Travelers 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

property-liability insurance

Investment Operations

Our investment operations’ primary objective is to maximize invest-

ment returns and generate sufficient liquidity to fund our cash

requirements, primarily consisting of insurance claim payments. The

funds we invest are generated by underwriting cash flows, consisting

of premiums collected less losses and expenses paid, and by invest-

ment cash flows, consisting of income received on existing

investments and proceeds from sales and maturities of investments.

The majority of funds available for investment are deployed in a

widely diversified portfolio of predominantly investment-grade fixed

maturities, consisting primarily of government-issued securities and

corporate bonds. We also invest lesser amounts in equity securities,

venture capital and real estate with the goal of producing long-term

growth in the value of our invested asset base and ultimately

enhancing shareholder value. The latter three investment classes

have the potential for higher returns but also involve a greater

degree of risk, including less stable rates of return and less liquidity.

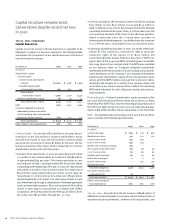

The following table summarizes the composition and carrying value

of our property-liability investment segment’s portfolio at the end

of 2001 and 2000. More information on each investment class fol-

lows the table.

December 31 2001 2000

(In millions)

carrying value

Fixed maturities $ 15,756 $14,584

Equities 1,110 1,396

Real estate and mortgage loans 972 1,025

Venture capital 859 1,064

Securities on loan 775 1,207

Short-term investments 2,043 2,223

Other investments 67 183

Total investments $21,582 $21,682

Fixed Maturities – Our fixed maturities portfolio is primarily com-

posed of high-quality, intermediate-term taxable U.S. government,

corporate and mortgage-backed bonds, and tax-exempt U.S. munic-

ipal bonds. We manage our bond portfolio conservatively, investing

almost exclusively in investment-grade (BBB- or better) securities.

At Dec. 31, 2001, approximately 95% of our portfolio was rated

investment grade, with the remaining 5% split between high-yield

and nonrated securities, most of which we believe would be con-

sidered investment-grade if rated.

We participate in a securities lending program whereby certain fixed

maturities from our portfolio are loaned to other institutions for

short periods of time. We receive a fee from the borrower in return.

We require collateral equal to 102% of the fair value of the loaned

securities, and we record the cash collateral received as a liability.

The collateral is invested in short-term investments and reported

as such on our balance sheet. The market value of the securities on

loan is reclassified out of fixed maturities and shown as a separate

investment asset on our balance sheet. We continue to earn interest

on the securities on loan, and earn a portion of the interest related

to the short-term investments.

The amortized cost of our fixed maturities portfolio at the end of

2001 was $15.2 billion, $1 billion higher than the comparable total

of $14.2 billion at the end of 2000. The increase was partially due

to the $432 million decline in securities on loan. Our level of fixed

maturity invested assets benefited near the end of the year from

the investment of $335 million in cash proceeds from the sale of

F&G Life in September, and the investment of proceeds from our

issuance of preferred securities in November. We ultimately con-

tributed $500 million of the net proceeds of the issue to the

policyholders’ surplus of our primary domestic insurance under-

writing subsidiary, St. Paul Fire and Marine Insurance Company,

which subsequently invested the funds in taxable fixed maturities.

These investments more than offset the decline in our fixed matu-

rity portfolio through the first nine months of 2001 which had

resulted from net sales of investments to fund operational cash

requirements (primarily insurance claim payments).

We carry bonds on our balance sheet at market value, with the cor-

responding appreciation or depreciation recorded in shareholders’

equity, net of taxes. The market values of our bonds fluctuate with

changes in market interest rates and changes in yield differentials

between fixed-maturity asset classes. If we believe a decline in

value of any of our bonds is other than temporary, we write down

the asset for the decline and record a realized loss on our statement

of operations.

At the end of 2001, the pretax unrealized appreciation of our bond

portfolio was $563 million, compared with unrealized appreciation

of $380 million at the end of 2000. The significant decline in inter-

est rates during 2001 was the primary factor in the increase in

unrealized appreciation. The Federal Reserve reduced short-term

rates 11 times in 2001 for a cumulative total of 4.75% in response

to the economic slowdown in the United States. The increase in

unrealized appreciation was not as large as might have been

expected given the magnitude of interest rate declines in 2001, as

the market value of our holdings began to increase significantly

prior to the end of 2000 in anticipation of the Federal Reserve

actions to reduce rates.

Our decision whether to purchase taxable or tax-exempt securities

is driven by corporate tax considerations, and the relationship

between taxable and tax-exempt yields at the time of purchase.

In each of the last three years, a significant majority of our new

fixed maturity purchases consisted of taxable bonds. The average

yield on taxable bonds purchased in 2001 was 6.5%, compared with

7.7% in 2000 and 7.2% in 1999. The decline in 2001 reflected the

impact of the Federal Reserve rate actions. Taxable bonds

accounted for 70% of our fixed maturity portfolio at year-end 2001.

The bond portfolio in total carried a weighted average pretax yield

of 6.6% at Dec. 31, 2001, compared with 6.8% at the end of 2000.

Reported pretax investment income generated from our fixed matu-

rities portfolio in 2001 totaled $1.11 billion, down 5% from

comparable 2000 investment income of $1.16 billion. Investment

income in 2001 and 2000 included $14 million and $11 million,

respectively, from the elimination of one-quarter reporting lags in

each year for portions of our foreign operations. The decline in

investment income in 2001 reflected the lower level of fixed matu-

rity invested assets during much of 2001 and the decline in yields

on new investments. In 2000, excluding the incremental impact of

The St. Paul Companies 2001 Annual Report 29