Travelers 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report50

2

September 11, 2001 Terrorist Attack

On September 11, 2001, terrorists hijacked four commercial

passenger jets in the United States. Two of the jets were flown into

the World Trade Center towers in New York, N.Y., causing their

collapse. The third jet was flown into the Pentagon building in

Washington, D.C., causing severe damage, and the fourth jet crashed

in rural Pennsylvania. This terrorist attack caused significant loss of

life and resulted in unprecedented losses for the property-liability

insurance industry.

Our estimated gross pretax losses and loss adjustment expenses

incurred as a result of the terrorist attack totaled $2.3 billion. The

estimated net pretax operating loss of $941 million from that event

included an estimated benefit of $1.2 billion from cessions made

under various reinsurance agreements, a $47 million provision for

uncollectible reinsurance, a net $83 million benefit from additional

and reinstatement premiums, and a $91 million reduction in

contingent commission expenses in our Reinsurance segment.

Our estimated losses were based on a variety of actuarial

techniques, coverage interpretation and claims estimation

methodologies, and included an estimate of losses incurred but not

reported, as well as estimated costs related to the settlement of

claims. Our estimate of losses is also based on our belief that

property-liability insurance losses from the terrorist attack will total

between $30 billion and $35 billion for the insurance industry. Our

estimate of industry losses is subject to significant uncertainties

and may change over time as additional information becomes

available. A material increase in our estimate of industry losses

would likely cause us to make a corresponding material increase to

our provision for losses related to the attack.

Our estimated after-tax loss of $612 million ($941 million pretax) is

recorded in our 2001 statement of operations in the following line

items. The tax benefit has been calculated at the statutory rate of 35%.

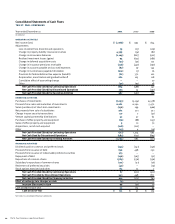

(In millions)

Premiums earned $83

Insurance losses and loss adjustment expenses (1,115)

Operating and administrative expenses 91

Loss from continuing operations, before income taxes (941)

Income tax benefit 329

Loss from continuing operations $(612)

The estimated net pretax loss of $941 million was distributed among

our property-liability business segments as follows.

(In millions)

Specialty Commercial $89

Commercial Lines Group 108

Surety & Construction 2

Health Care 5

Lloyd’s & Other 181

Total Primary Insurance 385

Reinsurance 556

Total Property-Liability Insurance $ 941

3

December 2001 Strategic Review

In October 2001, we announced that we were undertaking a

thorough review of each of our business operations under the

direction of our new chief executive officer. On completion of that

review in December 2001, we announced a series of actions

designed to improve our profitability, summarized as follows.

• We will exit, on a global basis, all business underwritten in our

Health Care segment through ceasing to write new business and

the non-renewal of business upon policy expiration, in

accordance with regulatory requirements.

• We will narrow the product offerings and geographic presence of

our reinsurance operation. We will no longer underwrite aviation

or bond and credit reinsurance, or offer certain financial risk and

capital markets reinsurance products. We will also substantially

reduce the North American business we underwrite in London.

Our reinsurance operation will focus on several areas, including

property catastrophe reinsurance, excess-of-loss casualty

reinsurance, and marine and traditional finite reinsurance.

• At Lloyd’s, we will exit most of our casualty insurance and

reinsurance business, in addition to U.S. surplus lines and certain

non-marine reinsurance lines. We will continue to underwrite

aviation, marine, financial and professional services, property

insurance, kidnap and ransom, accident and health, creditor and

other personal specialty products.

• We will also exit those countries where we are not likely to

achieve competitive scale, and are pursuing the sale of certain

of these international operations. We will continue to underwrite

business through our offices in Canada, the United Kingdom and

Ireland, and we will continue to underwrite surety business in

Mexico through our subsidiary, Afianzadora Insurgentes.

• We will reduce corporate overhead expenses, primarily through

staff reductions.

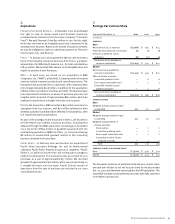

The following table presents the premiums earned and underwriting

results for 2001, 2000 and 1999 for the businesses to be exited

under these actions.

2001 2000 1999

(In millions)

Premiums earned $ 1,609 $ 1,277 $ 857

Underwriting results (1,515) (433) (241)

In connection with these actions, we wrote off $73 million of

goodwill related to businesses to be exited, of which $56 million

related to our Health Care segment and $10 million related to our

operations at Lloyd’s. The remaining goodwill written off was related

to our operations in Spain and Australia. In addition, we recorded

a $62 million pretax restructuring charge related to the termination

of employees and other costs to exit these businesses. See Note 16

for a discussion of this charge.