Travelers 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the MMI acquisition and the elimination of the one-quarter report-

ing lag, fixed maturities investment income was approximately 5%

below comparable 1999 investment income, due to net sales of

investments to fund operational cash needs. Funds available for

investment in the last three years were also reduced by cumulative

premium payments of $639 million related to our corporate rein-

surance program.

Equities – Our equity holdings consist of a diversified portfolio of

common stocks, which accounted for 5% of total investments (at

cost) at Dec. 31, 2001. Equity markets in the United States in 2001

suffered from the economic slowdown and the Sept. 11 terrorist

attack. The total return on our equity portfolio in 2001 (encom-

passing dividend income, realized gains and losses, and the change

in unrealized appreciation) was (20.7%), and our five-year return

through 2001 was approximately 10.5%. Despite the negative return

in 2001, the $1.10 billion market value of our portfolio at Dec. 31,

2001 still exceeded its cost by $52 million. At the end of 2000, the

pretax unrealized appreciation included in the $1.40 billion carrying

value totaled $326 million.

Real Estate and Mortgage Loans – Real estate ($838 million carrying

value) and mortgage loans ($134 million carrying value) comprised

5% of our total property-liability investments at the end of 2001.

Our real estate holdings primarily consist of commercial office and

warehouse properties that we own directly or in which we have a

partial interest through joint ventures. Our properties are geo-

graphically distributed throughout the United States and had an

occupancy rate of 95% at year-end 2001. These investments pro-

duced pretax income of $97 million in 2001 and $63 million in 2000,

and generated cash flows totaling $138 million in 2001 and $90 mil-

lion in 2000. The increase in investment income and cash flows in

2001 was primarily due to earnings from a Southern California res-

idential land development. We did not make any significant real

estate purchases in 2001 or 2000.

We acquired the portfolio of mortgage loans in the 1998 merger

with USF&G. The loans, which are collateralized by income-pro-

ducing real estate, produced investment income of $18 million in

2001 and $27 million in 2000. Net pay downs and repayments of

the loans totaled $51 million in 2001 and $204 million in 2000. We

did not originate any new loans in either of the last two years.

Venture Capital – Venture capital comprised 4% of our invested

assets (at cost) at the end of 2001. These private investments span

a variety of industries but are concentrated in information tech-

nology, health care and consumer products. In 2001, we invested

$289 million in this asset class, compared with $296 million in

2000. Our total return on average net venture capital investments

(encompassing dividend income, realized gains and losses, and

the change in unrealized appreciation) was (41.5%) in 2001. The

negative return in 2001 was driven by a significant decline in the

unrealized appreciation of our investments in the difficult market

environment that characterized the year. Much of this appreciation

had accumulated during favorable market conditions in recent

years. In 2000, our portfolio produced a total pretax return on

average net assets of 52%, primarily the result of pretax realized

gains totaling $554 million for the year. The carrying value of the

venture capital portfolio at year-end 2001 and 2000 included unre-

alized appreciation of $93 million and $406 million, respectively.

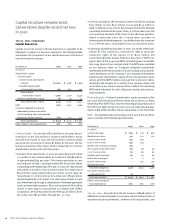

Realized Investment Gains and Losses – The following table sum-

marizes our property-liability operations’ pretax realized gains and

losses by investment class for each of the last three years.

Year ended December 31 2001 2000 1999

(In millions)

pretax realized investment

gains (losses)

Fixed maturities $ (77) $ (29) $ (19)

Equities (4) 87 118

Real estate and mortgage loans 4418

Venture capital (43) 554 158

Other investments (6) 8(1)

Total $ (126) $ 624 $ 274

Pretax realized losses in the fixed maturities category in 2001 were

driven by write-downs in the carrying value of certain of our bond

holdings. These write-downs included a $20 million write-down of

various Argentina government and corporate bonds following eco-

nomic upheaval in that country, and a $19 million write-down in

Enron Corporation bonds following that company’s bankruptcy

filing. The remaining carrying values of our Argentina and Enron

investments at Dec. 31, 2001 totaled $21 million and $5 million,

respectively. Venture capital realized losses in 2001 primarily

resulted from the sale of several of our direct investments.

Venture capital realized gains in 2000 and 1999 were primarily

driven by sales of and distributions from investments in technology-

related companies. The single largest gain in 2000, $117 million,

resulted from the sale of our direct investment in Flycast Com-

munications Corp., a leading provider of Internet direct response

solutions.

2002 Investment Outlook – We do not anticipate investment income

growth in 2002. Although underwriting cash flow in 2002 is

expected to improve due to price increases realized in our continu-

ing operations, that improvement will be diminished by the

anticipated cash payments associated with the runoff of reserves

in businesses that we are exiting and other cash payments, includ-

ing claim payments resulting from the terrorist attack. In addition,

yields on new fixed maturities investments in 2002 are expected to

be lower than those on maturing securities.

With funds provided from maturing investments in 2002, new

investment purchases will be concentrated in taxable, investment-

grade bonds, with additional capital allocated to our other asset

classes as market conditions warrant. We anticipate improving eco-

nomic conditions will improve equity valuations in 2002, but we

expect to realize only modest gains in our venture capital portfolio.

The St. Paul Companies 2001 Annual Report30