Travelers 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 63

Non-U.S. Plans — We also have separate stock option plans for

certain employees of our non-U.S. operations. The options granted

under these plans were priced at the market price of our common

stock on the grant date. Generally, they can be exercised from three

to 10 years after the grant date. Approximately 250,000 option

shares were available at Dec. 31, 2001 for future grants under our

non-U.S. plans.

Global Stock Option Plan (“GSOP”) — We have a separate fixed

stock option plan for employees who are not eligible to participate

in the U.S. and non-U.S. plans previously described. Options granted

to eligible employees under the GSOP are contingent upon the

company achieving threshold levels of profitability, and the number

of options granted is determined by the level of profitability

achieved. Generally, options granted under this plan can be

exercised from three to 10 years after the grant date. At Dec. 31,

2001, approximately 1,300,000 option shares were available for

future grants under the GSOP.

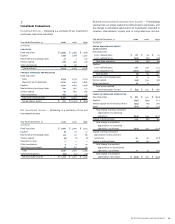

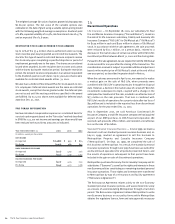

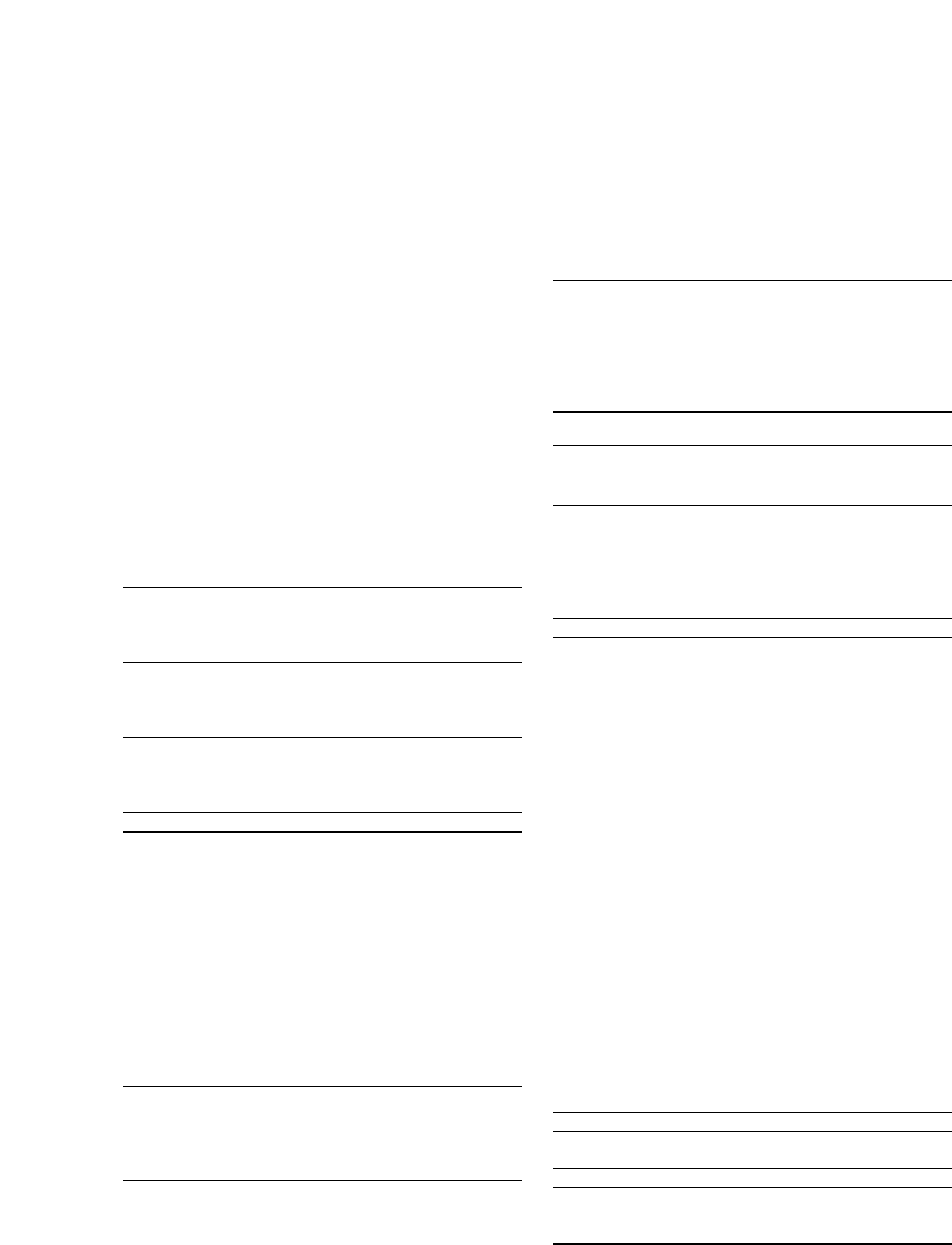

The following table summarizes the activity for our fixed option plans

for the last three years. All grants were made at the market price on

the date of grant.

Weighted

Average

Option Exercise

Shares Price

Outstanding Jan. 1, 1999 11,143,892 $ 30.78

Granted 3,531,418 30.16

Exercised (1,578,903) 22.63

Canceled (1,033,435) 39.07

Outstanding Dec. 31, 1999 12,062,972 30.96

Granted 6,539,436 33.94

Exercised (3,372,916) 26.42

Canceled (919,110) 36.41

Outstanding Dec. 31, 2000 14,310,382 33.04

Granted 7,333,445 47.29

Exercised (1,545,214) 31.22

Canceled (1,824,580) 38.56

Outstanding Dec. 31, 2001 18,274,033 $ 38.36

The following table summarizes the options exercisable at the end

of the last three years and the weighted average fair value of options

granted during those years. The fair value of options is estimated

on the date of grant using the Black-Scholes option-pricing model,

with the following weighted average assumptions used for grants

in 2001, 2000 and 1999, respectively: dividend yield of 3.0%, 3.0%

and 2.8%; expected volatility of 46.3%, 41.0% and 23.8%; risk-free

interest rates of 5.0%, 6.5% and 5.3%; and an expected life of

6.8 years, 6.5 years and 6.5 years.

2001 2000 1999

Options exercisable

at year-end 5,982,799 5,751,780 7,940,793

Weighted average fair

value of options granted

during the year $ 19.00 $ 12.96 $ 7.59

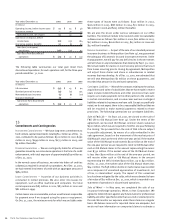

The following tables summarize the status of fixed stock options

outstanding and exercisable at Dec. 31, 2001.

Options Outstanding

Weighted

Average Weighted

Remaining Average

Range of Number of Contractual Exercise

Exercise Prices Options Life Price

$ 13.29 – 29.31 3,051,475 5.0 years $ 26.35

29.63 – 35.00 2,742,399 6.8 years 31.02

35.25 3,648,221 8.3 years 35.25

35.31 – 45.10 2,897,707 7.2 years 42.78

45.67 – 48.04 2,038,650 9.7 years 46.17

48.39 – 50.44 3,895,581 9.1 years 48.46

$ 13.29 – 50.44 18,274,033 7.7 years $ 38.36

Options Exercisable

Weighted

Average

Range of Number of Exercise

Exercise Prices Options Price

$ 13.29 – 29.31 2,096,892 $ 25.01

29.63 – 35.00 1,510,667 31.52

35.25 487,266 35.25

35.31 – 45.10 1,868,599 43.02

45.67 – 48.04 ——

48.39 – 50.44 19,375 50.44

$ 13.29 – 50.44 5,982,799 $ 33.20

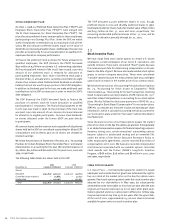

variable stock option grant

In 1999, we made a variable option grant of 375,000 shares from

our 1994 stock incentive plan to one of our key executives. This was

in addition to 1,966,800 variable option shares granted to executives

prior to 1999. The exercise price of each option was equal to the

market price of our stock on the grant date. One-half of the options

vested when the market price of our stock reached a 20-consecutive-

trading-day average of $50 per share, which occurred in November

2000. The remaining options were to vest when our stock price

reached a 20-consecutive-trading-day average of $55 per share,

which did not occur. Any of these options not exercised prior to

Dec. 1, 2001 expired on that date.

The following table summarizes the activity for our variable option

grants for the last three years.

Weighted

Average

Option Exercise

Shares Price

Outstanding Jan. 1, 1999 1,498,200 $ 30.26

Granted 375,000 29.63

Canceled (152,400) 29.38

Outstanding Dec. 31, 1999 1,720,800 30.20

Exercised (290,975) 30.41

Canceled (437,850) 29.59

Outstanding Dec. 31, 2000 991,975 30.15

Exercised (290,500) 29.74

Canceled (701,475) 30.32

Outstanding Dec. 31, 2001 ——