Travelers 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report52

Statutory Deposits — At Dec. 31, 2001, our property-liability

operation had investments in fixed maturities with an estimated fair

value of $852 million on deposit with regulatory authorities as

required by law.

Restricted Investments — Our subsidiaries Unionamerica and

St. Paul Re-U.K. are required, as accredited U.S. reinsurers, to hold

certain investments in trust in the United States. These trust funds

had a fair value of $514 million at Dec. 31, 2001. Additionally,

Unionamerica has funds deposited with third parties to be used as

collateral to secure various liabilities on behalf of insureds, cedants

and other creditors. These funds had a fair value of $53 million at

Dec. 31, 2001.

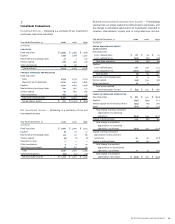

Fixed Maturities by Maturity Date — The following table presents

the breakdown of our fixed maturities by years to stated maturity.

Actual maturities may differ from those stated as a result of calls

and prepayments.

Amortized Estimated

December 31, 2001 Cost Fair Value

(In millions)

One year or less $ 971 $ 986

Over one year through five years 4,586 4,801

Over five years through 10 years 3,457 3,567

Over 10 years 3,725 3,889

Asset-backed securities with

various maturities 115 116

Mortgage-backed securities with

various maturities 2,493 2,552

Total $ 15,347 $ 15,911

6

Investments

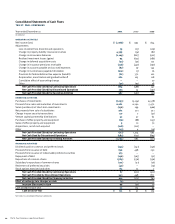

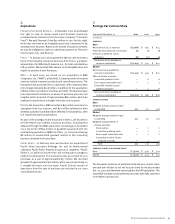

Valuation of Investments — The following presents the cost, gross unrealized appreciation and depreciation, and estimated fair value of

our investments in fixed maturities, equities, venture capital and securities on loan.

Gross Gross

Unrealized Unrealized Estimated

December 31, 2001 Cost Appreciation Depreciation Fair Value

(In millions)

Fixed maturities:

U.S. government $ 1,197 $ 74 $ (1) $ 1,270

State and political subdivisions 4,720 231 (3) 4,948

Foreign governments 1,168 44 (11) 1,201

Corporate securities 5,654 220 (50) 5,824

Asset-backed securities 115 4 (3) 116

Mortgage-backed securities 2,493 65 (6) 2,552

Total fixed maturities 15,347 638 (74) 15,911

Equities 1,415 107 (112) 1,410

Venture capital 766 210 (117) 859

Securities on loan 739 40 (4) 775

Total $18,267 $ 995 $ (307) $18,955

Gross Gross

Unrealized Unrealized Estimated

December 31, 2000 Cost Appreciation Depreciation Fair Value

(In millions)

Fixed maturities:

U.S. government $ 818 $ 35 $ (1) $ 852

State and political subdivisions 5,089 258 (1) 5,346

Foreign governments 999 37 (7) 1,029

Corporate securities 5,021 113 (74) 5,060

Asset-backed securities 117 2 (9) 110

Mortgage-backed securities 2,309 38 (14) 2,333

Total fixed maturities 14,353 483 (106) 14,730

Equities 1,124 418 (76) 1,466

Venture capital 657 438 (31) 1,064

Securities on loan 1,157 65 (15) 1,207

Total $ 17,291 $ 1,404 $ (228) $18,467