Travelers 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

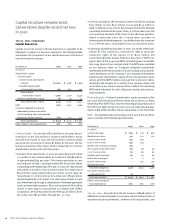

debt maturing during the year, including our $150 million, 8.375%

senior notes that matured in June and $46 million of medium-term

notes that matured throughout the year. During 2001, Nuveen uti-

lized a portion of its $250 million revolving line of credit for general

corporate purposes, including funding a portion of its acquisition

of Symphony Asset Management LLC, and the repurchase of its

common shares. At year-end 2001, $183 million, bearing a weighted

average interest rate of approximately 3.1%, was outstanding under

Nuveen’s line of credit agreement.

At the end of 2001, we were party to a number of interest rate swap

agreements related to several of our debt securities outstanding.

The notional amount of these swaps totaled $230 million, and their

aggregate fair value at Dec. 31, 2001 was $23 million. Upon our

adoption of SFAS No. 133, as amended, on Jan. 1, 2001, we began

recording the fair value of the swap agreements as an asset, with a

corresponding increase to reported debt.

2000 vs. 1999 – During 2000, we issued $500 million of senior

notes, the proceeds of which were used to repay commercial paper

and for other general corporate purposes. Of the $500 million

issued, $250 million bears an interest rate of 7.875% and is due in

April 2005, and $250 million bears an interest rate of 8.125% and

is due in April 2010. Commercial paper borrowings declined from

$400 million at the end of 1999 to $138 million at Dec. 31, 2000. In

addition, we repaid $46 million of floating rate notes in 2000 that

had been issued by a fully-consolidated special purpose offshore

reinsurance entity we created in 1999. We also repaid $13 million

of mortgage debt associated with two of our real estate invest-

ments in 2000.

Our total net interest expense related to debt was $110 million in

2001, $115 million in 2000 and $96 million in 1999.

Company-obligated Mandatorily Redeemable Preferred Securities

of Trusts Holding Solely Subordinated Debentures of the Company–

These securities were issued by five business trusts wholly-owned

by The St. Paul. Each trust was formed for the sole purpose of issu-

ing the preferred securities. St. Paul Capital Trust I was established

in November 2001 and issued $575 million of preferred securities

that make preferred distributions at a rate of 7.6%. These securi-

ties have a mandatory redemption date of Oct.15, 2050, but we can

redeem them on or after Nov. 13, 2006. The proceeds received from

the sale of these securities were used by the issuer to purchase our

subordinated debentures, and $500 million of the net proceeds

were ultimately contributed to the policyholders’ surplus of one of

our insurance subsidiaries.

MMI Capital Trust I was acquired in our purchase of MMI in 2000.

In 1997, the trust issued $125 million of 30-year redeemable

preferred securities. The securities make preferred distributions

at a rate of 7.625% and have a mandatory redemption date of

Dec. 15, 2027.

The remaining three trusts, acquired in the USF&G merger, each

issued $100 million of preferred securities making preferred distri-

butions at rates of 8.5%, 8.47% and 8.312%, respectively. In 2001,

we repurchased and retired $20 million of securities of the 8.5%

trust. In 1999, we repurchased and retired securities of these three

trusts with an aggregate liquidation value of $79 million, comprised

of the following components: $27 million of the 8.5% securities;

$22 million of the 8.47% securities; and $30 million of the 8.312%

securities. The repurchases were made in open market transactions

and were primarily funded through commercial paper borrowings.

Our total preferred distribution expense related to the preferred

securities was $33 million in 2001, $31 million in 2000, and $36 mil-

lion in 1999.

Independent Financial Ratings – In the aftermath of the Sept. 11

terrorist attack, certain of the major independent rating organiza-

tions placed our financial ratings under review. The scope of their

respective reviews was subsequently broadened to encompass the

rating implications of the strategic decisions that we announced in

December 2001 regarding our planned exit from certain businesses

and our intent to record significant provisions to strengthen loss

reserves. The rating agencies concluded their reviews in mid-

December concurrent with our strategic announcements and

announced updates to certain ratings. As of Jan. 23, 2002, none

of the major rating agencies has any of our financial ratings

under review.

We continue to have ready access to liquidity through the capital

markets, including the largest and most liquid sector of the

commercial paper market.

Acquisitions and Divestitures – In September 2001, we sold our life

insurance subsidiary, F&G Life, to Old Mutual plc, for $335 million

in cash and 190.4 million Old Mutual ordinary shares (valued at

$300 million at closing). The cash proceeds received were used for

general corporate purposes. We are required to hold the Old Mutual

common shares for one year after the closing date of the sale. These

shares had a market value of $242 million on Dec. 31, 2001. The sale

proceeds may be adjusted based on the market value of the shares

one year after the closing date of the sale as described on page 15

of this report. We also sold ACLIC, MMI’s life insurance subsidiary,

to CNA for $21 million in cash.

We purchased MMI in April 2000 for approximately $206 million in

cash, and the assumption of $165 million of short-term debt and

preferred securities. The short-term debt of $45 million was retired

subsequent to the acquisition. The cash portion of this transaction

and the repayment of debt was financed with internally-generated

funds. In addition, our purchase of Pacific Select in February 2000

for approximately $37 million in cash was financed with internally-

generated funds.

The St. Paul Companies 2001 Annual Report 35