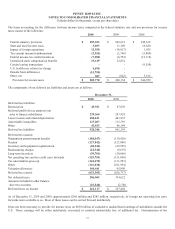

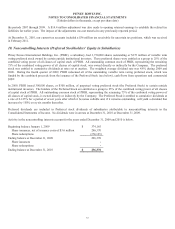

Pitney Bowes 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

56

liability that would result in the event all of these earnings were remitted to the U.S. is not practicable. It is estimated, however, that

withholding taxes on such remittances would approximate $15 million.

Uncertain Tax Positions

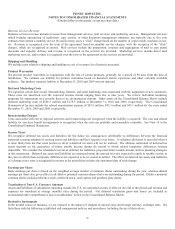

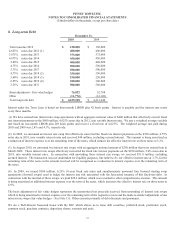

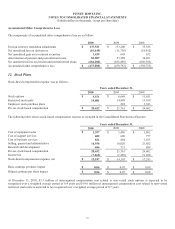

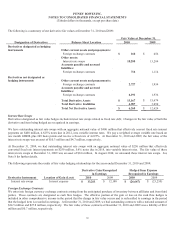

A reconciliation of the amount of unrecognized tax benefits at December 31, 2010, 2009 and 2008 is as follows:

2010 2009 2008

Balance at beginning of year $ 515,565 $ 434,164 $ 398,878

Increases from prior period positions 17,775 65,540 21,623

Decreases from prior period positions (27,669) (7,741) (8,899)

Increases from current period positions 43,804 42,696 33,028

Decreases from current period positions (8,689) - -

Decreases relating to settlements with tax authorities (1,434) (3,173) (7,426)

Reductions as a result of a lapse of the

applicable statute of limitations (7,562) (15,921) (3,040)

Balance at end of year $ 531,790 $ 515,565 $ 434,164

The amount of the unrecognized tax benefits at December 31, 2010, 2009 and 2008 that would affect the effective tax rate if

recognized was $434 million, $411 million and $371 million, respectively.

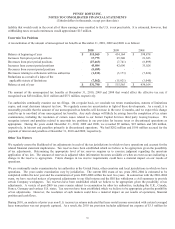

Tax authorities continually examine our tax filings. On a regular basis, we conclude tax return examinations, statutes of limitations

expire, and court decisions interpret tax law. We regularly assess tax uncertainties in light of these developments. As a result, it is

reasonably possible that the amount of our unrecognized tax benefits will decrease in the next 12 months, and we expect this change

could be up to one-third of our unrecognized tax benefits. Any such change will likely be arising from the completion of tax return

examinations, including the resolution of certain issues related to our former Capital Services third party leasing business. We

recognize interest and penalties related to uncertain tax positions in our provision for income taxes or discontinued operations as

appropriate. During the years ended December 31, 2010, 2009 and 2008, we recorded $9 million, $23 million and $26 million,

respectively, in interest and penalties primarily in discontinued operations. We had $202 million and $186 million accrued for the

payment of interest and penalties at December 31, 2010 and 2009, respectively.

Other Tax Matters

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment regarding the uncertain

application of tax law. The amount of reserves is adjusted when information becomes available or when an event occurs indicating a

change in the reserve is appropriate. Future changes in tax reserve requirements could have a material impact on our results of

operations.

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which we have

operations. The years under examination vary by jurisdiction. The current IRS exam of tax years 2001-2004 is estimated to be

completed within the next year and the examination of years 2005-2008 within the next two years. In connection with the 2001-2004

exam, we have received notices of proposed adjustments to our filed returns and the IRS has withdrawn a civil summons to provide

certain Company workpapers. Tax reserves have been established which we believe to be appropriate given the possibility of tax

adjustments. A variety of post-2000 tax years remain subject to examination by other tax authorities, including the U.K., Canada,

France, Germany and various U.S. states. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. However, the resolution of such matters could have a material impact on our results of operations, financial

position and cash flows.

During 2010, an analysis of prior year non-U.S. income tax returns indicated that lease rental income associated with certain leveraged

lease transactions was not properly captured. As a result, the 2010 tax provision includes additional tax expense of $3.3 million for