Travelers 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report68

During 2001, we reduced the occupancy-related reserve by a net

amount of $7 million. We entered into a lease buyout related to a

portion of the space, and reduced the reserve by $8 million of lease

payments we were no longer obligated to make. This amount was

offset by a $1 million adjustment related to sublease recoveries.

Other Restructuring Charges — Since 1997, we have recorded in

continuing operations three other restructuring charges related to

actions taken to improve our operations. (Also see Note 14 for a

discussion of the charge related to the sale of our standard personal

insurance business, which was included in discontinued operations

in 1999.)

In August 1999, we announced a cost reduction program designed

to enhance our efficiency and effectiveness in a highly competitive

environment. In the third quarter of 1999, we recorded a pretax

charge of $60 million related to this program, including $25 million

in employee-related charges related to the termination of

approximately 590 employees, $33 million in occupancy-related

charges and $2 million in equipment charges. The charge was

included in “Operating and administrative expenses” in the 1999

statement of operations and in “Property-liability insurance —

other” in the table titled “Income (Loss) from Continuing Operations

Before Income Taxes and Cumulative Effect of Accounting Change”

in Note 19.

Late in the fourth quarter of 1998, we recorded a pretax restructuring

charge of $34 million. The majority of the charge, $26 million, related

to the termination of approximately 500 employees, primarily in our

commercial insurance operations. The remaining charge of $8 million

related to costs to be incurred to exit lease obligations.

In connection with our merger with USF&G, in the second quarter

of 1998 we recorded a pretax charge to net income of $292 million,

primarily consisting of severance and other employee-related costs

related to the termination of approximately 2,200 positions, facilities

exit costs, asset impairments and transaction costs.

All actions have been taken and all obligations have been met

regarding these three charges, with the exception of certain

remaining lease commitments. The lease commitment charges

related to excess space created by the cost reduction actions. The

charge was calculated by determining the percentage of anticipated

excess space, by location, and the current lease costs over the

remaining lease period. The amounts payable under the existing

leases were not discounted, and sublease income was included in

the calculation only for those locations where sublease agreements

were in place.

During 2001, we reduced the remaining reserve by $1 million related

to sublease and buyout activity, which reduced our estimated

remaining lease commitments. We expect to be obligated under

certain lease commitments for at least seven years.

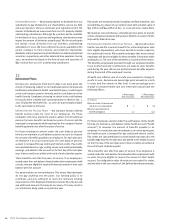

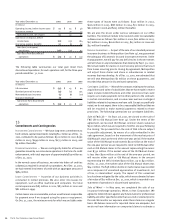

The following presents a rollforward of 2001 activity related to these commitments.

Reserve Reserve

Pretax at Dec. 31, 2001 2001 at Dec. 31,

Charge 2000 Payments Adjustments 2001

(In millions)

Lease commitments previously charged to earnings $ 75 $ 43 $ (11) $ (1) $31

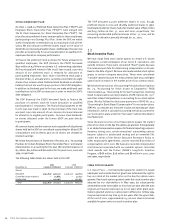

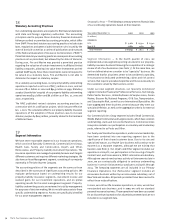

The following presents a rollforward of 2001 activity related to this charge.

Reserve Reserve

Pretax at Dec. 31, 2001 2001 at Dec. 31,

Charge 2000 Payments Adjustments 2001

(In millions)

Charges to earnings:

Employee-related $ 4 $ 1 $ (1) $ — $—

Occupancy-related 24 23 (8) (7) 8

Total $ 28 $ 24 $ (9) $ (7) $8