Travelers 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 53

7

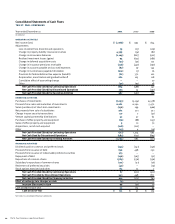

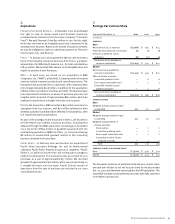

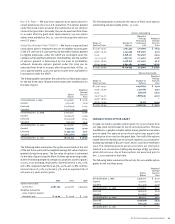

Investment Transactions

Investment Activity — Following is a summary of our investment

purchases, sales and maturities.

Year ended December 31 2001 2000 1999

(In millions)

purchases

Fixed maturities $4,959 $ 2,489 $ 2,818

Equities 1,737 2,168 1,403

Real estate and mortgage loans 27 3130

Venture capital 287 446 218

Other investments 23 48 9

Total purchases 7,033 5,154 4,578

proceeds from sales and maturities

Fixed maturities:

Sales 2,035 1,739 1,726

Maturities and redemptions 2,200 1,406 1,858

Equities 1,732 2,183 1,438

Real estate and mortgage loans 100 265 133

Venture capital 50 663 283

Other investments 164 34 34

Total sales and maturities 6,281 6,290 5,472

Net purchases (sales) $752 $ (1,136) $ (894)

Net Investment Income — Following is a summary of our net

investment income.

Year ended December 31 2001 2000 1999

(In millions)

Fixed maturities $ 1,069 $ 1,090 $ 1,104

Equities 16 16 17

Real estate and mortgage loans 115 91 86

Venture capital (4) (1) (1)

Securities on loan 222

Other investments 3410

Short-term investments 55 83 66

Total 1,256 1,285 1,284

Investment expenses (39) (23) (25)

Net investment income $1,217 $ 1,262 $ 1,259

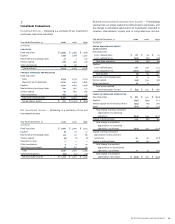

Realized and Unrealized Investment Gains (Losses) — The following

summarizes our pretax realized investment gains and losses, and

the change in unrealized appreciation of investments recorded in

common shareholders’ equity and in comprehensive income.

Year ended December 31 2001 2000 1999

(In millions)

pretax realized investments

gains (losses)

Fixed maturities:

Gross realized gains $28$29$ 10

Gross realized losses (105) (58) (29)

Total fixed maturities (77) (29) (19)

Equities:

Gross realized gains 276 296 224

Gross realized losses (280) (201) (97)

Total equities (4) 95 127

Real estate and mortgage loans 12 418

Venture capital (43) 554 158

Other investments 18 82

Total pretax realized

investment gains (losses) $(94)$ 632 $ 286

change in unrealized appreciation

Fixed maturities $187 $ 457 $ (997)

Equities (347) (199) 223

Venture capital net of minority interest (314) (61) 286

Other (80) 47 (44)

Total change in pretax unrealized

appreciation on continuing

operations (554) 244 (532)

Change in deferred taxes 214 (88) 185

Total change in unrealized

appreciation on continuing

operations, net of taxes (340) 156 (347)

Change in pretax unrealized

appreciation on discontinued

operations 26 63 (173)

Change in deferred taxes (9) (22) 61

Total change in unrealized

appreciation on discontinued

operations, net of taxes 17 41 (112)

Total change in unrealized

appreciation, net of taxes $ (323) $ 197 $ (459)