Travelers 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 59

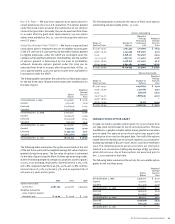

In connection with our purchase of MMI in April 2000, we assumed

all obligations under their preferred securities. In December 1997,

MMI issued $125 million of 30-year mandatorily redeemable

preferred securities through MMI Capital Trust I, formed for the sole

purpose of issuing the securities. The preferred securities pay a

preferred distribution of 75

⁄

8% semi-annually in arrears, and have

a mandatory redemption date of Dec. 15, 2027.

In 1997 and 1996, USF&G issued three series of preferred securities.

After consummation of the merger with USF&G in 1998, The St. Paul

assumed all obligations relating to these preferred securities. These

Series A, Series B and Series C Capital Securities were issued

through separate wholly-owned business trusts (“USF&G Capital I,”

“USF&G Capital II,” and “USF&G Capital III,” respectively) formed

for the sole purpose of issuing the securities. We have effectively

fully and unconditionally guaranteed all obligations of the three

business trusts.

In December 1996, USF&G Capital I issued 100,000 shares of 8.5%

Series A Capital Securities, generating gross proceeds of $100

million. The proceeds were used to purchase $100 million of USF&G

Corporation 8.5% Series A subordinated debentures, which mature

on Dec. 15, 2045. The debentures are redeemable under certain

circumstances related to tax events at a price of $1,000 per

debenture. The proceeds of such redemptions will be used to

redeem a like amount of the Series A Capital Securities.

In January 1997, USF&G Capital II issued 100,000 shares of 8.47%

Series B Capital Securities, generating gross proceeds of $100

million. The proceeds were used to purchase $100 million of USF&G

Corporation 8.47% Series B subordinated debentures, which mature

on Jan. 10, 2027. The debentures are redeemable at our option at

any time beginning in January 2007 at scheduled redemption prices

ranging from $1,042 to $1,000 per debenture. The debentures are

also redeemable prior to January 2007 under certain circumstances

related to tax and other special events. The proceeds of such

redemptions will be used to redeem a like amount of the Series B

Capital Securities.

In July 1997, USF&G Capital III issued 100,000 shares of 8.312%

Series C Capital Securities, generating gross proceeds of $100

million. The proceeds were used to purchase $100 million of USF&G

Corporation 8.312% Series C subordinated debentures, which

mature on July 1, 2046. The debentures are redeemable under

certain circumstances related to tax events at a price of $1,000 per

debenture. The proceeds of such redemptions will be used to

redeem a like amount of the Series C Capital Securities.

Under certain circumstances related to tax events, we have the

right to shorten the maturity dates of the Series A, Series B and

Series C debentures to no earlier than June 24, 2016, July 10, 2016

and April 8, 2012, respectively, in which case the stated maturities

of the related Capital Securities will likewise be shortened.

In 2001, we repurchased and retired $20 million of USF&G Capital I

securities. In 1999, we repurchased and retired a total of $79 million

of USF&G Capital I, II and III securities. Purchases in both years were

done in open market transactions. The amount retired in 1999

included $27 million of 8.5% Capital I, $22 million of 8.47%

Capital II, and $30 million of 8.312% Capital III securities.

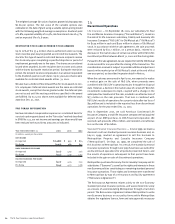

preferred shareholders’ equity

The preferred shareholders’ equity on our balance sheet represents

the par value of preferred shares outstanding that we issued to our

Stock Ownership Plan (“SOP”) Trust, less the remaining principal

balance on the SOP Trust debt. The SOP Trust borrowed funds from

a U.S. underwriting subsidiary to finance the purchase of the

preferred shares, and we guaranteed the SOP debt.

The SOP Trust may at any time convert any or all of the preferred

shares into shares of our common stock at a rate of eight shares of

common stock for each preferred share. Our board of directors has

reserved a sufficient number of our authorized common shares to

satisfy the conversion of all preferred shares issued to the SOP Trust

and the redemption of preferred shares to meet employee

distribution requirements. Upon the redemption of preferred shares,

we will issue shares of our common stock to the trust to fulfill the

redemption obligations.

common shareholders’ equity

Common Stock and Reacquired Shares — We are governed by the

Minnesota Business Corporation Act. All authorized shares of voting

common stock have no par value. Shares of common stock

reacquired are considered unissued shares. The number of

authorized shares of the company is 480 million.

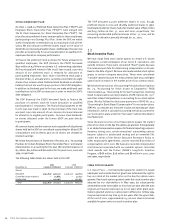

We reacquired some of our common shares in 2001, 2000 and 1999

for total costs of $589 million, $536 million and $356 million,

respectively. We reduced our capital stock account and retained

earnings for the cost of these repurchases.

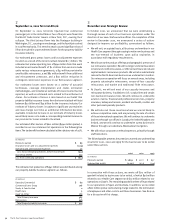

A summary of our common stock activity for the last three years is

as follows.

Year ended December 31 2001 2000 1999

(Shares)

Outstanding at beginning

of year 218,308,016 224,830,894 233,749,778

Shares issued:

Stock incentive plans

and other 2,012,533 3,686,827 1,896,229

Conversion of

preferred stock 287,442 661,523 287,951

Conversion of MIPS —7,006,954 —

Acquisition —— 27,936

Reacquired shares (12,983,616) (17,878,182) (11,131,000)

Outstanding at end

of year 207,624,375 218,308,016 224,830,894

Undesignated Shares — Our articles of incorporation allow us to

issue five million undesignated shares. The board of directors may

designate the type of shares and set the terms thereof. The board

designated 1,450,000 shares as Series B Convertible Preferred Stock

in connection with the formation of our Stock Ownership Plan.