Travelers 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 67

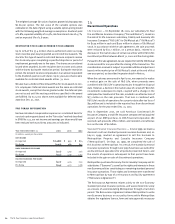

range of additional liability. We purchased insurance to cover a

portion of our exposure to such claims.

Under the sale agreement, we also committed to pay Aon

commissions representing a minimum level of annual reinsurance

brokerage business through 2012. We also have commitments under

lease agreements through 2015 for vacated space (included in our

lease commitment totals above), as well as a commitment to make

payments to a former Minet executive.

Acquisitions — We may be required to make an additional payment

of up to $20 million related to our purchase of the right to seek

to renew Fireman’s Fund surety business, based on the volume

of business renewed within one year of purchase. Our asset

management subsidiary, Nuveen, may be required to make

additional payments of up to $180 million related to their acquisition

of Symphony, based on reaching specified performance and

growth targets.

Joint Ventures — Our subsidiary, Fire and Marine, is a party to five

separate joint ventures, in each of which Fire and Marine is a 50%

owner of various real estate holdings and does not exercise control

over the joint ventures, financed by non-recourse mortgage notes.

Because we own only 50% of the holdings, we do not consolidate

these entities and the joint venture debt does not appear on our

balance sheet. Our maximum exposure under each of these joint

ventures, in the event of foreclosure of a property, is represented

by our carrying value in the joint venture, ranging individually from

$7 million to $31 million, and cumulatively totaling $65 million at

Dec. 31, 2001.

Municipal Trusts — We have purchased interests in certain

unconsolidated trusts holding highly rated municipal securities that

were formed for the purpose of executing corporate tax strategies.

Related to our interests, we are contingently liable for a portion of

the interest rate risk of the municipal securities we sold to the trust.

As of Dec. 31, 2001, our contingent liability was less than $1 million.

Legal Matters — In the ordinary course of conducting business, we,

and some of our subsidiaries, have been named as defendants in

various lawsuits. Some of these lawsuits attempt to establish

liability under insurance contracts issued by our underwriting

operations. Plaintiffs in these lawsuits are asking for money

damages or to have the court direct the activities of our operations

in certain ways.

It is possible that the settlement of these lawsuits may be material

to our results of operations and liquidity in the period in which they

occur. However, we believe the total amounts that we, and our

subsidiaries, will ultimately have to pay in these matters will have

no material effect on our overall financial position.

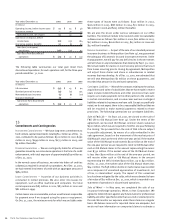

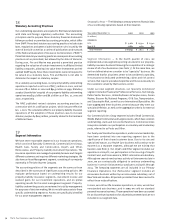

16

Restructuring and Other Charges

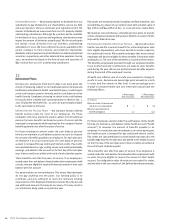

Fourth-Quarter 2001 Strategic Review — In December 2001, we

announced the results of a strategic review of all of our operations,

which included a decision to exit a number of businesses and

countries, as discussed in Note 3. Related to this strategic review, we

recorded a pretax charge of $62 million, including $46 million of

employee-related costs, $9 million of occupancy-related costs,

$4 million of equipment charges and $3 million of legal costs. The

charge was included in “Operating and administrative expenses” in

the 2001 statement of operations; with $42 million included in

“Property-liability insurance — other” and $20 million included in

“Parent company, other operations and consolidating eliminations”

in the table titled “Income (Loss) from Continuing Operations Before

Income Taxes and Cumulative Effect of Accounting Change” in Note 19.

The employee-related costs represent severance and related

benefits such as outplacement services to be paid to, or incurred

on behalf of, employees to be terminated by the end of 2002.

We estimated that a total of approximately 1,200 employee

positions would ultimately be terminated under this action, with

approximately 800 expected to be terminated by the end of 2002.

The remaining 400 employees were not included in the restructuring

charge since they will either be terminated after 2002 or are part

of one of the operations that may be sold. Of the total,

approximately 650 work in offices outside the U.S. (many of which

are closing), approximately 300 are in our Health Care business

(which is being exited), and the remaining 250 are spread

throughout our domestic operations.

The occupancy-related cost represents excess space created by the

terminations, calculated by determining the anticipated excess

space, by location, as a result of the terminations. The percentage

of excess space in relation to the total leased space was then

applied to the current lease costs over the remaining lease period.

The amounts payable under the existing leases were not discounted,

and sublease income was included in the calculation only for those

locations where sublease agreements were in place. The equipment

costs represent the net book value of computer and other equipment

that will no longer be used following the termination of employees

and closing of offices. The legal costs represent our estimate of fees

to be paid to outside legal counsel to obtain regulatory approval to

exit certain states or countries.

No payments were made in 2001 related to this action.

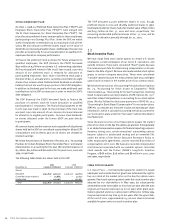

MMI Acquisition — Related to our April 2000 purchase of MMI (see

Note 4), we recorded a charge of $28 million, including $4 million

of employee-related costs and $24 million of occupancy-related

costs. The employee-related costs represented severance and

related benefits such as outplacement counseling to be paid to, or

incurred on behalf of, terminated employees. We estimated that

approximately 130 employee positions would be eliminated, at all

levels throughout MMI, and 119 employees were terminated. The

occupancy-related cost represented excess space created by the

terminations, calculated by determining the percentage of

anticipated excess space, by location, and the current lease costs

over the remaining lease period. The amounts payable under the

existing leases were not discounted, and sublease income was

included in the calculation only for those locations where sublease

agreements were in place.

The charge was included in “Operating and administrative

expenses” in the 2000 statement of operations and in “Property-

liability insurance — other” in the table titled “Income (Loss) from

Continuing Operations Before Income Taxes and Cumulative Effect

of Accounting Change” in Note 19.