Pitney Bowes 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

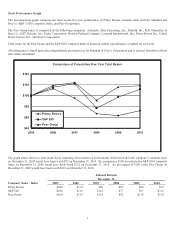

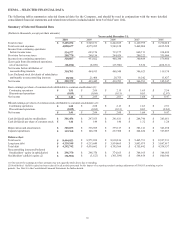

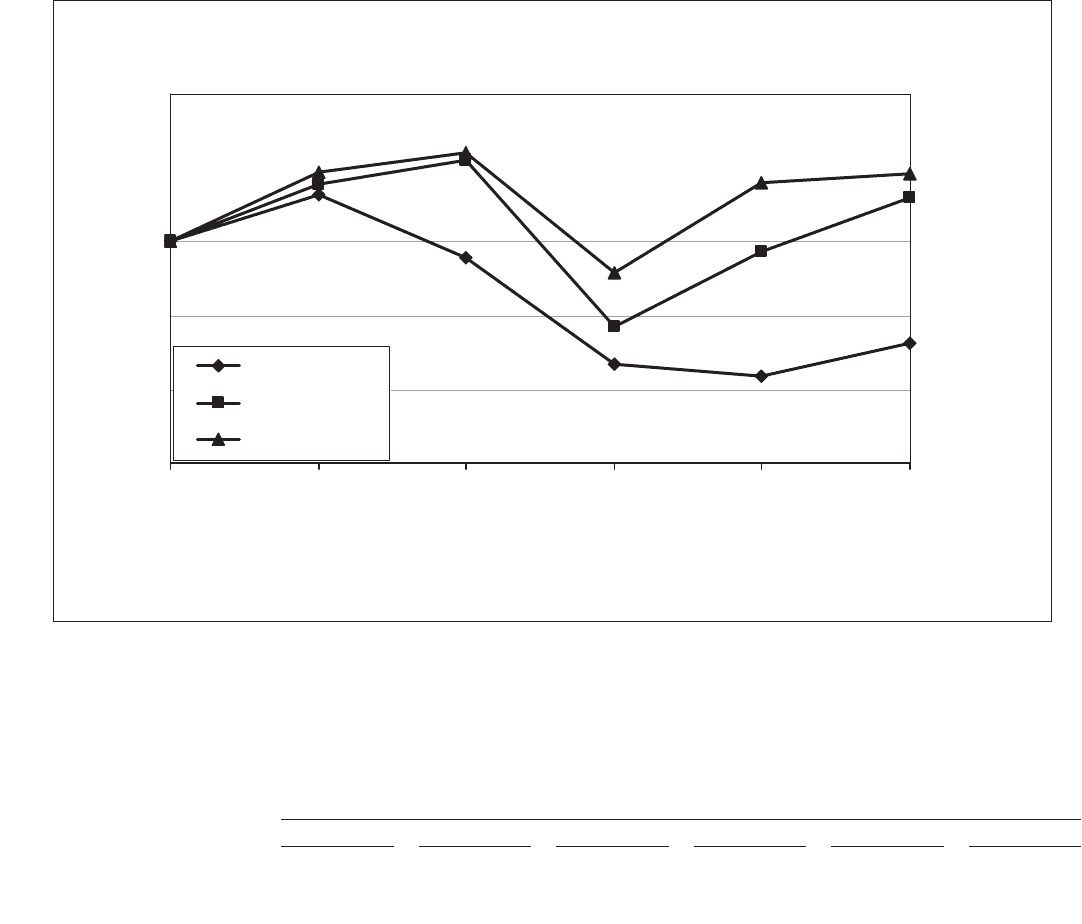

Stock Performance Graph

The accompanying graph compares the most recent five-year performance of Pitney Bowes common stock with the Standard and

Poor’s (“S&P”) 500 Composite Index, and Peer Group Index.

The Peer Group Index is comprised of the following companies: Automatic Data Processing, Inc., Diebold, Inc., R.R. Donnelley &

Sons Co., DST Systems, Inc., Fedex Corporation, Hewlett-Packard Company, Lexmark International, Inc., Pitney Bowes Inc., United

Parcel Service, Inc., and Xerox Corporation.

Total return for the Peer Group and the S&P 500 Composite Index is based on market capitalization, weighted for each year.

All information is based upon data independently provided to us by Standard & Poor’s Corporation and is derived from their official

total return calculation.

Comparison of Cumulative Five Year Total Return

$40

$60

$80

$100

$120

$140

2005 2006 2007 2008 2009 2010

Pitney Bowes

S&P 500

Peer Group

The graph shows that on a total return basis, assuming reinvestment of all dividends, $100 invested in the company’s common stock

on December 31, 2005 would have been worth $72 on December 31, 2010. By comparison, $100 invested in the S&P 500 Composite

Index on December 31, 2005 would have been worth $112 on December 31, 2010. An investment of $100 in the Peer Group on

December 31, 2005 would have been worth $118 on December 31, 2010.

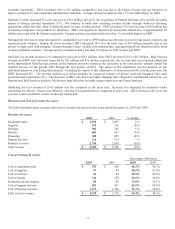

Indexed Returns

December 31,

Company Name / Index 2005 2006 2007 2008 2009 2010

Pitney Bowes $100 $113 $96 $67 $64 $72

S&P 500 $100 $116 $122 $77 $97 $112

Peer Group $100 $119 $124 $92 $116 $118