Travelers 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report60

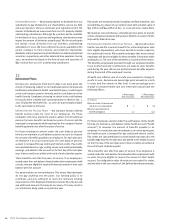

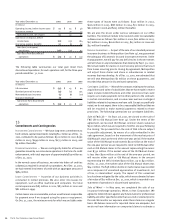

Dividend Restrictions — We primarily depend on dividends from our

subsidiaries to pay dividends to our shareholders, service our debt

and pay expenses. Various state laws and regulations limit the

amount of dividends we may receive from our U.S. property-liability

underwriting subsidiaries. Although $414 million will be available

for dividends in 2002, business and regulatory considerations may

impact the amount of dividends actually paid. We do not anticipate

the receipt of any dividends from our domestic underwriting

subsidiaries in 2002. We have sufficient resources available at the

parent company to fund common and preferred shareholder

dividends, interest payments and distributions on debt and preferred

securities, respectively, and other administrative expenses. During

2001, we received dividends in the form of cash and securities of

$827 million from our U.S. underwriting subsidiaries.

12

Retirement Plans

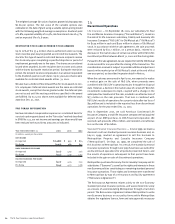

During 2000, employees hired prior to May 2000 were given the

choice of remaining subject to our traditional pension formula and

traditional postretirement health care benefits plan, or switching to

a new cash balance pension formula and/or cash balance retiree

health formula. Employees choosing to switch to the cash balance

formula(s) were credited with opening balances effective Jan. 1,

2001. Employees hired after Dec. 31, 2000 are automatically subject

to the cash balance formulas.

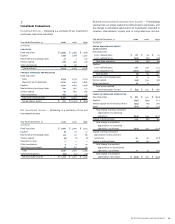

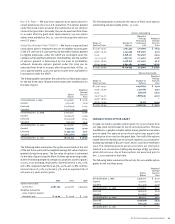

Defined Benefit Pension Plans — We maintain funded defined

benefit pension plans for most of our employees. For those

employees who have elected to remain subject to the traditional

pension formula, benefits are based on years of service and the

employee’s compensation while employed by the company. Pension

benefits generally vest after five years of service.

For those employees covered under the cash balance pension

formula, we maintain a cash balance pension account to measure

the amount of benefits payable to an employee. For each plan year

an employee is an active participant, the cash balance pension

account is increased for pay credits and interest credits. Pay credits

are calculated based on age, vesting service and actual pensionable

earnings, and added to the account on the first day of the next plan

year. Interest credits are added at the end of each calendar quarter.

These benefits vest after five years of service. If an employee is

vested under the cash balance formula when their employment with

us ends, they are eligible to receive the formula amount in their cash

balance pension account.

Our pension plans are noncontributory. This means that employees

do not pay anything into the plans. Our funding policy is to

contribute amounts sufficient to meet the minimum funding

requirements of the Employee Retirement Income Security Act and

any additional amounts that may be necessary. This may result in

no contribution being made in a particular year.

Plan assets are invested primarily in equities and fixed maturities, and

included 804,035 shares of our common stock with a market value of

$35 million and $44 million at Dec. 31, 2001 and 2000, respectively.

We maintain noncontributory, unfunded pension plans to provide

certain company employees with pension benefits in excess of limits

imposed by federal tax law.

Postretirement Benefits Other Than Pension — We provide certain

health care and life insurance benefits for retired employees (and

their eligible dependents), who have elected to remain subject to

the traditional formula. We currently anticipate that most covered

employees will become eligible for these benefits if they retire while

working for us. The cost of these benefits is shared with the retiree.

The benefits are generally provided through our employee benefits

trust, to which periodic contributions are made to cover benefits

paid during the year. We accrue postretirement benefits expense

during the period of the employee’s service.

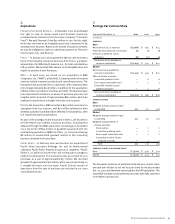

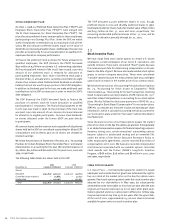

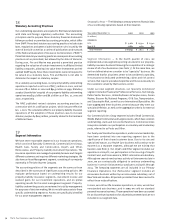

A health care inflation rate of 10.00% was assumed to change to

9.00% in 2002; decrease one percentage point annually to 5.00%

in 2006; and then remain at that level. A one-percentage-point

change in assumed health care cost trend rates would have the

following effects.

1-Percentage- 1-Percentage-

Point Increase Point Decrease

(In millions)

Effect on total of service and

interest cost components $ 2 $ (2)

Effect on postretirement

benefit obligation 27 (22)

For those employees covered under the cash balance retiree health

formula, we maintain a cash balance retiree health account (“health

account”) to measure the amount of benefits payable to an

employee. For each plan year an employee is an active participant,

the health account is increased for pay credits and interest credits.

Pay credits are calculated based on pensionable earnings up to the

taxable wage base for the plan year and added to the health account

on the first day of the next plan year. Interest credits are added at

the end of each calendar quarter.

These benefits vest after five years of service. If an employee is

vested under the cash balance formula when their employment with

us ends, they are eligible to receive the amount in their health

account. Our obligations under this plan are accounted for under,

and included in the 2001 results of, the defined benefit pension plan.