Travelers 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 51

4

Acquisitions

Fireman’s Fund Surety Business — In December 2001, we purchased

the right to seek to renew surety bond business previously

underwritten by Fireman’s Fund Insurance Company (“Fireman’s

Fund”). We paid Fireman’s Fund $10 million in 2001 for this right,

which was recorded as an intangible asset and is expected to be

amortized over ten years. Based on the volume of business renewed,

we may be obligated to make an additional payment to Fireman’s

Fund in early 2003 (see Note 15).

Penco — In January 2001, we acquired the right to seek to renew a

book of municipality insurance business from Penco, a program

administrator for Willis North America Inc., for total consideration

of $3.5 million. We recorded that amount as an intangible asset and

expect to amortize it over five years.

MMI — In April 2000, we closed on our acquisition of MMI

Companies, Inc. (“MMI”), a Deerfield, IL-based provider of medical

services-related insurance products and consulting services. The

transaction was accounted for as a purchase, with a total purchase

price of approximately $206 million, in addition to the assumption

of $165 million in preferred securities and debt. The final purchase

price adjustments resulted in an excess of purchase price over net

tangible assets acquired of approximately $85 million, which we

expected to amortize on a straight-line basis over 15 years.

Prior to the acquisition, MMI recorded a $93 million provision to

strengthen their loss reserves, with $77 million reflected in their

domestic operations and $16 million reflected in Unionamerica, their

U.K.-based international operations.

As part of the strategic review discussed in Note 3, we decided to

exit the Health Care liability insurance business, including that

obtained through the MMI acquisition. Accordingly, in December

2001, we wrote off $56 million in goodwill associated with the

underwriting operations of MMI. As of Dec. 31, 2001, the remaining

$8 million of unamortized goodwill related to the consulting

business obtained in the purchase.

Pacific Select — In February 2000, we closed on our acquisition of

Pacific Select Insurance Holdings, Inc. and its wholly-owned

subsidiary Pacific Select Property Insurance Co. (together, “Pacific

Select”), a California insurer that sells earthquake coverage to

California homeowners. The transaction was accounted for as a

purchase, at a cost of approximately $37 million. We recorded

goodwill of approximately $11 million, which we are amortizing on

a straight-line basis over ten years. Pacific Select’s results of

operations from the date of purchase are included in our 2000

consolidated results.

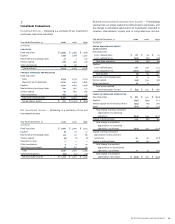

5

Earnings Per Common Share

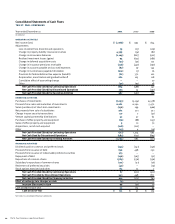

Year ended December 31 2001 2000 1999

(In millions)

earnings

Basic

Net income (loss), as reported $(1,088) $ 993 $ 834

Preferred stock dividends, net of taxes (9) (8) (8)

Premium on preferred shares

redeemed (8) (11) (4)

Net income (loss) available to

common shareholders $ (1,105) $ 974 $ 822

Diluted

Net income (loss) available to

common shareholders $ (1,105) $ 974 $ 822

Effect of dilutive securities:

Convertible preferred stock —66

Zero coupon convertible notes —33

Convertible monthly income

preferred securities —58

Net income (loss) available to

common shareholders $ (1,105) $ 988 $ 839

common shares

Basic

Weighted average common shares

outstanding 212 217 228

Diluted

Weighted average common shares

outstanding 212 217 228

Weighted average effects of

dilutive securities:

Stock options —32

Convertible preferred stock —77

Zero coupon convertible notes —22

Convertible monthly income

preferred securities —47

Total 212 233 246

earnings (loss) per common share

Basic $ (5.22) $ 4.50 $ 3.61

Diluted $ (5.22) $ 4.24 $ 3.41

The assumed conversion of preferred stock and zero coupon notes

are each anti-dilutive to our net loss per share for the year ended

Dec. 31, 2001, and therefore not included in the EPS calculation. The

convertible monthly income preferred securities were fully converted

or redeemed during 2000.