Travelers 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report24

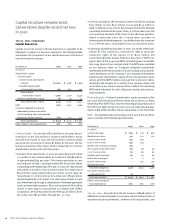

The following table summarizes key financial data for each of the

last three years in the Commercial Lines Group segment excluding

losses resulting from the terrorist attack in 2001 and excluding the

impact of the corporate reinsurance program in all three years. Data

including these factors is presented on page 21 of this report.

Year ended December 31 2001 2000 1999

(Dollars in millions)

Written premiums $ 1,687 $ 1,418 $ 1,358

Percentage increase over prior year 19% 4%

GAAP underwriting result $71$ 98 $ (234)

Loss and loss adjustment expense ratio 64.0 58.7 80.2

Underwriting expense ratio 30.2 34.2 35.7

Combined ratio 94.2 92.9 115.9

2001 vs. 2000 – Premium growth in 2001 was driven by price

increases, strong renewal retention rates and new business

throughout the segment. Price increases averaged 14% in 2001, and

the pace of those increases accelerated as the year progressed.

Middle Market Commercial premiums totaled $971 million in 2001,

16% higher than 2000 premiums of $836 million. In the Small

Commercial business center, premium volume of $579 million grew

19% over the comparable 2000 total of $485 million. In July 2001,

we established a new service center in Atlanta, which contributed

to premium growth in our Small Commercial operation by provid-

ing agents and brokers in the southeastern U.S. with a more

efficient and cost-effective platform for placing small commercial

business with us.

Each of the three business centers in this segment experienced an

improvement in current accident year results, despite a $38 million

increase in catastrophe losses in 2001. However, the magnitude of

favorable prior-year development declined compared with 2000

levels, accounting for the deterioration in reported underwriting

results. Results in 2001 benefited from a $128 million reduction in

prior-year loss reserves, of which $93 million related to business

written prior to 1988. In 2000, prior-year reserve reductions of

approximately $260 million included $80 million for various gen-

eral liability reserves, $69 million for workers’ compensation

reserves and $50 million for business written prior to 1988.

Underwriting results in the Large Accounts business center were

$31 million better than comparable 2000 results, driven by improve-

ment in both current and prior-year loss experience.

The improvement in the expense ratio in 2001 reflected the com-

bined impact of significant premium growth and a reduction in fixed

expenses. Over the last three years, we have successfully imple-

mented aggressive initiatives to reduce expenses and improve

efficiency in this segment.

2000 vs. 1999 — The 4% increase in premium volume in 2000 was

driven by significant price increases throughout the segment, the

impact of which was partially offset by a targeted reduction in busi-

ness volume in our Large Accounts business center, and a decline

in premiums generated through our participation in insurance

pools. Total written premiums in our Small Commercial and Middle

Market Commercial business centers increased a combined 7% over

1999, largely due to price increases that averaged 9% for the year.

The $332 million improvement in underwriting results in 2000 was

centered in our Small Commercial and Middle Market Commercial

operations, and reflected the impact of significant prior-year reserve

reductions, as well as price increases and tightened underwriting

standards aimed at eliminating underperforming accounts from our

book of business.

2002 Outlook – We believe the aggressive initiatives undertaken in

recent years to reduce expenses, solidify our agency relationships

and streamline our claim organization have positioned us well to

capitalize on new opportunities emerging in the standard commer-

cial marketplace. We will focus on further strengthening our pricing

structure, while managing our renewal retentions, new business

growth and portfolio mix. We will continue to build our small com-

mercial platform to better serve our agents, brokers and insureds.

Quality risk selection and aggressive expense management will

remain our highest priorities in 2002, as we pursue profitable

growth in our Commercial Lines Group segment.

primary insurance operations

Surety and Construction

The Surety business center underwrites predominantly

contract surety bonds, which guarantee that third par-

ties will be indemnified against the nonperformance of

contractual obligations. The Surety business center

includes our subsidiary Afianzadora Insurgentes, the

largest surety bond underwriter in Mexico. Based on

2000 premium volume, our surety operations are the

largest in North America, and the largest in the world.

The Construction business center delivers value-added

products and services, including traditional insurance

and financial and risk management solutions, to a broad

range of contractors and owners of construction projects.