Travelers 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

primary insurance operations

Lloyd’s and Other

This business segment consists of the following

components: our operations at Lloyd’s, where we

provide capital to five underwriting syndicates and

own a managing agency; our participation in the

insuring of the Lloyd’s Central Fund, which would be

utilized if an individual member of Lloyd’s were to be

unable to pay its share of a syndicate’s losses; and

results from MMI’s London-based insurance operation,

Unionamerica, placed in runoff in 2000 except for cer-

tain business it is contractually obligated to continue

writing through 2004. As discussed on pages 13 and 14

of this report, we announced in late 2001 that we would

cease underwriting certain business through Lloyd’s

beginning in 2002, and would, when current contractual

commitments expire in 2003, end our involvement in the

insuring of the Lloyd’s Central Fund.

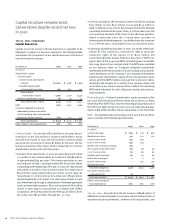

The following table summarizes results for this segment for the last

three years. Data for 2001 exclude losses from the terrorist attack,

and data for all three years exclude the impact of the corporate rein-

surance program. Data including these factors is presented on page

21 of this report.

Year ended December 31 2001 2000 1999

(Dollars in millions)

Written premiums $599 $ 430 $ 201

Percentage increase over prior year 39% 114%

GAAP underwriting result $(173)$ (144) $ (23)

Loss and loss adjustment expense ratio 101.7 102.5 84.2

Underwriting expense ratio 28.2 30.2 28.0

Combined ratio 129.9 132.7 112.2

2001 vs. 2000 – Premium growth in 2001 was primarily due to new

business resulting from our increased capacity in several syndicates

at Lloyd’s. Our Lloyd’s premium volume totaled $500 million in

2001, compared with $331 million in 2000. In addition, price

increases in our operations at Lloyd’s averaged nearly 20% for the

year, and began to accelerate further after the Sept. 11 terrorist

attack. Unionamerica generated $99 million of written premiums in

each of 2001 and 2000. Although we ceased new business activity

at Unionamerica late in 2000, we are contractually obligated to

continue underwriting business in certain Unionamerica syndicates

at Lloyd’s through 2004.

The deterioration in underwriting results compared with 2000 was

the result of adverse prior-year loss development in several Lloyd’s

syndicates, particularly those associated with North American lia-

bility coverages. In addition, poor prior-year loss experience and

the write-off of uncollectible reinsurance receivables in our finan-

cial and professional services syndicate contributed to the increase

in underwriting losses in 2001. Unionamerica generated an under-

writing loss of $61 million in 2001, compared with $63 million in

2000. The majority of Unionamerica’s losses in both years were the

result of adverse development on business written in prior years.

2000 vs. 1999 – The addition of Unionamerica accounted for

$99 million of written premium volume in 2000. Excluding

Unionamerica, the 65% increase in premiums over 1999 was driven

by growth in our Lloyd’s operations, where we expanded our invest-

ment in several specialty underwriting syndicates. Premiums

generated at Lloyd’s in 2000 totaled $331 million, compared with

$201 million in 1999. Underwriting results in 2000 suffered from sig-

nificant adverse prior-year loss development at Unionamerica and

deterioration in several syndicates’ results at Lloyd’s. Subsequent

to our acquisition of MMI, we strengthened Unionamerica’s loss

reserves and ceased writing new business in that entity, except

where contractually required. At Lloyd’s, underwriting losses were

centered in a syndicate specializing in financial and professional

liability coverage and in an aviation syndicate, which incurred

significant losses from a number of airline accidents.

2002 Outlook – In 2002, we will limit our operations at Lloyd’s to

the following types of coverage which we believe offer the greatest

potential for profitable growth: aviation, marine, financial and pro-

fessional services, property, kidnap and ransom, accident and

health, creditor, specialist London market reinsurance, and other

personal specialty products. We anticipate additional significant

price increases on business written through Lloyd’s, as worldwide

insurance markets continue to harden in the aftermath of the

Sept. 11 terrorist attack.

The St. Paul Companies 2001 Annual Report 27