Travelers 2001 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report70

18

Statutory Accounting Practices

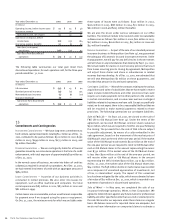

Our underwriting operations are required to file financial statements

with state and foreign regulatory authorities. The accounting

principles used to prepare these statutory financial statements

follow prescribed or permitted accounting principles, which differ

from GAAP. Prescribed statutory accounting practices include state

laws, regulations and general administrative rules issued by the

state of domicile as well as a variety of publications and manuals

of the National Association of Insurance Commissioners (“NAIC”).

Permitted statutory accounting practices encompass all accounting

practices not so prescribed, but allowed by the state of domicile.

During 2001, Fire and Marine was granted a permitted practice

regarding the valuation of certain investments in affiliated limited

liability companies, allowing it to value these investments at their

audited GAAP equity. Since these investments were not required to

be valued on a statutory basis, Fire and Marine is not able to

determine the impact on statutory surplus.

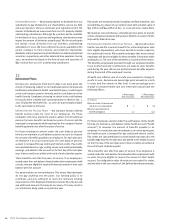

On a statutory accounting basis, our property-liability underwriting

operations reported a net loss of $873 million in 2001, and net

income of $1.2 billion in 2000 and $945 million in 1999. Statutory

surplus (shareholder’s equity) of our property-liability underwriting

operations was $4.5 billion and $6.3 billion as of Dec. 31, 2001 and

2000, respectively.

The NAIC published revised statutory accounting practices in

connection with its codification project, which became effective

Jan. 1, 2001. The cumulative effect to our property-liability insurance

operations of the adoption of these practices was to increase

statutory surplus by $165 million, primarily related to the treatment

of deferred taxes.

19

Segment Information

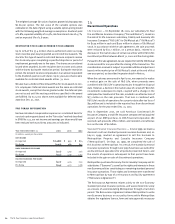

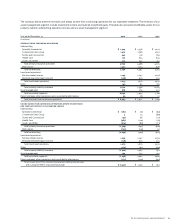

We have seven reportable segments in our insurance operations,

which consist of Specialty Commercial, Commercial Lines Group,

Health Care, Surety and Construction, Lloyd’s and Other,

Reinsurance, and Property-Liability Investment Operations. The

insurance operations are managed separately because each targets

different customers and requires different marketing strategies. We

also have an Asset Management segment, consisting of our majority

ownership in The John Nuveen Company.

The accounting policies of the segments are the same as those

described in the summary of significant accounting policies. We

evaluate performance based on underwriting results for our

property-liability insurance segments, investment income and

realized gains for our investment operations, and on pretax

operating results for the asset management segment. Property-

liability underwriting assets are reviewed in total by management

for purposes of decision-making. We do not allocate assets to these

specific underwriting segments. Assets are specifically identified

for our asset management segment.

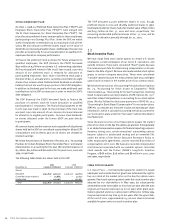

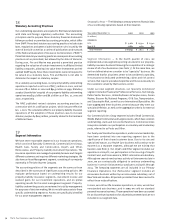

Geographic Areas — The following summary presents financial data

of our continuing operations based on their location.

Year ended December 31 2001 2000 1999

(In millions)

revenues

U.S. $7,161 $ 6,792 $ 6,342

Non-U.S. 1,782 1,180 807

Total revenues $ 8,943 $ 7,972 $ 7,149

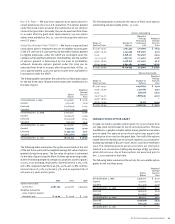

Segment Information — In the fourth quarter of 2001, we

implemented a new segment reporting structure for our property-

liability insurance business following the completion of a strategic

review of all of our businesses (see Note 3). At the same time, we

further defined what we consider to be “specialty” business. We

determined that for a business center to be considered a specialty,

it must possess dedicated underwriting, claims and risk control

services that require specialized expertise and focus exclusively on

the customers served by that business center.

Under our new segment structure, our Specialty Commercial

segment includes Financial & Professional Services, Technology,

Public Sector Services, Umbrella/Excess & Surplus Lines, Ocean

Marine, Discover Re, National Programs, Oil & Gas, Transportation,

and Catastrophe Risk, as well as our International Specialties. We

have aggregated these business centers because they meet our

specialty definition, as well as the aggregation criteria for external

segment reporting.

Our Commercial Lines Group segment includes Small Commercial,

Middle Market Commercial and Large Accounts, which have common

underwriting, claim and risk control functions. Commercial Lines

Group also includes our participation in voluntary and involuntary

pools, referred to as Pools and Other.

Our Surety and Construction operations, under common leadership,

have been combined into one reporting segment due to the

significance of their shared customer base. Due to its size and

specialized nature, our Health Care business will continue to be

reported as a separate segment, although we are exiting that

business (see Note 3). Our Lloyd’s and Other segment includes our

operations at Lloyd’s, our participation in the insuring of Lloyd’s

Central Fund, and Unionamerica, MMI’s international subsidiary.

Although we ceased new business activity at Unionamerica late in

2000, we are contractually obligated to continue underwriting

business in certain Unionamerica syndicates at Lloyd’s through

2004. The foregoing segments are all included in our Primary

Insurance Operations. Our Reinsurance segment includes all

reinsurance business written by our reinsurance subsidiary, out of

New York and London. All periods presented have been revised to

reflect these reclassifications.

In 2001, we sold our life insurance operations; in 2000, we sold our

nonstandard auto business; and in 1999, we sold our standard

personal insurance business. These operations have been accounted

for as discontinued operations for all periods presented and are not

included in our segment data.