Travelers 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The St. Paul Companies 2001 Annual Report 39

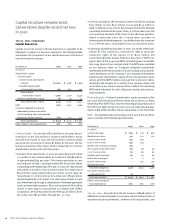

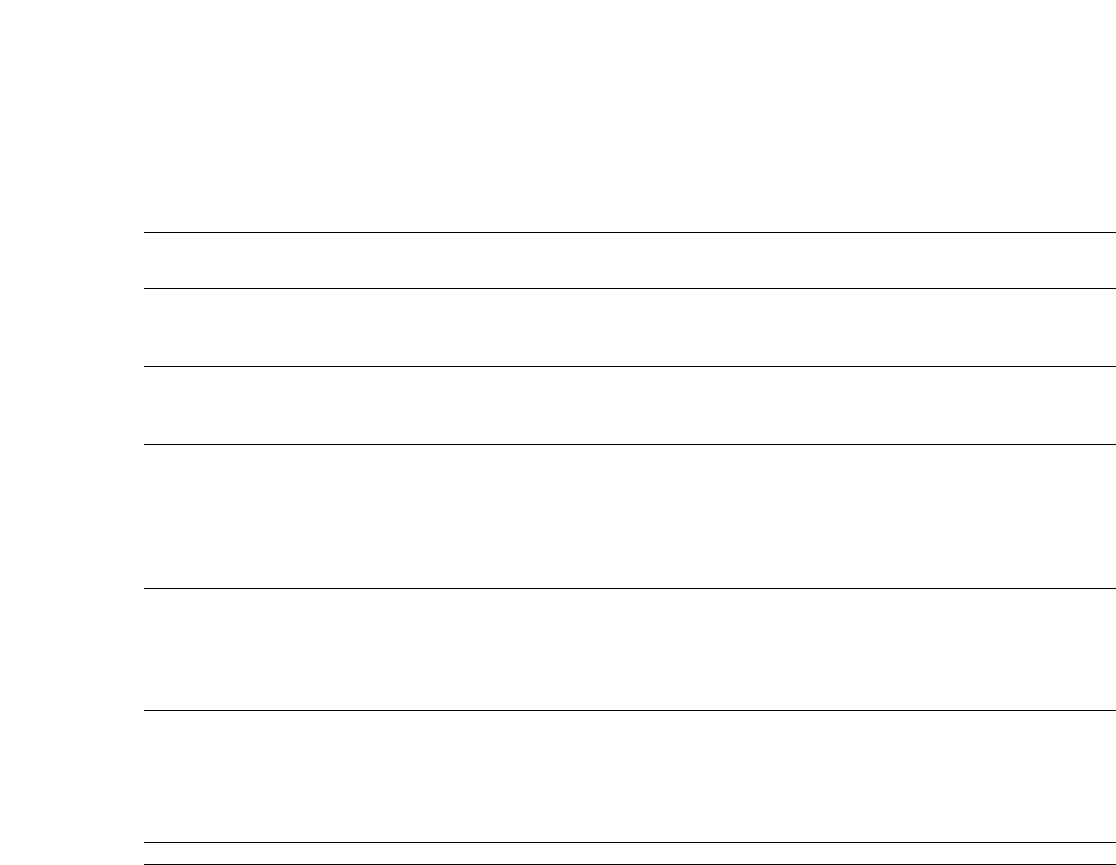

Six-Year Summary of Selected Financial Data

the st. paul companies

2001 2000 1999 1998 1997 1996

(In millions, except ratios and per share data)

consolidated

Revenues from continuing operations $ 8,943 $ 7,972 $ 7,149 $ 7,315 $ 7,904 $ 7,536

After-tax income (loss) from continuing operations (1,009) 970 705 187 1,011 1,054

investment activity

Net investment income 1,217 1,262 1,259 1,295 1,320 1,240

Pretax realized investment gains (losses) (94) 632 286 203 409 205

other selected financial data (as of December 31)

Total assets 38,321 35,502 33,418 33,211 32,735 30,971

Debt 2,130 1,647 1,466 1,260 1,304 1,171

Redeemable preferred securities 893 337 425 503 503 307

Common shareholders’ equity 5,056 7,178 6,448 6,621 6,591 5,631

Common shares outstanding 207.6 218.3 224.8 233.7 233.1 230.9

per common share data

Income (loss) from continuing operations (4.84) 4.14 2.89 0.73 4.02 4.09

Year-end book value 24.35 32.88 28.68 28.32 28.27 24.39

Year-end market price 43.97 54.31 33.69 34.81 41.03 29.31

Cash dividends declared 1.12 1.08 1.04 1.00 0.94 0.88

property-liability insurance

Written premiums 7,763 5,884 5,112 5,276 5,682 5,683

Pretax income (loss) from continuing operations (1,400) 1,467 971 298 1,488 1,257

GAAP underwriting result (2,294) (309) (425) (881) (139) (35)

Statutory combined ratio:

Loss and loss adjustment expense ratio 102.5 70.0 72.9 82.2 69.8 68.9

Underwriting expense ratio 28.1 34.8 35.0 35.2 33.5 31.9

Combined ratio 130.6 104.8 107.9 117.4 103.3 100.8