Travelers 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

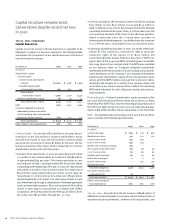

Nuveen provides consultative services to financial advisors on man-

aged assets for fee-based customers, and structured investment

services for transaction-based advisors. These activities generate

three principal sources of revenue: (1) ongoing advisory fees earned

on assets under management, including individually managed

accounts, mutual funds and exchange-traded funds; (2) distribu-

tion revenues earned upon the sale of defined portfolio and mutual

fund products and (3) fees earned on certain institutional accounts

based on the performance of such accounts.

In July 2001, Nuveen acquired Symphony Asset Management LLC

(“Symphony”), an institutional investment manager based in

San Francisco with approximately $4 billion in assets under

management. As a result of the acquisition, Nuveen’s product offer-

ings were expanded to include managed accounts and funds

designed to reduce risk through market-neutral and other strate-

gies in several equity and fixed-income asset classes for

institutional investors.

In 2001, gross sales of investment products increased 32% to $14.2

billion, driven by continuing success with exchange-traded funds.

Nuveen launched 20 new municipal funds, as well as a REIT-based

fund, issuing approximately $2.8 billion of new municipal exchange-

traded fund common shares and $1.2 billion in MuniPreferred™

shares. Reflecting the strength of Nuveen’s consultative platform,

managed account sales were very strong, growing 39% for the year.

Mutual fund sales grew 22% mainly as a result of an increase in

municipal fund sales. Nuveen’s strong sales in exchange-traded

funds, managed accounts and mutual funds were partially offset by

lower equity defined portfolio sales as a result of equity market

volatility, particularly in the technology sector. Nuveen’s net flows

(equal to the sum of sales, reinvestments and exchanges, less

redemptions) totaled $7.7 billion in 2001, a 64% increase over net

flows of $4.7 billion in 2000.

Total assets under management grew 10% to $68.5 billion at the

end of 2001, compared with $62.0 billion a year earlier. The increase

was due to the addition of Symphony and Nuveen’s strong net flows

for the year. At the end of 2001, managed assets consisted of

$32.0 billion of exchange-traded funds, $24.7 billion of managed

accounts, and $11.8 billion of mutual funds. Municipal securities

accounted for 70% of assets under management at Dec. 31, 2001.

Including defined portfolios, Nuveen managed or oversaw approx-

imately $76 billion in assets at Dec. 31, 2001.

Operating revenues totaled $371 million in 2001, an increase of 4%

over 2000. Growth in advisory fees of 6%, which occurred as a result

of an increase in average assets under management, was offset

slightly by a decline in distribution revenue related to lower defined

portfolio sales.

Operating expenses for the year declined 4%. Excluding the impact

of the Symphony acquisition, operating expenses declined 9%. The

decline from 2000 was largely due to a reduction in advertising and

promotional spending, which had been higher in 2000 due to

Nuveen’s brand awareness campaign.

During 2001, Nuveen utilized a portion of its $250 million revolving

line of credit for general corporate purposes, including day-to-day

cash requirements, share repurchases and funding a portion of the

$208 million acquisition of Symphony. At the end of 2001, $183 mil-

lion was outstanding under the line of credit, and that entire

amount is included in The St. Paul’s reported consolidated debt out-

standing at Dec. 31, 2001.

Nuveen repurchased common shares from minority shareholders

in 2001, 2000 and 1999 for total costs of $172 million, $51 million

and $36 million, respectively. No shares were repurchased from

The St. Paul in those years; however, our percentage ownership fell

from 78% in 2000 to 77% at the end of 2001 due to Nuveen’s

issuance of additional shares under various stock option and

incentive plans and the issuance of common shares upon the con-

version of a portion of its preferred stock. As part of an ongoing

repurchase program, Nuveen had authority from its board of direc-

tors at Dec. 31, 2001 to repurchase up to approximately 2.4 million

additional common shares.

On August 9, 2001, Nuveen announced a 3-for-2 split of its common

stock. The stock split was effected as a dividend to shareholders of

record as of Sept. 20, 2001. Shareholders received one additional

share of Nuveen common stock for every two shares they owned as

of the record date.

2000 vs. 1999 – In 2000, Nuveen’s 7% revenue growth over 1999

was driven by a significant increase in distribution revenues result-

ing from strong sales of defined investment portfolios. In addition,

advisory fees increased over 1999 due to the 4% growth in assets

under management. Gross sales of investment products of

$10.8 billion in 2000 were 23% below the comparable 1999 total of

$14.1 billion, primarily due to a decline in managed account sales

in a volatile market environment. That decline was partially offset,

however, by strong growth in defined portfolio sales. The 4%

increase in expenses over 1999 was primarily due to advertising

expenses associated with Nuveen’s brand awareness campaign.

Nuveen’s consolidated net flows totaled $4.7 billion in 2000, com-

pared with $9.6 billion in 1999.

2002 Outlook – Nuveen’s positioning as a premier investment man-

agement firm with a specialty focus on risk management and

tax-sensitivity in equity and fixed-income holdings is expected to

serve its advisor customers and institutional investors well in 2002.

Nuveen will continue to strengthen its customer relationships,

build on and extend its premium brands, and leverage its proven

distribution and service platforms.

The St. Paul Companies 2001 Annual Report 33