Pitney Bowes 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

60

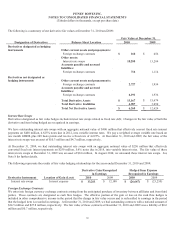

Stock Plans

Long-term incentive awards are provided to employees under the terms of our plans. The Executive Compensation Committee of the

Board of Directors administers these plans. Awards granted under these plans may include stock options, restricted stock units, other

stock-based awards, cash or any combination thereof. We settle employee stock compensation awards with treasury shares. Our

stock-based compensation awards require a minimum requisite service period of one year for retirement eligible employees to vest.

At December 31, 2010, there were 17,458,044 shares available for future grants of stock options and restricted stock units under our

stock plans.

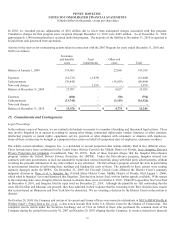

Stock Options

Under our stock option plan, certain officers and employees are granted options at prices equal to the market value of our common

shares at the date of grant. Options granted from 2005 through 2008 generally become exercisable in four equal installments during

the first four years following their grant and expire ten years from the date of grant. Options granted on or after 2009 generally

become exercisable in three equal installments during the first three years following their grant and expire ten years from the date of

grant.

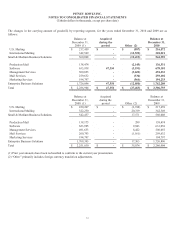

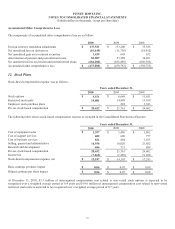

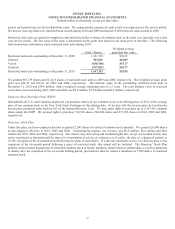

The following tables summarize information about stock option activity during 2010:

Shares

Per share weighted

average exercise price

Options outstanding at December 31, 2009 17,580,079 $38.59

Granted 1,714,731 $22.09

Exercised - -

Cancelled (4,350,018) $37.34

Forfeited (438,270) $26.58

Options outstanding at December 31, 2010 14,506,522 $37.38

Options exercisable at December 31, 2010 10,986,577 $40.35

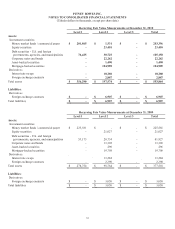

The weighted average remaining contractual life of options outstanding and options exercisable at December 31, 2010 was 4.9 years

and 3.8 years, respectively. The options exercisable at December 31, 2010 had no intrinsic value. No options were exercised during

2010 and 2009. The total intrinsic value of options exercised during 2008 was $1.1 million.

We granted 1,638,709 and 2,126,310 options in 2009 and 2008, respectively. The weighted average exercise price of the options

granted was $24.75 and $36.74 in 2009 and 2008, respectively. The weighted average remaining contractual life of the options

outstanding and options exercisable at December 31, 2009 was 4.3 years and 3.2 years, respectively. The total options outstanding

and exercisable at December 31, 2009 had no intrinsic value.