Travelers 2001 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 65

to write non-Economy business through their own insurance

subsidiaries. Any business written on our policy forms during this

transition period is then fully ceded to Metropolitan under the

Reinsurance Agreement. We recognized no gain or loss on the

inception of the Reinsurance Agreement and will not incur any net

revenues or expenses related to the Reinsurance Agreement. All

economic risk of post-sale activities related to the Reinsurance

Agreement has been transferred to Metropolitan. We anticipate that

Metropolitan will pay all claims incurred related to this Reinsurance

Agreement. In the event that Metropolitan is unable to honor their

obligations to us, we will pay these amounts.

As part of the sale to Metropolitan, we guaranteed the adequacy of

Economy’s loss and loss expense reserves. Under that guarantee,

we will pay for any deficiencies in those reserves and will share in

any redundancies that develop by Sept. 30, 2002. We remain liable

for claims on non-Economy policies that result from losses occurring

prior to closing. By agreement, Metropolitan will adjust those claims

and share in redundancies in related reserves that may develop. As

of Dec. 31, 2001, we have estimated that we will owe Metropolitan

$7 million on these guarantees, and have included that amount in

discontinued operations. We have no other contingent liabilities

related to the sale.

As a result of the sale, approximately 1,600 standard personal

insurance employees of The St. Paul effectively transferred to

Metropolitan on Oct. 1, 1999.

We received gross proceeds on the sale of $597 million, less the

payment of the reinsurance premium of $325 million, for net

proceeds of $272 million. We recognized, in discontinued operations,

a pretax gain on disposal of $130 million, after adjusting for a

$26 million pension and postretirement curtailment gain and

disposition costs of $32 million. The gain on disposal combined with

a $128 million pretax gain on discontinued operations (subsequent

to our decision to sell), resulting in a total pretax gain of

$258 million. Included in the pretax gain on discontinued operations

was a $145 million reduction in loss and loss adjustment expense

reserves. In the third quarter of 1999, based on favorable trends

noted in the standard personal insurance reserve analysis, and

considering the pending sale and its economic consequences, we

concluded that this reserve reduction was appropriate.

The $26 million pretax curtailment gain represented the impact of

a reduced number of employees in the pension and post-retirement

plans due to the sale of the standard personal insurance business.

The $32 million pretax disposition costs netted against the gain

represented costs directly associated with the decision to dispose

of the standard personal insurance segment and included $14 million

of employee-related costs, $8 million of occupancy-related costs,

$7 million of transaction costs, $2 million of record separation costs

and $1 million of equipment charges. The employee-related costs

related to the expected termination of 385 employees due to the

sale of the personal insurance segment. Approximately 350

employees were terminated related to this action. In 2000, we

reduced the employee-related reserve by $3 million due to a number

of voluntary terminations, which reduced the expected severance

to be paid. In 2001, we reduced the occupancy-related reserve by

$2 million due to a lease buyout.

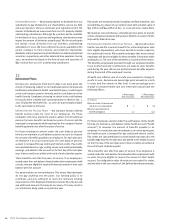

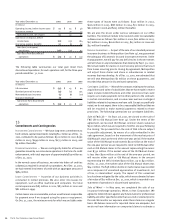

The following presents a rollforward of 2001 activity related to this charge.

Reserve Reserve

Pretax at Dec. 31, at Dec. 31,

Charge 2000 Payments Adjustments 2001

(In millions)

Charges to earnings:

Employee-related $14 $— $— $— $—

Occupancy-related 8 7 (3) (2) 2

Transaction costs 7 — — — —

Record separation costs 2 — — — —

Equipment charges 1 — — — —

Total $32 $ 7 $(3) $(2) $2

Nonstandard Auto Business — In December 1999, we decided to

sell our nonstandard auto business marketed under the Victoria

Financial and Titan Auto brands. On Jan. 4, 2000, we announced an

agreement to sell this business to The Prudential Insurance

Company of America (“Prudential”) for $200 million in cash, subject

to certain adjustments based on the balance sheet as of the closing

date. As a result, the nonstandard auto business results of

operations were accounted for as discontinued operations for the

year ended Dec. 31, 1999. Included in “Discontinued operations—

gain (loss) on disposal, net of tax” in our 1999 statement of

operations was an estimated loss on the sale of approximately

$83 million, which included the estimated results of operations

through the disposal date. All prior period results of nonstandard

auto have been reclassified to discontinued operations.

On May 1, 2000, we closed on the sale of our nonstandard auto

business to Prudential, receiving total cash consideration of

approximately $175 million (net of a $25 million dividend paid to

our property-liability operations prior to closing).

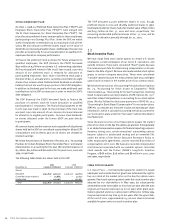

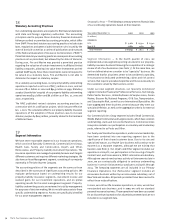

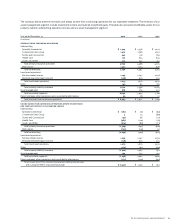

The following table summarizes our discontinued operations,

including our life insurance business, our standard personal

insurance business, our nonstandard auto business and our

insurance brokerage business, Minet (sold in 1997), for the three-

year period ended Dec. 31, 2001.