Pitney Bowes 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

50

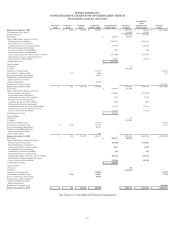

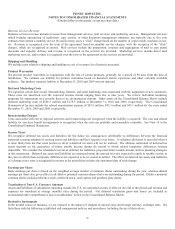

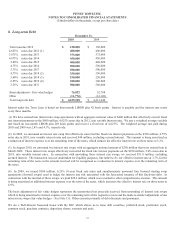

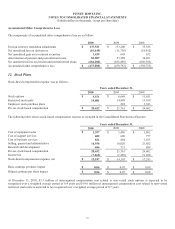

6. Intangible Assets and Goodwill

The components of our purchased intangible assets are as follows:

December 31, 2010 December 31, 2009

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Customer relationships $ 453,523 $ (229,143) $ 224,380 $ 428,888 $ (197,497) $ 231,391

Supplier relationships 29,000 (16,192) 12,808 29,000 (13,292) 15,708

Mailing software

and technology 172,188 (118,390) 53,798 164,211 (103,388) 60,823

Trademarks

and trade names 36,322 (30,224) 6,098 35,855 (27,898) 7,957

Non-compete

agreements 7,845 (7,486) 359 7,753 (7,215) 538

$ 698,878 $ (401,435) $ 297,443 $ 665,707 $ (349,290) $ 316,417

Amortization expense for intangible assets was $60.8 million, $69.1 million and $72.3 million for the years ended December 31, 2010,

2009 and 2008, respectively. The future amortization expense related to intangible assets as of December 31, 2010 is as follows:

Year ended December 31, Amount

2011 $ 58,865

2012 50,983

2013 47,343

2014 42,191

2015 35,044

Thereafter 63,017

$ 297,443

Actual amortization expense may differ from the amounts above due to, among other things, future acquisitions, impairments of

intangible assets, accelerated amortization and changes in foreign currency exchange rates.

In 2010, we recorded impairment charges of $4.7 million and included these charges in restructuring charges and asset impairments in

the Consolidated Statements of Income. See Note 14 for further details.

Intangible assets acquired during 2010 are shown in the table below. There were no additions in 2009.

December 31, 2010

Amount

Weighted

Average

Life

Customer relationships $ 36,763 11 years

Mailing software and technology 13,954 6 years

Trademarks and trade names 1,125 6 years

Non-compete agreements 110 5 years

$ 51,952 10 years