Travelers 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2000, we completed the sale of our nonstandard auto

operations for a total cash consideration of approximately $175

million (net of a $25 million dividend paid by these operations to

our property-liability operations prior to closing). In September

1999, we completed the sale of our standard personal insurance

operations to Metropolitan for net proceeds of approximately $272

million. Proceeds from both transactions were used for general

corporate purposes.

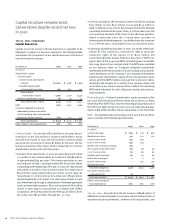

Capital Commitments – Capital expenditures that we might consider

in 2002 include acquisitions of existing businesses consistent with

our commercial insurance focus, and repurchases of our common

stock. As of year-end 2001 and through Jan. 23, 2002, we had the

authorization to make up to $89 million of common share repur-

chases under a repurchase program approved by our board of

directors in February 2001. We repurchase our shares on the open

market and through private transactions when we deem such repur-

chases to be a prudent use of capital. We made no major capital

improvements during any of the last three years.

the st. paul companies

Liquidity

Liquidity is a measure of our ability to generate sufficient cash flows

to meet the short- and long-term cash requirements of our business

operations. Our underwriting operations’ short-term cash needs pri-

marily consist of paying insurance loss and loss adjustment

expenses and day-to-day operating expenses. Those needs are met

through cash receipts from operations, which consist primarily of

insurance premiums collected and investment income. Our invest-

ment portfolio is also a source of additional liquidity, through the

sale of readily marketable fixed maturities, equity securities and

short-term investments, as well as longer-term investments such

as real estate and venture capital holdings. After satisfying our cash

requirements, excess cash flows from these underwriting and

investment activities are used to build the investment portfolio and

thereby increase future investment income.

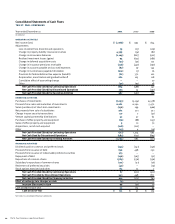

Cash flows from continuing operations totaled $884 million in 2001,

compared with cash outflows of $588 million in 2000 and cash

flows of $147 million in 1999. The strong improvement in 2001 was

the result of several factors. In our property-liability operations,

written premiums of $7.76 billion were 32% higher than in 2000,

significantly outpacing the 9% increase in insurance losses and loss

adjustment expenses paid. Our net paid losses and loss adjustment

expenses totaled $5.57 billion in 2001. Premium payments we made

related to our corporate reinsurance program in 2001 totaled $165

million, down significantly from payments of $345 million in 2000.

In addition, we received net federal tax refunds of $54 million in

2001, compared with net federal tax payments of $161 million in

2000. Our asset management segment also contributed approxi-

mately $82 million to the improvement in consolidated operational

cash flows in 2001.

The deterioration in 2000 operational cash flows compared with

1999 was primarily due to significant loss payments in our

Reinsurance, Health Care and Lloyd’s and Other business segments,

and premium payments totaling $345 million related to our corpo-

rate reinsurance program. Our underwriting cash flows in 1999 were

negatively impacted by the reductions in written premium volume

and investment receipts in our property-liability operations. Also in

1999, we made premium payments totaling $129 million related to

our corporate reinsurance program. The sale of fixed-maturity

investments to fund operational cash flow requirements resulted in

lower levels of investment cash flows in each of the last three years.

We expect our operational cash flows will be negatively impacted

in 2002 by the magnitude of insurance losses and loss adjustment

expenses payable as a result of the Sept. 11 terrorist attack, as well

as losses payable related to businesses we are exiting, particularly

the medical liability business. Excluding those factors, however, we

expect further improvement in operational cash flows in 2002,

reflecting the benefit of corrective pricing and underwriting actions

in our property-liability operations and expense reduction initia-

tives implemented throughout our operations in recent years. We

believe our financial position is strong and debt level conservative,

which provide us with the flexibility and capacity to obtain funds

externally through debt or equity financings on both a short-term

and long-term basis.

We do not anticipate receiving any cash dividends from our insur-

ance underwriting subsidiaries in 2002. We have sufficient

resources available at the parent company to fund common and

preferred shareholder dividends, interest payments and distribu-

tions on debt and preferred securities, respectively, and other

administrative expenses.

We are not aware of any current recommendations by regulatory

authorities that, if implemented, might have a material impact on

our liquidity, capital resources or operations.

the st. paul companies

Exposures to Market Risk

Market risk can be described as the risk of change in fair value of a

financial instrument due to changes in interest rates, equity prices,

creditworthiness, foreign exchange rates or other factors. We seek

to mitigate that risk by a number of actions, as described below.

Our exposure to these risks, and our policies to address these risks,

were unchanged from the previous year.

Interest Rate Risk – Our exposure to market risk for changes in inter-

est rates is concentrated in our investment portfolio, and to a lesser

extent, our debt obligations. However, changes in investment values

attributable to interest rate changes are mitigated by correspon-

ding and partially offsetting changes in the economic value of our

insurance reserves and debt obligations. We monitor this exposure

through periodic reviews of our asset and liability positions. Our

estimates of cash flows, as well as the impact of interest rate fluc-

tuations relating to our investment portfolio and insurance reserves,

are modeled and reviewed quarterly.

The following table provides principal cash flow estimates by year

for our Dec. 31, 2001 and 2000 inventories of interest-sensitive

investment assets considered to be other than trading. Also pro-

vided are the weighted average interest rates associated with each

year’s cash flows. Principal cash flow projections for collateralized

mortgage obligations were prepared using third-party prepayment

analyses. Cash flow estimates for mortgage passthroughs were pre-

pared using average prepayment rates for the prior three months.

Principal cash flow estimates for callable bonds are either to

The St. Paul Companies 2001 Annual Report36