Pitney Bowes 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

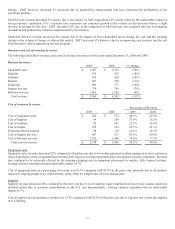

ITEM 7A. – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to the impact of interest rate changes and foreign currency fluctuations due to our investing and funding activities and

our operations denominated in different foreign currencies.

Our objective in managing our exposure to changing interest rates is to limit the volatility and impact of changing interest rates on

earnings and cash flows. To achieve these objectives, we use a balanced mix of debt maturities and interest rate swaps that convert

the fixed rate interest payments on certain debt issuances to variable rates.

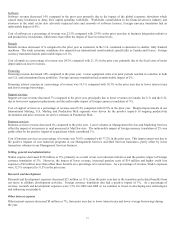

Our objective in managing our exposure to foreign currency fluctuations is to reduce the volatility in earnings and cash flows

associated with the effect of foreign exchange rate changes on transactions that are denominated in foreign currencies. Accordingly,

we enter into various contracts, which change in value as foreign exchange rates change, to protect the value of external and

intercompany transactions. The principal currencies actively hedged are the British pound, Canadian dollar and Euro.

We employ established policies and procedures governing the use of financial instruments to manage our exposure to such risks. We

do not enter into foreign currency or interest rate transactions for speculative purposes. The gains and losses on these contracts offset

changes in the value of the related exposures.

We utilize a “Value-at-Risk” (VaR) model to determine the potential loss in fair value from changes in market conditions. The VaR

model utilizes a “variance/co-variance” approach and assumes normal market conditions, a 95% confidence level and a one-day

holding period. The model includes all of our debt and all interest rate derivative contracts as well as our foreign exchange derivative

contracts associated with forecasted transactions. The model excludes anticipated transactions, firm commitments, and receivables

and accounts payable denominated in foreign currencies, which certain of these instruments are intended to hedge. The VaR model is

a risk analysis tool and does not purport to represent actual losses in fair value that will be incurred by us, nor does it consider the

potential effect of favorable changes in market factors.

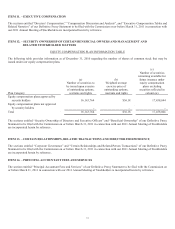

During 2010 and 2009, our maximum potential one-day loss in fair value of our exposure to foreign exchange rates and interest rates,

using the variance/co-variance technique described above, was not material.