Travelers 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 69

17

Reinsurance

The primary purpose of our ceded reinsurance program, including

the aggregate excess-of-loss coverages discussed below, is to

protect us from potential losses in excess of what we are prepared

to accept. We expect the companies to which we have ceded

reinsurance to honor their obligations. In the event these companies

are unable to honor their obligations to us, we will pay these

amounts. We have established allowances for possible nonpayment

of amounts due to us. As described in Note 2, we increased our

provision for uncollectible reinsurance by $47 million after the 2001

terrorist attack.

We report balances pertaining to reinsurance transactions “gross”

on the balance sheet, meaning that reinsurance recoverables on

unpaid losses and ceded unearned premiums are not deducted from

insurance reserves but are recorded as assets.

The largest concentration of our total reinsurance recoverables and

ceded unearned premiums at Dec. 31, 2001 was with General

Reinsurance Corporation (“Gen Re”). Gen Re (with approximately

22% of our recoverables) is rated “A+ +” by A.M. Best, “Aaa” by

Moody’s and “AAA” by Standard & Poor’s for its financial strength.

During each of the years 2001, 2000 and 1999, we entered into two

aggregate excess-of-loss reinsurance treaties. One of these treaties

in each year was corporate-wide, with coverage triggered when our

insurance losses and LAE across all lines of business reached a

certain level, as prescribed by terms of the treaty (the “corporate

program”). Additionally, our Reinsurance segment benefited from

cessions made under a separate treaty in each year unrelated to the

corporate treaty. The combined impact of these treaties (together,

the “reinsurance treaties”) is included in the table that follows.

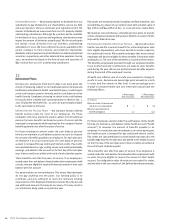

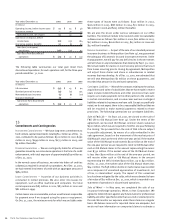

Year ended December 31 2001 2000 1999

(In millions)

Corporate program:

Ceded written premiums $9$ 419 $ 211

Ceded losses and loss

adjustment expenses (25) 709 384

Ceded earned premiums 9419 211

Net pretax benefit (detriment) (34) 290 173

Reinsurance segment treaty:

Ceded written premiums 119 55 62

Ceded losses and loss

adjustment expenses 278 122 150

Ceded earned premiums 119 55 62

Net pretax benefit 159 67 88

Combined total:

Ceded written premiums 128 474 273

Ceded losses and loss

adjustment expenses 253 831 534

Ceded earned premiums 128 474 273

Net pretax benefit $125 $ 357 $ 261

Under the 1999 and 2000 corporate treaties, we ceded losses to the

reinsurer when our corporate-wide incurred insurance losses and

LAE exceeded accident year attachment loss ratios specified in the

contract. We paid the ceded earned premiums shortly after the

coverage under the treaties was invoked. We will recover the ceded

losses and LAE from our reinsurer as we settle the related claims,

which may occur over several years. For the separate Reinsurance

segment treaties, for all three years, we remit the premiums ceded

(plus accrued interest) to our counterparty when the related losses

and LAE are settled.

During 2001, we did not cede losses to the corporate treaty. The

$9 million written and earned premiums ceded in 2001 represented

the initial premium paid to our reinsurer. Our primary purpose in

entering into the corporate reinsurance treaty was to reduce the

volatility in our reported earnings over time. Because of the

magnitude of losses associated with the Sept. 11 terrorist attack,

that purpose could not be fulfilled had the treaty been invoked to

its full capacity in 2001. In addition, our actuarial analysis concluded

that there would be little, if any, economic value to us in ceding

any losses under the treaty. As a result, in early 2002, we mutually

agreed with our reinsurer to commute the 2001 corporate treaty

for consideration to the reinsurer equaling the $9 million initial

premium paid.

The $25 million change in our estimate of ceded losses and LAE in

2001 in the table above represented an adjustment for losses ceded

under our 2000 corporate treaty. Deterioration in our 2000 accident

year loss experience in 2001 caused our expectations of the payout

patterns of our reinsurer to change and resulted in our conclusion

that losses originally ceded in 2000 would exceed an economic limit

prescribed in the 2000 treaty.

The effect of assumed and ceded reinsurance on premiums

written, premiums earned and insurance losses and loss

adjustment expenses is as follows (including the impact of the

reinsurance treaties).

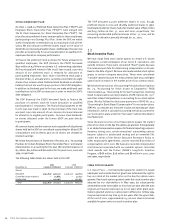

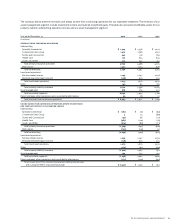

Year ended December 31 2001 2000 1999

(In millions)

premiums written

Direct $7,135 $ 6,219 $ 4,622

Assumed 2,700 2,064 1,645

Ceded (2,072) (2,399) (1,155)

Net premiums written $7,763 $ 5,884 $ 5,112

premiums earned

Direct $ 6,656 $5,819 $4,621

Assumed 2,685 2,019 1,537

Ceded (2,045) (2,246) (1,055)

Total premiums earned $ 7,296 $ 5,592 $ 5,103

insurance losses and

loss adjustment expenses

Direct $6,876 $ 4,068 $ 3,532

Assumed 3,952 1,798 1,124

Ceded (3,349) (1,953) (936)

Total net insurance losses and

loss adjustment expenses $7,479 $ 3,913 $ 3,720