Travelers 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

primary insurance operations

Health Care

The Health Care segment historically has provided a

wide range of insurance products and services through-

out the entire health care delivery system, including

individual physicians and other health care providers,

physician groups, hospitals, managed care organiza-

tions and long-term care facilities. In the fourth quarter

of 2001, we announced our intention to exit the medical

liability insurance market subject to applicable regula-

tory requirements.

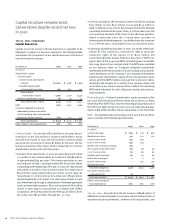

The following table summarizes key financial data for each of the

last three years in this segment. Data for all years exclude the

impact of the corporate reinsurance program, and data for 2001

exclude losses resulting from the terrorist attack. Data including

these factors is presented on page 21 of this report.

Year ended December 31 2001 2000 1999

(Dollars in millions)

Written premiums $ 776 $ 659 $ 545

Percentage increase over prior year 18% 21%

GAAP underwriting result $ (979) $ (284) $ (70)

Loss and loss adjustment expense ratio 197.9 116.5 87.8

Underwriting expense ratio 23.3 25.7 27.0

Combined ratio 221.2 142.2 114.8

2001 vs. 2000 – Price increases averaging 27% in 2001 were the

primary factor in the 18% growth in written premiums over 2000. In

addition, a full year of business volume generated by MMI, acquired

in April 2000, contributed to premium growth in 2001. However, we

significantly curtailed the amount of new Health Care business in

2001, due to an unfavorable pricing environment and unacceptable

loss experience in most of the lines of business and geographic

locations where we offered our products.

The nearly $1 billion underwriting loss in 2001 was driven by provi-

sions to strengthen loss reserves for prior accident years, particularly

the years 1997 through 1999. The prior-year reserve increases, which

totaled $735 million for the year, culminated in a $540 million pro-

vision in December that coincided with our announcement that we

would exit the medical liability market. The 2001 reserve increases

followed $225 million of increases recorded in 2000 that primarily

related to our long-term care and major accounts lines of business.

The reserve increases in 2000 were prompted by an increase in the

severity of losses driven by the rapidly escalating amounts that were

awarded by juries in professional liability lawsuits.

Through the first nine months of 2001, our actuarial analyses indi-

cated that prior-year reserve actions were necessary, as we

determined that claim severity on the specific lines of business

identified in 2000 was continuing to increase at a very high rate. We

also determined that the worsening severity was not limited solely

to those lines. As a result, we recorded additional prior-year reserve

provisions totaling $195 million in the first nine months of the year.

In the fourth quarter, as loss severity continued to escalate, we

performed a comprehensive re-evaluation of the underlying

assumptions and projections supporting our reserve positions. We

concluded that a significant additional provision to prior-year med-

ical liability loss reserves was necessary, and announced our intent

to fully withdraw from this market segment due to minimal

prospects for future profitability.

As part of the strategic review that led to our decision to exit the

medical liability business, our analysis of the unamortized goodwill

asset of $64 million related to the MMI acquisition indicated that

approximately $56 million of that goodwill was not recoverable, and

that amount was written off in the fourth quarter of 2001. The

remaining goodwill deemed recoverable was related to that portion

of MMI’s ongoing consulting business that was not placed in runoff.

2000 vs. 1999 – Health Care premium volume in 2000 included $98

million of premiums from MMI’s domestic operations. In 1999, the

written premium total included a one-time premium of $37 million

recorded on one three-year policy. Excluding that premium and

MMI’s incremental contribution in 2000, premium volume in 2000

was 11% higher than 1999. The increase was driven by price

increases, new business in selected coverages and higher renewal

retention ratios on accounts targeted for renewal. The significant

deterioration in underwriting results compared with 1999 was

driven by losses incurred in our long-term care and major accounts

books of business, including but not limited to business acquired

in the MMI transaction. Sharp increases in the amounts awarded in

jury verdicts against the large entities served by the major accounts

business center caused us to strengthen previously established loss

reserves for these coverages. MMI accounted for $256 million of

the Health Care underwriting loss in 2000, a substantial portion of

which resulted from losses in its major accounts business.

2002 Outlook – Our focus in 2002 will be on the efficient runoff

of our Health Care business. As of Jan. 23, 2002, we had not

renewed or had given notice of our intention not to renew business

that accounted for approximately 80% of the Health Care segment’s

premium volume in 2001. The remaining 20% represented business

in states where we are awaiting regulatory approval to withdraw

from the market. We anticipate approximately $400 million of

domestic Health Care written premium volume in 2002, 50% of

which is expected to result from reporting endorsements on busi-

ness being exited. We expect underwriting losses to decline

significantly in 2002.

The St. Paul Companies 2001 Annual Report26