Travelers 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

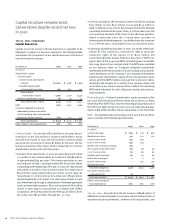

The following table summarizes results for this segment for the last

three years. Results presented for all three years exclude the impact

of the corporate reinsurance program, and results for 2001 also

exclude losses resulting from the terrorist attack. Data including

these factors is presented on page 21 of this report.

Year ended December 31 2001 2000 1999

(Dollars in millions)

Written premiums $ 1,024 $ 925 $ 852

Percentage increase over prior year 11% 9%

GAAP underwriting result $(47)$ 23 $ (49)

Loss and loss adjustment expense ratio 68.2 55.1 62.6

Underwriting expense ratio 35.8 40.0 40.2

Combined ratio 104.0 95.1 102.8

2001 vs. 2000 – The 11% increase in premium volume in 2001 was

primarily due to price increases in the Construction business center,

which averaged 18% for the year. Construction premiums totaled

$609 million in 2001, compared with $472 million in 2000. Surety

premiums of $415 million declined 8% compared with 2000, reflect-

ing the impact of tightened underwriting standards we began to

implement near the end of 1999 in anticipation of an economic

slowdown in both the United States and Mexico. As that slowdown

materialized in 2001, our tightened standards had produced a more

conservative risk profile of our commercial surety exposures. An

increase in reinsurance costs was also a factor in the decline in

Surety’s net written premiums in 2001.

Both business centers contributed to the deterioration in under-

writing results compared with 2000. The Surety underwriting profit

of $11 million declined from the comparable 2000 profit of

$34 million, reflecting an increase in losses amid the economic

downturn in the U.S. Also included in the 2001 Surety result was a

$10 million provision for losses associated with Enron Corporation’s

bankruptcy filing late in the year.

The Construction underwriting loss of $58 million in 2001 deterio-

rated from 2000’s comparable loss of $11 million, driven by adverse

loss development on prior-year business that prompted a

$24 million provision to strengthen reserves. Current accident year

loss experience in 2001 was much improved over 2000, reflecting

the impact of aggressive underwriting initiatives implemented over

the last three years. Construction’s 2000 underwriting result

included the benefit of prior-year reserve reductions totaling

$57 million, including $33 million of workers’ compensation loss

reserves. The strong improvement in the segment expense ratio

over 2000 reflected the combined effect of Construction’s written

premium growth and active management of expenses in both

business centers.

2000 vs. 1999 – Both business centers achieved written premium

growth in 2000. Surety premiums of $453 million grew 8% over

1999, and Construction premiums of $472 million were 9% higher

than the 1999 total. The increases reflected strong economic con-

ditions in both the U.S. and Mexico, which fueled growth in the

construction industry and, in turn, the demand for contract surety

products. Price increases averaging 15% in the Construction busi-

ness center were also a significant factor contributing to premium

growth in 2000. Construction’s underwriting result improved by

$78 million over 1999, due to favorable prior-year loss develop-

ment, which included the $33 million reduction in workers’

compensation reserves. Surety’s underwriting profit of $34 million

was $6 million less than the comparable 1999 profit, due to

increased claim activity on two large accounts in Mexico.

2002 Outlook – In early 2002, we expect to close on our purchase

of London Guarantee Insurance Company, a specialty property-lia-

bility insurance company focused on providing surety products, and

management liability, bond, and professional indemnity products.

London Guarantee, headquartered in Toronto, generated approxi-

mately $53 million (Canadian) in surety net written premiums in

2001. In addition, late in 2001, our Surety operation acquired the

right to seek to renew surety bond business underwritten by

Fireman’s Fund Insurance Company, without assuming any past lia-

bilities. This transaction is expected to enhance our position in 2002

as the largest surety underwriter in the U.S. by increasing our

market penetration in western states. In the current economic envi-

ronment, we will maintain a conservative underwriting profile in our

Surety and Construction operations while continuing to aggressively

seek additional price increases. The anticipated higher cost and lim-

ited availability of surety reinsurance in 2002 is expected to further

tighten underwriting standards for certain types of surety bonds and

will likely result in significant price increases for the surety customer.

The St. Paul Companies 2001 Annual Report 25