Travelers 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report54

8

Derivative Financial Instruments

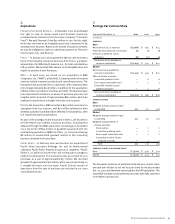

Derivative financial instruments include futures, forward, swap and

option contracts and other financial instruments with similar

characteristics. We have had limited involvement with these

instruments, primarily for purposes of hedging against fluctuations

in foreign currency exchange rates, interest rates and movement in

the price of a particular investment. All investments, including

derivative instruments, have some degree of market and credit risk

associated with them. However, the market risk on our derivatives

substantially offsets the market risk associated with fluctuations in

interest rates, foreign currency exchange rates and market prices.

We seek to reduce our credit risk exposure by conducting derivative

transactions only with reputable, investment-grade counterparties.

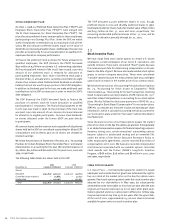

Effective Jan. 1, 2001, we adopted the provisions of SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” as

amended (“SFAS No. 133”). The statement requires the recognition

of all derivatives as either assets or liabilities on the balance sheet,

carried at fair value. In accordance with the statement, derivatives

are specifically designated into one of three categories based on

their intended use, and the applicable category dictates the

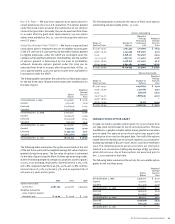

accounting for each derivative. We have held the following

derivatives, by category.

Fair Value Hedges — We have several pay-floating, receive-fixed

interest rate swaps, totaling $230 million notional amount, that are

designated as fair value hedges of a portion of our medium-term

and senior notes, that we have entered into for the purpose of

managing the effect of interest rate fluctuations on this debt. The

terms of the swaps match those of the debt instruments, and the

swaps are therefore considered 100% effective. The transitional

impact of adopting SFAS No. 133 for the fair value of the hedges was

$15 million, which was recorded in “Other Assets” on the balance

sheet with an equivalent liability recorded in debt. The related

statement of operations impacts were offsetting; as a result, there

was no transitional statement of operations impact of adopting SFAS

No. 133 for fair value hedges. The impact related to the 2001

movement in interest rates was an $8 million increase in the fair

value of the swaps and the related debt on the balance sheet, with

the statement of operations impacts again offsetting.

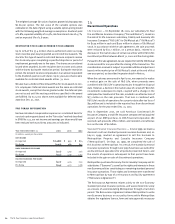

Cash Flow Hedges — We have purchased foreign currency forward

contracts that are designated as cash flow hedges. They are utilized

to minimize our exposure to fluctuations in foreign currency values

that result from forecasted foreign currency payments, as well as

from foreign currency payables and receivables. The transitional

impact of adopting SFAS No. 133 for cash flow hedges was a gain

of less than $1 million, which was included in Other Comprehensive

Income (“OCI”). During 2001, we recognized a $2 million loss on the

cash flow hedges, which is also included in OCI. The amounts

included in OCI will be reclassified into earnings concurrent with the

timing of the hedged cash flows, which is not expected to occur

within the next twelve months. During 2001 we recognized a loss in

the statement of operations of less than $1 million representing the

portion of the forward contracts deemed ineffective.

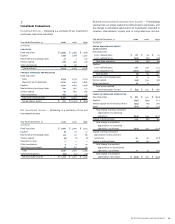

Non-Hedge Derivatives — We have entered into a variety of other

financial instruments that are considered to be derivatives, but

which are not designated as hedges, that we utilize to minimize the

potential impact of market movements in certain investment

portfolios. These include our investment in an embedded collar on

Old Mutual common stock received as partial consideration from

the sale of our life insurance business (see Note 15), foreign currency

put options on British Pounds Sterling to hedge currency risk

associated with our position in Old Mutual stock and stock warrants

in our venture capital business. There was no transition adjustment

related to the adoption of SFAS No. 133, and we recorded $3 million

of income in continuing operations during 2001 relating to the

change in the market value of these derivatives during the period.

For the same period we also recorded $17 million of income in

discontinued operations relating to non-hedge derivatives associated

with the sale of our life insurance business.

Derivative-type Instruments Accounted for Under EITF 99-2 — We

have also offered insurance products that are accounted for as

weather derivatives. These derivatives are accounted for under

EITF 99-2, “Accounting for Weather Derivatives,” which provides

for accounting similar to that for SFAS No. 133 derivatives. The net

impact to our statement of operations of these insurance products

in 2001 was a $2 million loss, with no impact in 2000. At Dec. 31,

2001, we had two contracts outstanding, with total maximum

exposure of $15 million. As part of our December 2001 strategic

review, we determined that we would no longer issue this type

of product.