Travelers 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 49

goodwill and intangible assets

Goodwill is the excess of the amount we paid to acquire a company

over the fair value of its net assets, reduced by amortization and

any subsequent valuation adjustments. Intangible assets arise from

the purchase from another entity of contractual or other legal rights,

or an asset capable of being separated and sold. We amortize

goodwill and intangible assets over periods of up to 40 years,

generally on a straight-line basis. The accumulated amortization of

goodwill and intangible assets was $257 million and $216 million

at Dec. 31, 2001 and 2000, respectively.

In June 2001, the FASB issued SFAS No. 141, “Business

Combinations,” which established financial accounting and

reporting standards for business combinations. It required all

business combinations initiated subsequent to June 30, 2001 to be

accounted for under the purchase method of accounting. In addition,

this statement required that intangible assets that can be identified

and meet certain criteria be recognized as assets apart from

goodwill. We adopted the provisions of SFAS No. 141 via Nuveen’s

2001 acquisition of Symphony. Nuveen recorded an intangible asset

estimated to be in the amount of $53 million related to the purchase,

which is expected to be amortized over a weighted average of ten

years, and goodwill estimated to be in the amount of $151 million,

which will not be amortized, but will be evaluated for possible

impairment on an annual basis. (Goodwill acquired in a business

combination completed after the adoption of SFAS No. 141, but

before the adoption of SFAS No. 142, “Goodwill and Other Intangible

Assets,” is not amortized.)

impairments of long-lived assets and intangibles

We monitor the recoverability of the value of our long-lived assets

to be held and used based on our estimate of the future cash flows

(undiscounted and without interest charges) expected to result from

the use of the asset and its eventual disposition considering any

events or changes in circumstances which indicate that the carrying

value of an asset may not be recoverable. We monitor the value

of our goodwill based on our estimates of discounted future

earnings. If either estimate is less than the carrying amount of

the asset, we reduce the carrying value to fair value with a

corresponding charge to expenses. We monitor the value of our

long-lived assets, and certain identifiable intangibles, to be disposed

of and report them at the lower of carrying value or fair value less

our estimated cost to sell.

office properties and equipment

We carry office properties and equipment at depreciated cost. We

depreciate these assets on a straight-line basis over the estimated

useful lives of the assets. The accumulated depreciation for office

properties and equipment was $483 million and $452 million at the

end of 2001 and 2000, respectively.

internally developed software costs

We capitalize certain internally developed software costs incurred

during the application development stage of a project. These costs

include external direct costs associated with the project and payroll

and related costs for employees who devote time to the project. We

begin to amortize costs once the software is ready for its intended

use, and amortize them over the software’s expected useful life,

generally five years.

At Dec. 31, 2001 and 2000, respectively, we had $50 million and

$42 million of unamortized internally developed computer software

costs and recorded $7 million and $3 million of amortization

expense during 2001 and 2000, respectively.

foreign currency translation

We assign functional currencies to our foreign operations, which

are generally the currencies of the local operating environment.

Foreign currency amounts are remeasured to the functional currency,

and the resulting foreign exchange gains or losses are reflected in

the statement of operations. Functional currency amounts are then

translated into U.S. dollars. The unrealized gain or loss from this

translation, net of tax, is recorded as a part of common shareholders’

equity. The change in unrealized foreign currency translation gain

or loss during the year, net of tax, is a component of comprehensive

income. Both the remeasurement and translation are calculated

using current exchange rates for the balance sheets and average

exchange rates for the statements of operations.

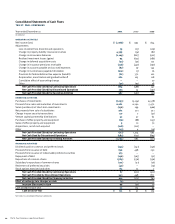

supplemental cash flow information

Interest and Income Taxes Paid — We paid interest on debt and

distributions on redeemable preferred securities of trusts of

$133 million in 2001, $134 million in 2000 and $128 million in

1999. We received net federal income tax refunds of $54 million in

2001, and paid federal income taxes of $161 million in 2000 and

$73 million in 1999.

Non-cash Investing and Financing Activities — In September 2001,

related to the sale of our life insurance subsidiary to Old Mutual plc,

we received approximately 190 million shares of Old Mutual common

stock as partial consideration. The shares were valued at $300 million

at the time of closing. In August 2000, we issued 7,006,954 common

shares in connection with the conversion of over 99% of the

$207 million of 6% Convertible Monthly Income Preferred Securities

issued by St. Paul Capital LLC (our wholly-owned subsidiary).