Travelers 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maturity or to the next call date depending on whether the call was

projected to be “in-the-money” assuming no change in interest

rates. No projection of the impact of reinvesting the estimated cash

flows is included in the table, regardless of whether the cash flow

source is a short-term or long-term fixed maturity security. Principal

cash flow projections include securities on loan.

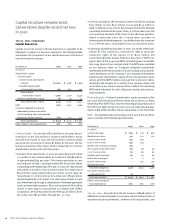

December 31, 2001 December 31, 2000

Period from Weighted Weighted

balance sheet Principal Average Principal Average

date Cash Flows Interest Rate Cash Flows Interest Rate

(In millions)

fixed maturities,

short-term

investments and

mortgage loans

One year $ 4,416 4.4% $ 4,002 5.6%

Two year 2,017 6.6% 1,698 7.1%

Three years 1,616 7.5% 1,710 7.3%

Four years 1,454 6.5% 1,538 7.8%

Five years 1,562 6.4% 1,428 6.3%

Thereafter 7,547 6.2% 7,428 6.4%

Total $ 18,612 $17,804

Fair Value $18,198 $17,222

The following table provides principal runoff estimates by year for

our Dec. 31, 2001 and 2000 inventories of interest-sensitive debt

obligations and related weighted average interest rates by stated

maturity dates.

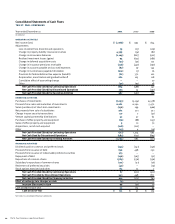

December 31, 2001 December 31, 2000

Period from Weighted Weighted

balance sheet Principal Average Principal Average

date Cash Flows Interest Rate Cash Flows Interest Rate

(In millions)

medium-term notes,

zero coupon notes and

senior notes

One year $49 7.5% $ 195 8.1%

Two year 67 6.5% 49 7.5%

Three years 54 7.1% 67 6.5%

Four years 429 7.5% 55 7.1%

Five years 59 7.0% 428 7.5%

Thereafter 635 6.8% 694 6.8%

Total $ 1,293 $ 1,488

Fair Value $ 1,330 $ 1,475

To mitigate a portion of the interest rate risk related to $230 million

notional amount of certain of our fixed rate medium-term and senior

notes, we have entered into a number of pay-floating, receive-fixed

interest rate swap agreements. Of the total notional amount of the

swaps, $80 million matures in 2005 and $150 million matures in

2008, with a weighted average pay rate of 1.26% and a weighted

average receive rate of 6.64%. These swaps had a fair value of

$23 million at Dec. 31, 2001.

The company also has liability for payment under “company-

obligated mandatorily redeemable preferred securities of trusts

holding solely subordinated debentures of the company” that

mature at various times, the earliest of which is 2027. The princi-

pal amounts due under these obligations were $901 million and

$346 million at Dec. 31, 2001 and 2000, respectively, with weighted

average preferred distribution rates of 7.8 % and 8.1 %, respectively.

The fair value of these securities was $893 million and $327 million

as of Dec. 31, 2001 and 2000, respectively. Approximately $575 mil-

lion of the securities are callable at the company’s option after

Nov. 13, 2006. An additional $78 million are callable at the com-

pany’s option between 2007 and their maturity.

Credit Risk – Our portfolios of fixed maturities, mortgage loans and

to a lesser extent short-term investments are subject to credit risk.

This risk is defined as the potential loss in market value resulting

from adverse changes in the borrower’s ability to repay the debt.

Our objective is to earn competitive returns by investing in a diver-

sified portfolio of securities. We manage this risk by up-front,

stringent underwriting analysis, reviews by a credit committee and

regular meetings to review credit developments. Watchlists are

maintained for exposures requiring additional review, and all credit

exposures are reviewed at least annually. At Dec. 31, 2001, approx-

imately 95% of our property-liability fixed maturity portfolio was

rated investment grade.

We also have other receivable amounts subject to credit risk. The

most significant of these are reinsurance recoverables. To mitigate

credit risk related to these counterparties, we establish business

and financial standards for reinsurer approval, incorporating rat-

ings by major rating agencies and considering current market

information, and obtain letters of credit where deemed necessary.

Foreign Currency Exposure – Our exposure to market risk for

changes in foreign exchange rates is concentrated in our invested

assets, and insurance reserves, denominated in foreign currencies.

Cash flows from our foreign operations are the primary source of

funds for our purchase of investments denominated in foreign cur-

rencies. We purchase these investments primarily to hedge

insurance reserves and other liabilities denominated in the same

currency, effectively reducing our foreign currency exchange rate

exposure. For those foreign insurance operations that were identi-

fied at the end of 2001 as business to be exited, we intend to

continue to closely match the foreign currency-denominated liabil-

ities with assets in the same currency. At Dec. 31, 2001 and 2000,

respectively, approximately 11% and 9% of our invested assets were

denominated in foreign currencies. Invested assets denominated

in the British Pound Sterling comprised approximately 5% of our

total invested assets at Dec. 31, 2001. We have determined that a

hypothetical 10% reduction in the value of the Pound Sterling would

have an approximate $100 million reduction in the value of our

assets, although there would be a similar hypothetical change in

the value of the related insurance reserves. No other individual for-

eign currency accounts for more than 3% of our invested assets.

We have also entered into foreign currency forwards with a U.S.

dollar equivalent notional amount of $128 million as of Dec. 31,

2001 to hedge our foreign currency exposure on certain contracts.

Of this total, 76% are denominated in British Pound Sterling, 14%

are denominated in the Australian dollar, and 10% are denominated

in the Canadian dollar.

Equity Price Risk – Our portfolio of marketable equity securities,

which we carry on our balance sheet at market value, has exposure

to price risk. This risk is defined as the potential loss in market value

resulting from an adverse change in prices. Our objective is to earn

competitive returns by investing in a diverse portfolio of high-qual-

ity, liquid securities. Portfolio characteristics are analyzed regularly

and market risk is actively managed through a variety of modeling

The St. Paul Companies 2001 Annual Report 37