Pitney Bowes 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

80

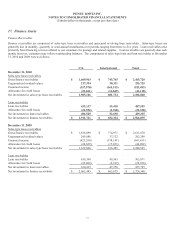

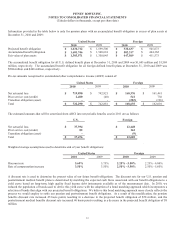

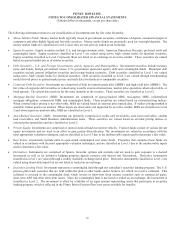

19. Retirement Plans and Postretirement Medical Benefits

We have several defined benefit retirement plans. Benefits are primarily based on employees’ compensation and years of service.

Our contributions are determined based on the funding requirements of U.S. federal and other governmental laws and regulations. We

use a measurement date of December 31 for all of our retirement plans.

U.S. employees hired after January 1, 2005, Canadian employees hired after April 1, 2005, and U.K. employees hired after July 1,

2005, are not eligible for our defined benefit retirement plans. As of December 31, 2014, benefit accruals for our U.S. pension plans,

the Pitney Bowes Pension Plan and the Pitney Bowes Pension Restoration Plan, will be determined and frozen and no future benefit

accruals under these plans will occur after that date.

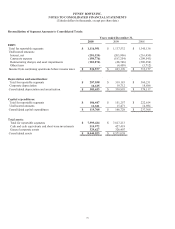

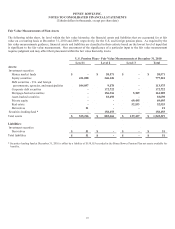

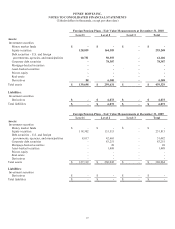

The change in benefit obligation, plan assets and the funded status of defined benefit pension plans are as follows:

United States Foreign

2010 2009 2010 2009

Change in benefit obligation:

Benefit obligation at beginning of year $ 1,599,506 $ 1,605,380 $ 507,932 $ 384,507

Service cost 23,157 24,274 6,907 6,853

Interest cost 89,602 93,997 27,507 25,200

Plan participants’ contributions - - 1,962 2,231

Actuarial loss 39,971 17,698 27,129 63,325

Foreign currency changes - - (5,257) 45,858

Settlement / curtailment 6,419 (24,297) (3,396) (1,579)

Special termination benefits 8,148 112 557 2,012

Benefits paid (134,517) (117,658) (22,100) (20,475)

Benefit obligation at end of year $ 1,632,286 $ 1,599,506 $ 541,241 $ 507,932

Change in plan assets:

Fair value of plan assets at beginning of year $ 1,350,045 $ 1,175,271 $ 414,313 $ 312,206

Actual return on plan assets 149,599 177,119 50,609 48,128

Company contributions 20,047 115,313 9,291 32,755

Plan participants’ contributions - - 1,962 2,231

Foreign currency changes - - (3,392) 39,468

Benefits paid (134,517) (117,658) (22,100) (20,475)

Fair value of plan assets at end of year $ 1,385,174 $ 1,350,045 $ 450,683 $ 414,313

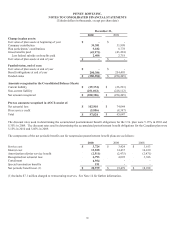

Funded status, end of year:

Fair value of plan assets at end of year $ 1,385,174 $ 1,350,045 $ 450,683 $ 414,313

Benefit obligations at end of year 1,632,286 1,599,506 541,241 507,932

Funded status $ (247,112) $ (249,461) $ (90,558) $ (93,619)

Amounts recognized in the

Consolidated Balance Sheets:

Non-current asset $ 29 $ - $ 508 $ 484

Current liability (6,962) (19,424) (901) (957)

Non-current liability (240,179) (230,037) (90,165) (93,146)

Net amount recognized $ (247,112) $ (249,461) $ (90,558) $ (93,619)