Travelers 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report58

77

⁄

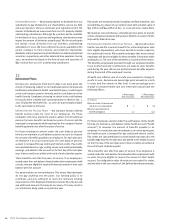

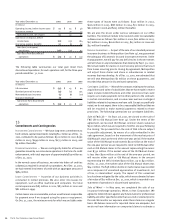

8% Senior Notes — In April 2000, we issued $250 million of senior

notes due April 15, 2005. Proceeds were used to repay commercial

paper debt and for general corporate purposes.

81

⁄

8% Senior Notes — Also in April 2000, we issued $250 million of

senior notes due April 15, 2010. Proceeds were used to repay

commercial paper debt and for general corporate purposes.

Nuveen Line of Credit Borrowings — In 2001, our asset management

subsidiary, The John Nuveen Company, entered into a $250 million

revolving line of credit that extends through August 2003. The line

is divided into two equal facilities, one of which has a three year

term, the other is renewable in 364 days. At Dec. 31, 2001, Nuveen

had two borrowings under this facility, including $125 million under

the three-year facility and $58 million under the 364-day facility.

The majority of the amount outstanding was used to finance a

portion of Nuveen’s acquisition of Symphony Asset Management

LLC. At Dec. 31, 2001, the weighted average interest rate under these

facilities was approximately 3.1%.

Commercial Paper — Our commercial paper is supported by a

$400 million credit agreement that expires in 2002 and by a

$200 million portfolio of high quality, highly liquid fixed maturity

securities.

Interest rates on commercial paper issued in 2001 ranged from 1.1%

to 6.7%; in 2000 the range was 5.5% to 6.7%; and in 1999 the range

was 4.6% to 6.6%.

Zero Coupon Convertible Notes — The zero coupon convertible

notes mature in 2009, but were redeemable beginning in 1999 for

an amount equal to the original issue price plus accreted original

issue discount. In addition, on March 3, 1999 and March 3, 2004,

the holders of the zero coupon convertible notes had/have the right

to require us to purchase their notes for the price of $640.82 and

$800.51, respectively, per $1,000 of principal amount due at

maturity. In March 1999, we repurchased approximately $34 million

face amount of the zero coupon convertible notes, for a total cash

consideration of $21 million.

71

⁄

8% Senior Notes — The 7 1

⁄

8% senior notes mature in 2005.

Variable Rate Borrowings — A number of our real estate entities are

parties to variable rate loan agreements aggregating $64 million.

The borrowings mature in the year 2030, with principal paydowns

starting in the year 2006. The interest rate is set weekly by a third

party, and was 2.7% at Dec. 31, 2001.

Real Estate Mortgage — The real estate mortgage represents a

portion of the purchase price of one of our investments. The

mortgage bears a fixed rate of 8.1% and matures in February 2002.

During 2000, we repaid $13 million of mortgage debt associated

with two of our real estate investments.

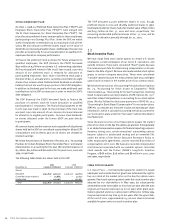

Interest Rate Swap Agreements — At Dec. 31, 2001, we were party

to a number of interest rate swap agreements related to several of

our debt securities outstanding. The net effect of the swaps was a

$7 million reduction in our 2001 interest expense. The notional

amount of these swaps totaled $230 million, and their aggregate

fair value at Dec. 31, 2001 was an asset of $23 million. Prior to our

adoption of SFAS No. 133, as amended, on Jan. 1, 2001, the fair value

of these swap agreements was not recorded on our balance sheet.

Upon adoption, we reflected the fair value of these swap agreements

as an increase to other assets and a corresponding increase to

debt on our balance sheet, with the statement of operations

impacts of recording the swaps offsetting.

83

⁄

8% Senior Notes — In June 2001, our $150 million of 83

⁄

8% senior

notes matured. The repayment of these notes was funded through

a combination of internally generated funds and the issuance of

commercial paper.

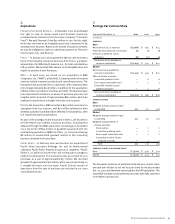

Interest Expense — Our interest expense on debt was $110 million

in 2001, $115 million in 2000 and $96 million in 1999.

Maturities — The amount of debt obligations, other than commercial

paper, that become due in each of the next five years is as follows:

2002, $108 million; 2003, $67 million; 2004, $180 million; 2005,

$428 million; and 2006, $59 million.

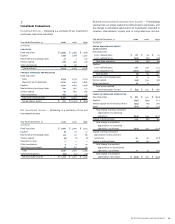

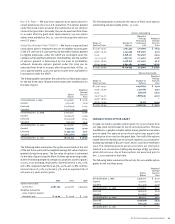

company-obligated mandatorily redeemable

preferred securities of trusts holding solely

subordinated debentures of the company

In November 2001, St. Paul Capital Trust I issued 23,000,000 Trust

Preferred Securities, generating gross proceeds of $575 million.

St. Paul Capital Trust I had been formed for the sole purpose of

issuing these securities. The proceeds were used to buy The St. Paul’s

junior subordinated debentures. The Trust Preferred Securities pay

a quarterly distribution at an annual rate of 7.6% of each security’s

liquidation amount of $25. The St. Paul’s debentures have a

mandatory redemption date of Oct. 15, 2050, but we can redeem

them on or after Nov. 13, 2006. The proceeds of such redemptions

will be used to redeem a like amount of Trust Preferred Securities.

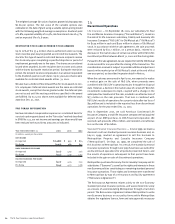

In 1995, we issued, through St. Paul Capital LLC (SPCLLC), 4,140,000

company-obligated mandatorily redeemable preferred securities,

generating gross proceeds of $207 million. These securities were

also known as convertible monthly income preferred securities

(“MIPS”). The MIPS paid a monthly distribution at an annual rate

of 6% of the liquidation preference of $50 per security. During 2000,

SPCLLC provided notice to the holders of the MIPS that it was

exercising its right to cause the conversion rights of the owners of

the MIPS to expire. The MIPS were convertible into 1.6950 shares

of our common stock (equivalent to a conversion price of $29.50

per share). Prior to the expiration date, holders of over 99% of the

MIPS exercised their conversion rights and, in August 2000, we

issued 7,006,954 common shares in connection with the conversion.

The remaining MIPS were redeemed for cash at $50 per security,

plus accumulated preferred distributions.