performance.

To finance the preferred stock purchase for future allocation to

qualified employees, the SOP (formerly the PSOP) borrowed

$150 million at 9.4% from our primary U.S. underwriting subsidiary.

As the principal and interest of the trust’s loan is paid, a pro rata

amount of our preferred stock is released for allocation to

participating employees. Each share of preferred stock pays a

dividend of $11.72 annually and is currently convertible into eight

shares of our common stock. Preferred stock dividends on all shares

held by the trust are used to pay a portion of this SOP obligation.

In addition to dividends paid to the trust, we make additional cash

contributions to the SOP as necessary in order to meet the SOP’s

debt obligation.

The SOP (formerly the ESOP) borrowed funds to finance the

purchase of common stock for future allocation to qualified

participating U.S. employees. The final principal payment on the

trust’s loan was made in 1998. As the principal of the trust loan

was paid, a pro rata amount of our common stock was released

for allocation to eligible participants. Common stock dividends

on shares allocated under the former ESOP are paid directly

to participants.

All common shares and the common stock equivalent of all preferred

shares held by the SOP are considered outstanding for diluted EPS

computations and dividends paid on all shares are charged to

retained earnings.

We follow the provisions of Statement of Position 76-3, “Accounting

Practices for Certain Employee Stock Ownership Plans,” and related

interpretations in accounting for this plan. We recorded expense of

$.5 million, $14 million and $26 million for the years 2001, 2000 and

1999, respectively.

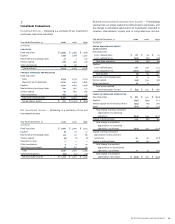

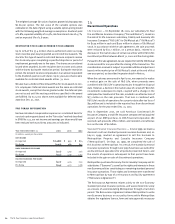

The following table details the shares held in the SOP.

2001 2000

December 31 Common Preferred Common Preferred

(Shares)

Allocated 5,144,640 492,252 5,546,251 448,819

Committed to be released — 25,885 — 49,646

Unallocated — 254,085 — 309,663

Total 5,144,640 772,222 5,546,251 808,128

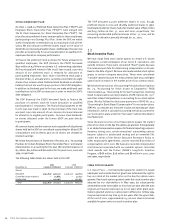

The SOP allocated 55,578 preferred shares in 2001, 83,585

preferred shares in 2000 and 183,884 preferred shares in 1999.

Unallocated preferred shares had a fair market value of $90 million

and $135 million at Dec. 31, 2001 and 2000, respectively. The

remaining unallocated preferred shares at Dec. 31, 2001, will be

released for allocation annually through Jan. 31, 2005.

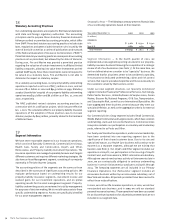

13

Stock Incentive Plans

We have made fixed stock option grants to certain U.S.-based

employees, certain employees of our non-U.S. operations, and

outside directors. These were considered “fixed” grants because

the measurement date for determining compensation costs was

fixed on the date of grant. We have also made variable stock option

grants to certain company executives. These were considered

“variable” grants because the measurement date was contingent

upon future increases in the market price of our common stock.

We follow the provisions of Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees,” FASB

Interpretation 44, “Accounting for Certain Transactions involving

Stock Compensation (an interpretation of APB Opinion No. 25),”

and other related interpretations in accounting for our stock option

plans. We also follow the disclosure provisions of SFAS No. 123,

“Accounting for Stock-Based Compensation” for our option plans.

SFAS No. 123 requires pro forma net income and earnings per share

information, which is calculated assuming we had accounted for

our stock option plans under the “fair value” method described in

that Statement.

Since the exercise price of our fixed options equals the market

price of our stock on the day the options are granted, there generally

is no related compensation expense for financial reporting purposes.

However, during 2001, certain executives’ outstanding options

became subject to accelerated vesting and an extended life,

under the terms of the Senior Executive Severance Policy or

other employment agreements, and we recorded $16 million of

compensation cost in 2001. We have also recorded compensation

cost/(income) associated with our variable options, restricted

stock awards and the former USF&G’s Long-Term Incentive

Program, of $(8) million, $28 million and $8 million in 2001, 2000

and 1999, respectively.

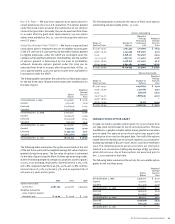

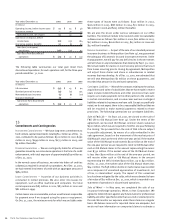

fixed option grants

U.S.-Based Plans — Our fixed option grants for certain U.S.-based

employees and outside directors give these individuals the right to

buy our stock at the market price on the day the options were

granted. Fixed stock options granted under the stock incentive plan

adopted by our shareholders in May 1994 (as subsequently

amended) become exercisable no less than one year after the date

of grant and may be exercised up to ten years after grant date.

Options granted under our option plan in effect prior to May 1994

may be exercised at any time up to ten years after the grant date.

At the end of 2001, approximately 14,300,000 shares remained

available for grant under our stock incentive plan.